Shares of chipmaker SanDisk (SNDK) are surging today after Nomura Securities said that the firm plans to sharply raise the prices of its high-capacity 3D NAND memory chips. Indeed, Nomura says that SanDisk’s prices could more than double this quarter as demand for storage in AI servers continues to surge. While it is not yet clear how much this will affect the flash memory used in smartphones and laptops, those chips are often made in the same factories, so price increases in enterprise storage usually spread to consumer devices over time.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nomura’s research shows that memory suppliers across the industry are already raising prices, with enterprise-grade NAND seeing the biggest increases. The analysts believe this is happening because of both short-term shortages and long-term growth in demand, driven mainly by artificial intelligence systems that require massive amounts of fast, reliable storage. One of the biggest drivers of this demand is Nvidia’s (NVDA) AI infrastructure, especially its new Inference Context Memory Storage Platform.

Each Nvidia VR NVL144 rack uses 18 special data-processing units, and each one includes a 512-gigabyte SSD, which adds up to over 9 terabytes of NAND memory per rack. If Nvidia ships 50,000 of these racks a year, it would need nearly half an exabyte of NAND just for this one product line. Even though the global industry produces hundreds of exabytes each year, the fast growth of AI systems is pushing demand closer to supply limits, which is why prices are now rising so quickly.

Is SNDK Stock a Good Buy?

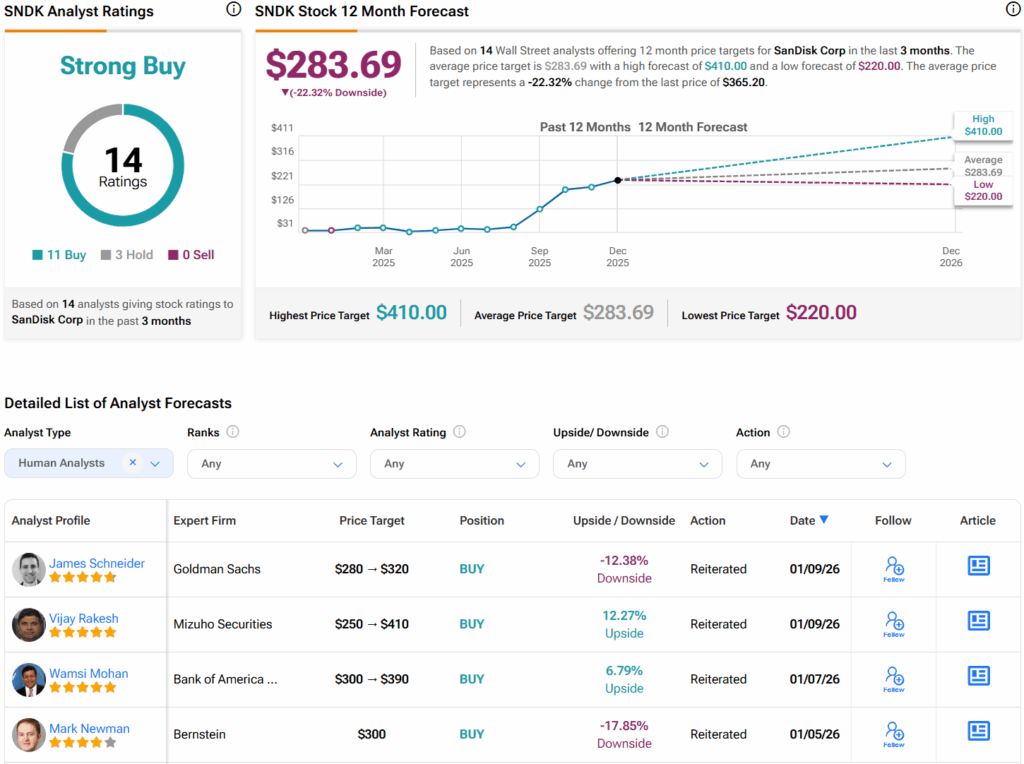

Turning to Wall Street, analysts have a Strong Buy consensus rating on SNDK stock based on 36 Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SNDK price target of $283.69 per share implies 22.3% downside risk.