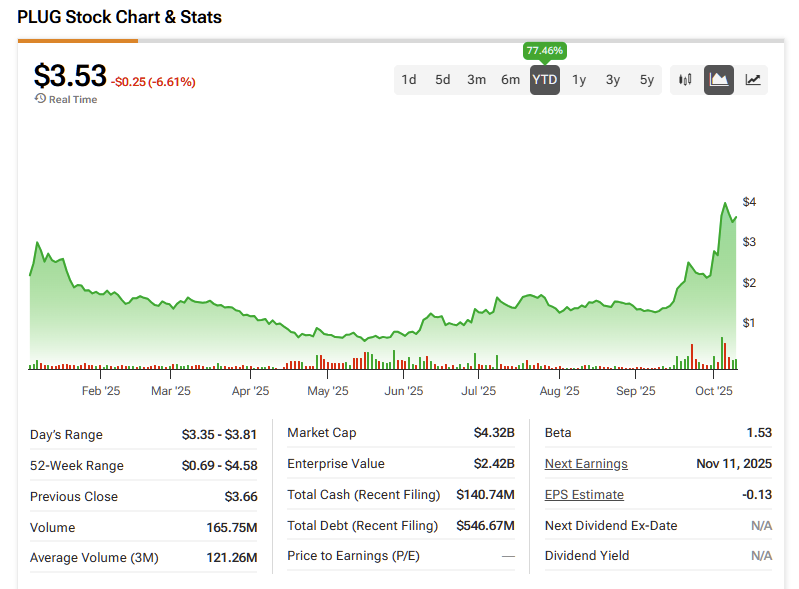

Even by Plug Power’s (PLUG) wild standards, the past few weeks have been extraordinary. The stock has surged about 153% in just a month, fueled by upbeat headlines, a bullish analyst upgrade, and a heavy dose of short-squeeze momentum. Optimists say the tide is finally turning—electrolyzer deliveries are ramping up, tax-credit guidance has improved, and soaring electricity demand from AI could lift hydrogen demand alongside it. But I’m not convinced.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The same catalysts driving PLUG higher also highlight its biggest vulnerabilities—execution risk, balance sheet strain, and overextended sentiment. For those reasons, I remain Bearish from here.

Why PLUG Stock Caught Fire Recently

One of the most significant events that helped fuel the ongoing rally was H.C. Wainwright hiking its price target to $7 and arguing that rising power prices could make green hydrogen tech more competitive. This refreshing twist got investors’ attention, as the very same note materially bumped long-term revenue expectations.

Second, Plug delivered its first 10-megawatt GenEco electrolyzer array to Galp in Portugal, providing tangible proof that the electrolyzer line is more than just a slide deck (and in the past, it was indeed just a slide deck).

The DOE’s conditional $1.66 billion loan guarantee (from 2024, reaffirmed on DOE channels in early 2025) is another macro tailwind. It should keep hope alive for building out U.S. green hydrogen plants, even if it doesn’t end up generating immediate revenue. The Treasury finalized rules for the 45V clean hydrogen production tax credit this year, as well, and they clarified tricky issues like hourly vs. annual matching and carbon intensity accounting. Any time a messy policy regime gets clearer, risk premiums compress, and stocks tied to it can jump.

And then there’s the old Plug ingredient that accompanies these catalysts. Short interest. With roughly 30% of the float sold short, even a spark can trigger a surge into manic buying. A few green days on high volume, and you can get incredibly long green candles. If short sellers are forced to cover, assuming the bullish sentiment persists, the stock could move further up in a parabolic manner.

Plug Power’s Progress is Promising Yet Doubtful

However, there are several issues to keep in mind. The DOE backing is only a conditional commitment as it’s subject to due diligence and closing conditions. Until the ink is dry (and the plants are financed, built, and operating), you can’t treat that $1.66 billion as de-risked capital. Plenty can slip on timelines, costs, and compliance.

On 45V, the final rules are helpful because they remove ambiguity, but they also come with rigor. Annual matching is permitted initially, but hourly matching (and deliverability) ultimately kicks in. This can pinch project economics if you don’t have the right power contracts and grid conditions. In other words, today’s “green-light” models can still wobble once the operational realities of hourly carbon accounting arrive.

