Some stocks are a portfolio’s comfort food, and Realty Income (O) is one of them. I’m moderately bullish on the company as it prepares to publish its keenly anticipated first-quarter earnings report next week.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

In a world where tech gets all the hype and volatility grabs headlines, Realty Income keeps doing what it does best: paying dividends like clockwork every month, growing Adjusted Funds From Operations (AFFO), and staying steadfast in the face of macro noise. It’s not flashy, but it is exactly the kind of name I want in a defensive, low-volatility portfolio focused on cash flow over aggressive growth.

Slow and Steady Wins the Race

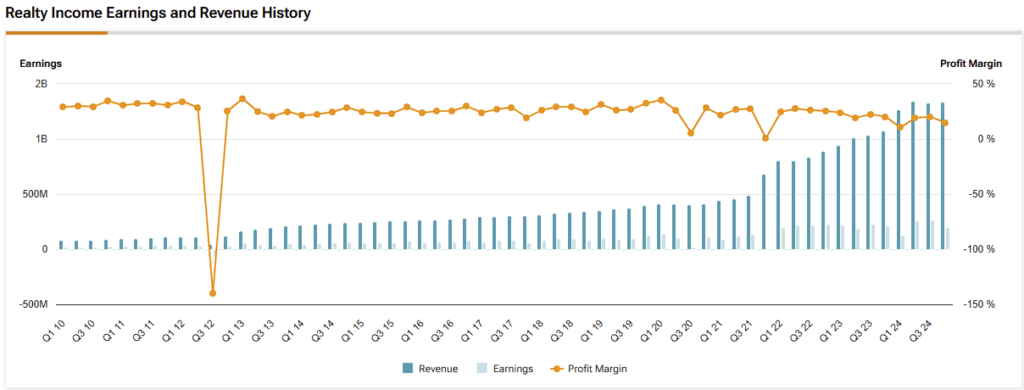

Realty Income finished FY2024 with continued stability despite macro headwinds. AFFO per share grew nearly 5% from last year, upholding a 14-year streak of yearly gains. Such dependability is precisely what I cherish. Moreover, management invested $3.9 billion in new properties, achieving average cash yields of approximately 7.4%. It’s not only solid; it’s quite impressive in today’s higher-rate environment. They continue to find excellent opportunities, yet remain disciplined.

One of the most thrilling developments I’ve noticed recently from Realty Income is its expansion overseas. In Q4 2024, the company spent about $650 million acquiring properties in Europe, with over 8% initial yields. This is a commendable return, especially considering that U.S. transactions were slightly lower. A highlight for me was the astonishing $770 million sale-leaseback transaction with 7-Eleven. That transaction made 7-Eleven their largest tenant and showed how Realty Income continues to grow smarter.

With over 15,600 properties worldwide and a 98.7% occupancy rate, the company is not just expanding—it’s strategically maneuvering into a better position that allows for smoother value accretion further down the track.

Let’s look at the blockbuster deal: Realty Income’s record $9.3 billion all-stock acquisition of Spirit Realty Capital. Its annualized rent grew overnight from $3.8 billion to a staggering $4.5 billion, with management estimating over 2.5% yearly growth in AFFO as a consequence. Even better, the transaction assisted in diversifying their tenant base and reducing concentration risk—a factor I always search for in REITs.

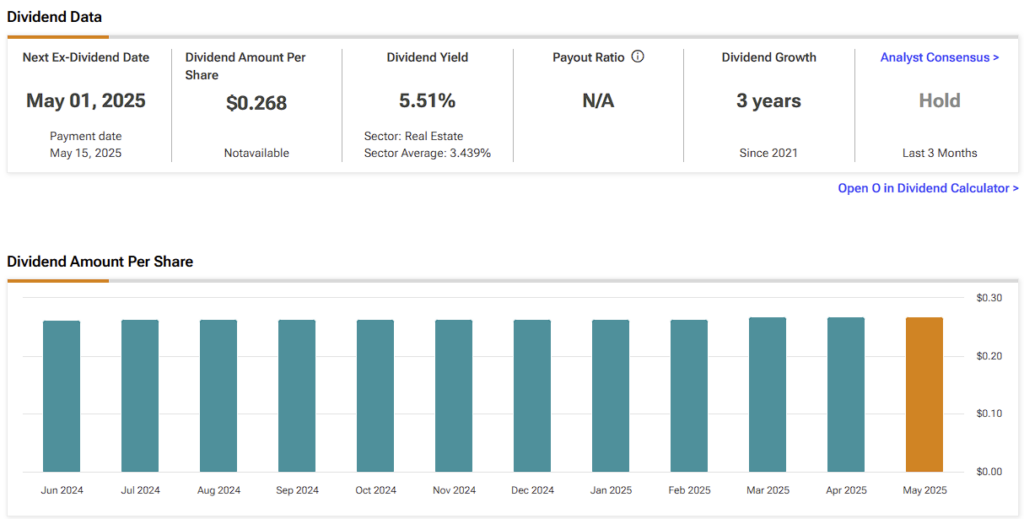

Financials Support a Killer Dividend

But here’s the number one reason I’m a fan of Realty Income: the dividend. O’s yield is hovering around 5.5%, and they’ve raised it yearly for 30 years straight. Over the long term, the dividend’s grown at a little over 4% per year, and it’s easily covered with a payout ratio of around 75% of AFFO. With an A-rated balance sheet to support it, it is one of the safest payments in the market. Not to mention, it pays the annual yield in monthly increments.

