Cloud computing giant Salesforce (CRM) is making headlines after its recent Dreamforce event where management made the case that the company is the place to be if enterprise customers are looking for value in artificial intelligence (AI). The stock is currently trading at $266 per share and flat on the year. I believe it’s one of the best growth at a reasonable price (GARP) stocks investors can own right now. A compelling valuation and the fact that its new AI initiative isn’t priced into the share price yet are additional reasons why I’m bullish on CRM stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Salesforce’s Wide Moat

My bullish thesis is driven by Salesforce’s competitive advantage or wide moat around its business. The company is a global provider of Customer Relationship Management (CRM) software. Its software does everything from sales to marketing to customer service. It’s like spreadsheets on steroids, but with interactive dashboards and a feature-rich user interface.

Salesforce’s unique offering has allowed it to command a 22% market share, according to International Data Corp. Salesforce has a powerful ecosystem, just like Apple (AAPL), and its business customers find all sorts of tools on its platform that they can use to enhance their sales, marketing, and customer service. In this way, Salesforce’s products are indispensable to its customer base.

Salesforce remains a one-stop-shop for enterprises and meets most, if not all, of the needs that a large enterprise customer might have. While Salesforce has faced competition from the likes of Microsoft (MSFT) and Oracle (ORCL), it has managed to remain the platform of choice for enterprises that are looking for CRM software. Customers are also extremely loyal to Salesforce given the high costs associated with changing CRM software providers.

A Blockbuster Quarter

Salesforce’s recent quarterly financial results were a blockbuster and another reason why I’m bullish on CRM stock. Revenue grew 8.4% to $9.3 billion and earnings came in at $1.47 per share, crushing analysts’ expectations by $0.13. While growth is slowing a bit, profitability is improving. The company’s operating margins rose by 190 basis points to 19.1% during the quarter and earnings per share (EPS) rose 15%.

Looking ahead, Salesforce is guiding for $37.7 billion to $38 billion in revenue for its fiscal 2025 year, up 8% to 9% year over year. For a company that was previously growing double digits, this does raise some concerns. However, I am not too worried about a slowdown in sales as long as profitability and cash improve. And Salesforce is guiding for 23% to 25% growth in its operating cash flow.

Additionally, Salesforce is returning excess cash to shareholders. In the most recent quarter, the company returned $4.7 billion to shareholders through dividends and stock buybacks. It has repurchased $18.1 billion worth of its shares under the current and ongoing $30 billion repurchase program. As the company continues to cut costs and distribute excess cash, I see it driving long-term value for shareholders.

Agentforce is a Catalyst

Finally, I’m bullish on CRM because Agentforce, the company’s new low-code AI tool, is not yet priced into the stock. Agentforce is going to drive cost savings for businesses and is likely to become a necessity. According to Salesforce CEO Marc Benioff, Agentforce represents what AI is supposed to be, an assistant for humans. The goal of Agentforce is to make companies more productive and help drive long-term profitability.

Initial feedback on Agentforce from customers has been positive. Businesses are using it to build autonomous agents for sales, customer support, marketing, and commerce. This tool has the potential to drive significant margin expansion in the businesses that use it, and I agree with management’s view that the product should scale over the coming year.

Salesforce is a GARP Stock

Finally, I’m bullish on the current valuation of CRM stock and see it as a top GARP security. The stock is trading at 25 times this year’s earnings, a slight 6% premium to its sector. That’s not bad. While analysts expect the company to grow its earnings by 23% this year and 10% in 2025, I see an upward revision to next year’s earnings estimates as Agentforce becomes more popular among enterprise clients and its sales accelerate.

Analysts’ Take on CRM Stock

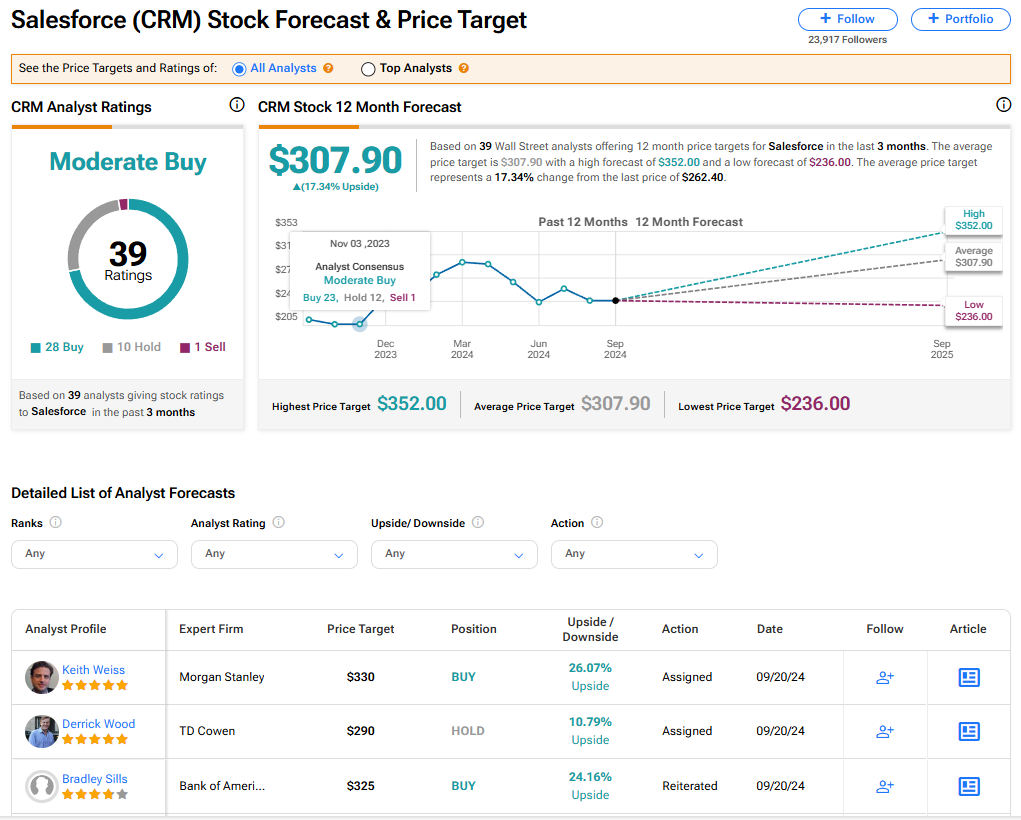

Salesforce currently has a Moderate Buy consensus rating among 39 Wall Street analysts. This is based on 28 Buy, 10 Hold, and 1 Sell recommendation made within the last three months. The average price target on CRM stock of $307.90 implies 17.69% upside from current levels.

Read more analyst ratings on CRM stock

Conclusion

Salesforce is a high quality company with a wide moat and a growing business. Its technology, strong brand and new AI platform are going to help drive long-term value for clients. CRM stock is currently trading at a reasonable multiple and my outlook on the stock is bullish.