Shares of QuantumScape (QS) are drawing strong attention from investors as excitement over its solid-state battery technology grows. QS stock is up over 1% in pre-market hours on Friday. This followed an 18% jump on Thursday, extending its year-to-date gains to 133%. Despite multiple challenges, the company’s innovations, like the Cobra ceramic separator, make it a leader in solid-state batteries. Looking ahead, investors face a high-risk, high-reward situation as the company navigates execution hurdles and strong competition.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

QuantumScape is a solid-state battery developer aiming to revolutionize EV batteries with longer range and faster charging.

What’s Happening with QS Stock?

Yesterday, Panasonic (PCRFF) announced it’s working on an anode-free solid-state battery that could add about 90 miles of range to Tesla’s (TSLA) Model Y. The news sparked speculation about a possible tie-up with QuantumScape, whose own lithium-metal cell research closely mirrors Panasonic’s efforts. The buzz over a potential Panasonic-QuantumScape partnership helped lift QS shares in pre-market trading today.

Earlier this month, QS stock spiked over 20% after it unveiled its QSE-5 solid-state cells at Volkswagen’s (VWAGY) IAA Mobility show, even powering a Ducati motorcycle. But the excitement was short-lived, with shares sliding about 12% within two days as investors questioned the demo’s near-term commercial impact.

What’s Next for Investors?

Recent rallies show buyers returning, but QuantumScape still faces major challenges. The company’s main hurdle is turning its lab successes into batteries that can be produced at scale and sold profitably. Meanwhile, fierce competition from other battery start-ups and major automakers makes that challenge even tougher.

Moving forward, investors should keep a close eye on several key factors that could shape QuantumScape’s next move. First, progress on its pilot production line and updates on manufacturing timelines. Second, the company’s heavy cash burn makes future funding crucial, so any capital-raising efforts or government incentives will play a big role in determining dilution risk. Finally, competition is intensifying, and breakthroughs from rivals such as Panasonic or Toyota (TM) could quickly sway market sentiment.

Is QS Stock a Good Buy?

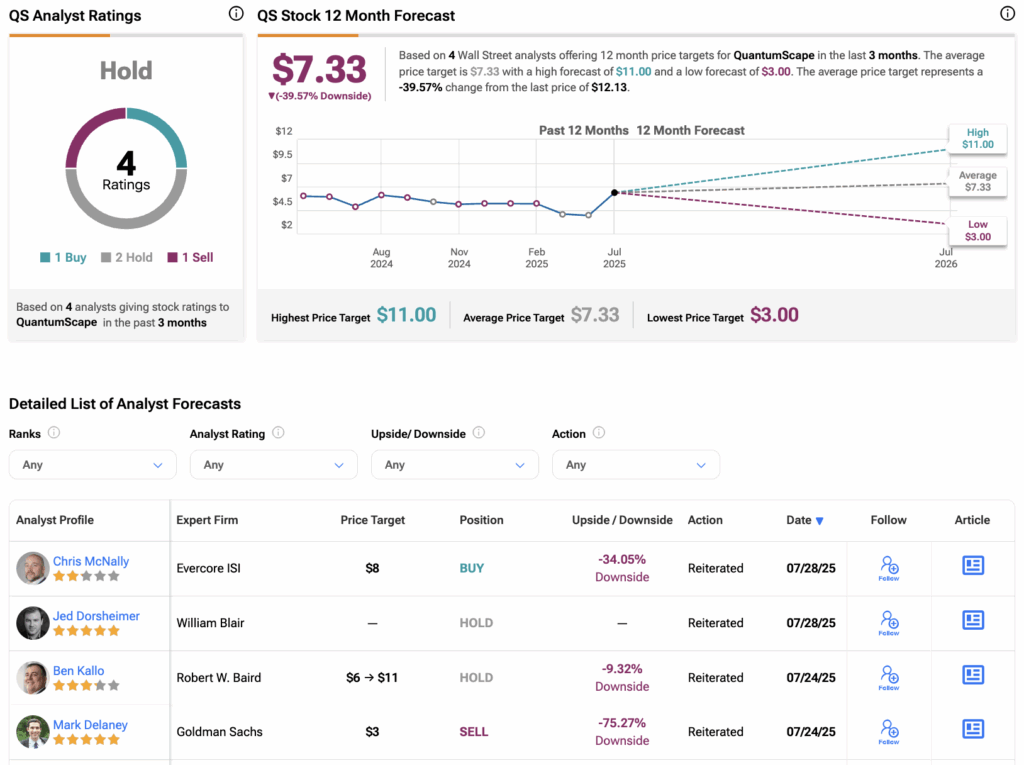

Turning to Wall Street, analysts have a Hold consensus rating on QuantumScape stock based on one Buy, two Holds, and one Sell assigned in the past three months. At $7.33, the average QS stock price target implies a 39.5% downside potential.