Earlier today, Roots Corporation (TSE:ROOT), an iconic Canadian outdoor-lifestyle retailer, reported its Q3-2022 results, sending the stock 12% lower today so far. Roots’ results missed both revenue and earnings-per-share (EPS) expectations. The company’s revenue reached C$69.8 million (falling 8.5% year-over-year), which missed expectations of C$78.36 million. The fall in revenue can be mostly attributed to a worsening economy and an unfavorable change in product mix.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Additionally, its diluted earnings per share were C$0.05, much lower than the consensus estimate of C$0.21 per share, decreasing 80% year-over-year. Roots’ CEO stated, “Our third-quarter results reflect a shift in the economic environment since we last reported, which we expect to continue in the fourth quarter of Fiscal 2022.”

Roots’ adjusted EBITDA margin was 10.4% compared to 25.1% last year, while EBITDA decreased by 62% to C$7.28 million. Similarly, its gross margin also fell, albeit not as much, from 60.8% to 56.5%. Adjusted for temporary costs and government support, its gross margin only fell by 135 basis points. Notably, Root’s net debt dropped by 21% year-over-year.

Regarding share buybacks, Roots bought back about C$1.9 million worth on a year-to-date basis – or about 1.8% of its current market cap. It also announced the renewal of its buyback program today, allowing it to repurchase up to 10% of its public float from December 16, 2022, to December 15, 2023.

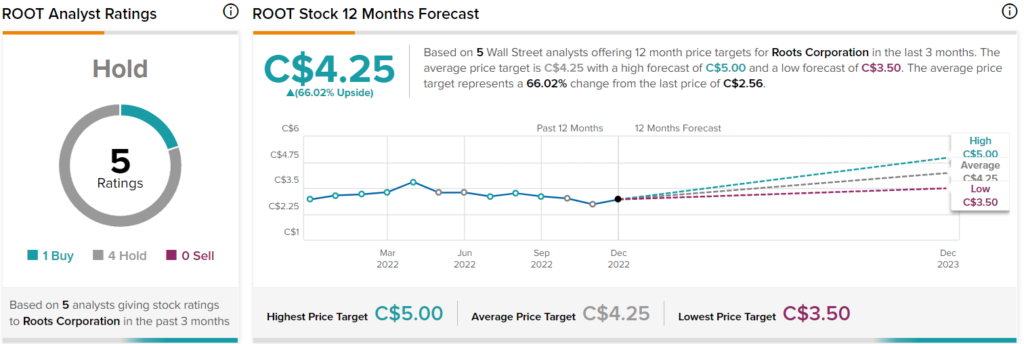

Is Roots Stock a Buy, According to Analysts?

According to analysts, ROOT stock comes in as a Hold based on one Buy and four Hold ratings assigned in the past three months. The average ROOT stock price target of C$4.25 implies 66% upside potential.

Conclusion: Roots’ Results Disappoint

Roots’ results were not the greatest, justifying the stock’s plunge today. A worsening economy is negatively affecting the retailer. Nonetheless, Roots has been around for decades and is still profitable, so it’s likely to survive a recession.