For FY2025, management is calling for 1-2% growth in AFFO per share. Granted, it’s a little slower—but I’m not too worried. Last year, we got a bit of a boost from lease termination fees and other one-time events, and tenant turnover is just a cost of doing business. What really matters is Realty Income’s long-term ability to replace vacancies with more favorable tenants, which they consistently do. This year may see a breather, but the fundamentals remain solid and intact.

Realty Income’s Macro Game Plan

Higher rates have been brutal on REITs, no doubt about it. Treasury yields have become formidable competition for dividend stocks, and valuations throughout the sector have suffered. But Realty Income has maintained its floating-rate debt exposure at only 4%—that’s risk management I can admire.

Also, while 1-2% fixed rent escalators might not track inflation, the firm has prudently tied much of its European leases to inflationary indexes. In addition, most tenants are in vital businesses like convenience retailing and grocery stores, which are sectors likely to weather even the worst economic storms.

Is Realty Income Stock a Buy or Sell?

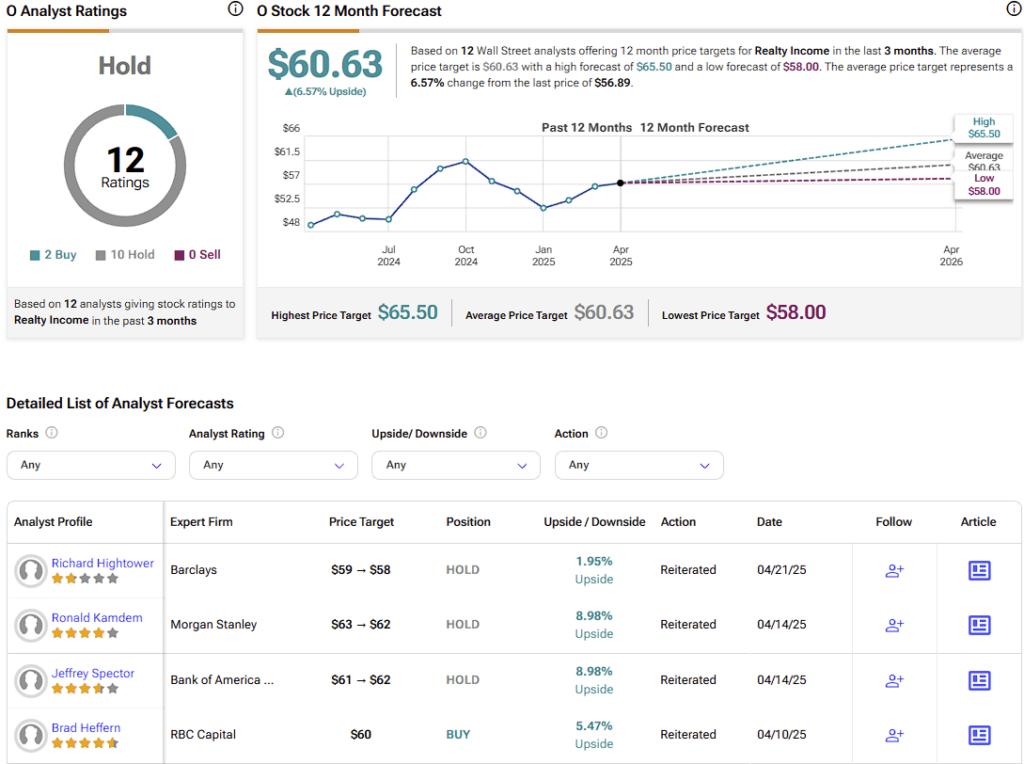

On Wall Street, Realty Income has a consensus Hold rating, based on two Buys, 10 Holds, and zero Sells over the past three months. The average O price target of $60.63 indicates a 6.5% upside potential over the next twelve months.

Realty Income Is Still Doing What It Does Best

Realty Income’s dividend is still safe and on the rise. And the company is managing the macro environment with discipline and smarts. The new financial year might not be a year of blockbuster events, but I’m not looking for short-term fireworks from this stock.

I’m looking at the long game of portfolio security, and Realty Income is precisely the vehicle for that. During volatile market times, I seek steady strength when modeling for risk-averse portfolios. With its secure dividend, consistent growth in AFFO, and conservative management, Realty Income is one of my default choices for steady income generation.