Investment firm Morgan Stanley (MS), led by four-star analyst Matthew Cost, assigned a Buy rating to video game platform Roblox (RBLX) with a price target of $170, which implies about 33% upside from current levels. In an even more optimistic scenario, the firm believes that the stock could reach $300. This positive outlook is based on Roblox’s strong user growth and potential to become a dominant platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

More specifically, the firm expects Roblox to surpass one billion monthly active users by 2030 after highlighting that its user base has already grown by roughly 10x since 2018. In addition, it estimates that the platform currently has 400 million monthly users, which is twice the combined user base of PlayStation, Xbox, and Switch, and nearly one-fourth the size of YouTube’s audience. Morgan Stanley also believes that Roblox is still in the early stages of penetrating its core demographic of five to 34-year-olds, with only 3% market penetration.

Beyond user growth, analysts point out that Roblox’s bookings have historically grown in line with its user base. Notably, they forecast sustained bookings and EBITDA growth of around 20% and 30% annually, respectively, over the next five years. With its strong position as both a content creation and consumption platform, Morgan Stanley also sees Roblox as one of the companies best positioned to benefit from the rise of AI tools in the gaming ecosystem.

Is RBLX Stock a Good Buy?

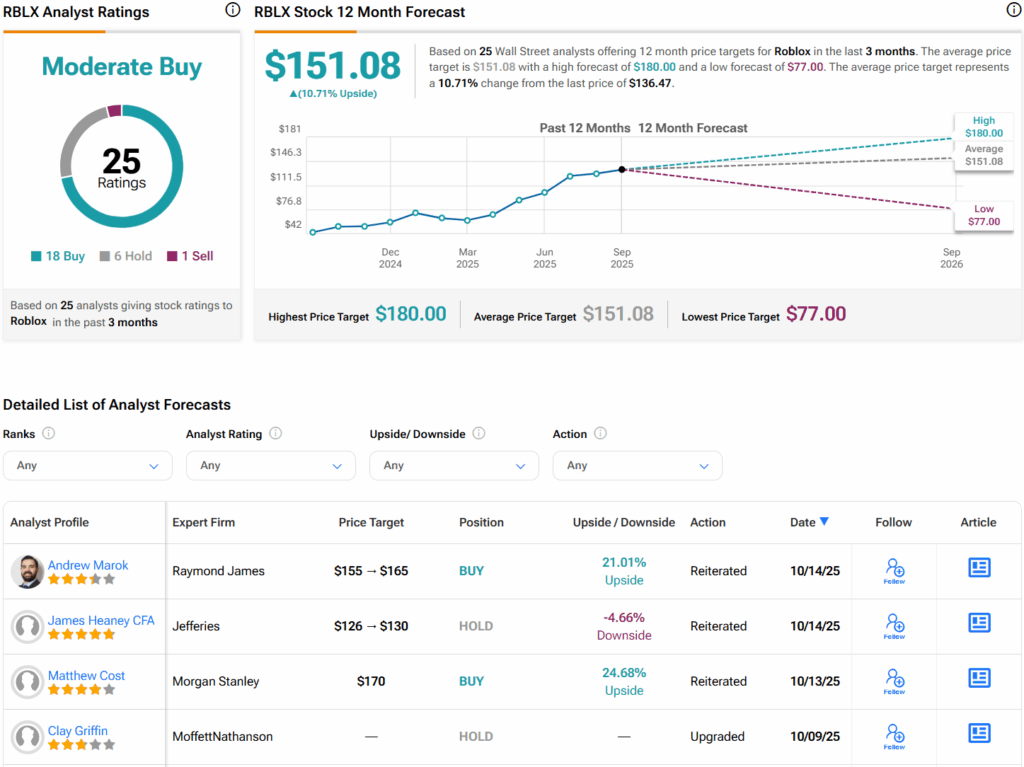

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RBLX stock based on 18 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average RBLX price target of $151.08 per share implies 10.7% upside potential.