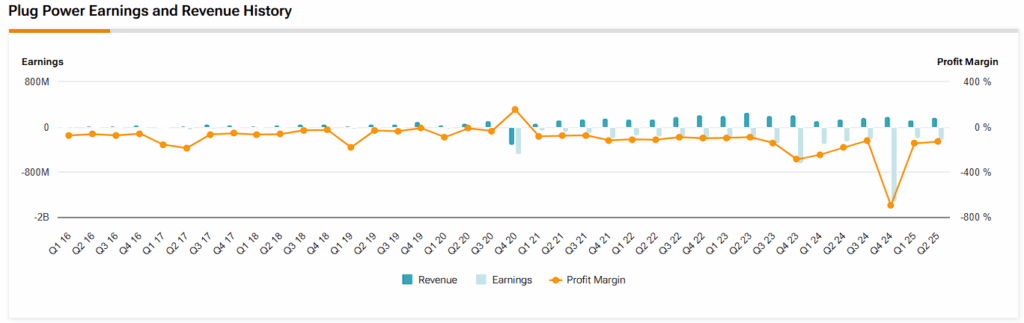

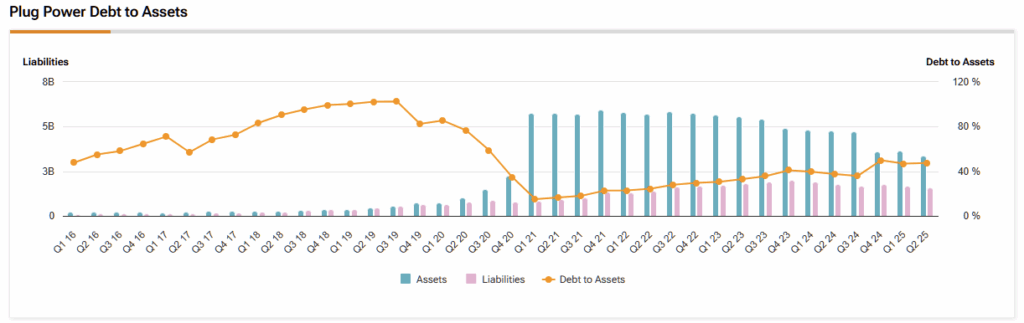

And financially, Plug remains loss-making and cash-hungry. The Q2 margin improvement (to –31% from a brutal –92% a year ago) is a step, but the company still printed negative gross margins and had limited unrestricted cash alongside ongoing burn. That means more non-dilutive funding needs to materialize, or equity holders risk further sentiment erosion.

Plugging Into a Moving Target

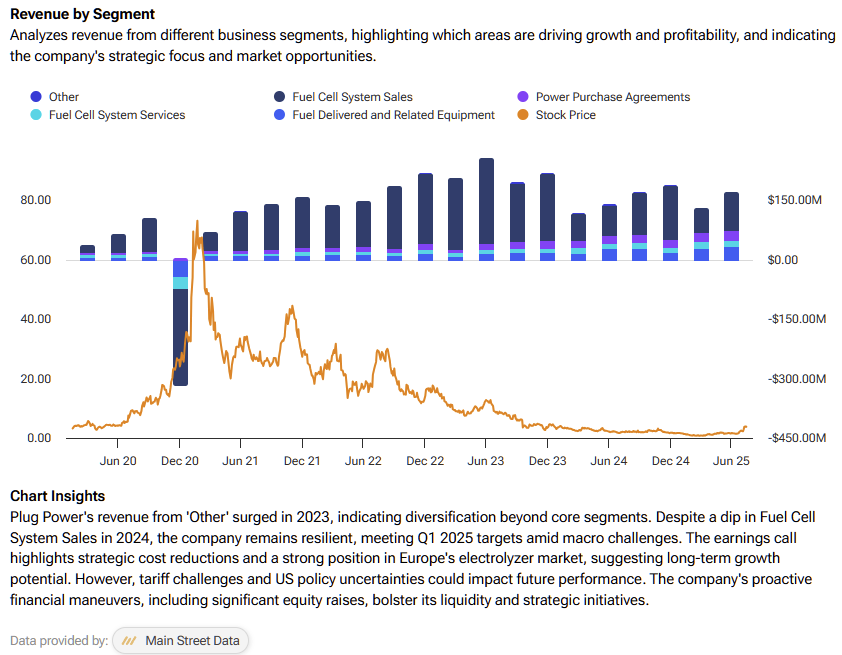

Valuing PLUG right now is, in my opinion, nearly impossible. The firm is revenue-generative but not self-sustaining. Consensus estimates project revenue to rise from roughly $710 million in 2025 to about $882 million in 2026, and then to around $1.08 billion in 2027 — a respectable growth trajectory. However, analysts also expect the company to continue posting losses, with negative EPS persisting through at least 2025. You can debate the slope of the line, but the sign is still negative.

While it might be tempting to value PLUG based on sales, I think that would be a grave mistake. The company’s actual margins are extremely thin, and its capital expenditures are massive. Expanding electrolyzer capacity, production facilities, logistics, and service infrastructure all require heavy investment. Even with improved contracts and cost reductions, gross margins remain razor-thin or even negative, and operating losses continue. For those keen to know where PLUG stands in relation to its sector, its EV/Sales ratio is 8.04 compared to 2.12 for the sector, with a similar discrepancy on a forward basis.

The difference in ratios indicates that the market is pricing Plug Power at a significant premium compared to its peers, such as Fuelcell Energy (FCEL), Solid Power (SLDP), and Microvast (MVST). This suggests investors are paying over three times more per dollar of revenue relative to the industry average—reflecting high expectations for future growth but also leaving little room for error if the company’s margins or execution continue to lag.

Moreover, Plug will almost certainly need to raise additional capital — which, in its case, means dilution. In fact, I suspect management will move quickly to capitalize on the recent share price surge and raise funds sooner rather than later.

Is PLUG a Good Stock to Buy?

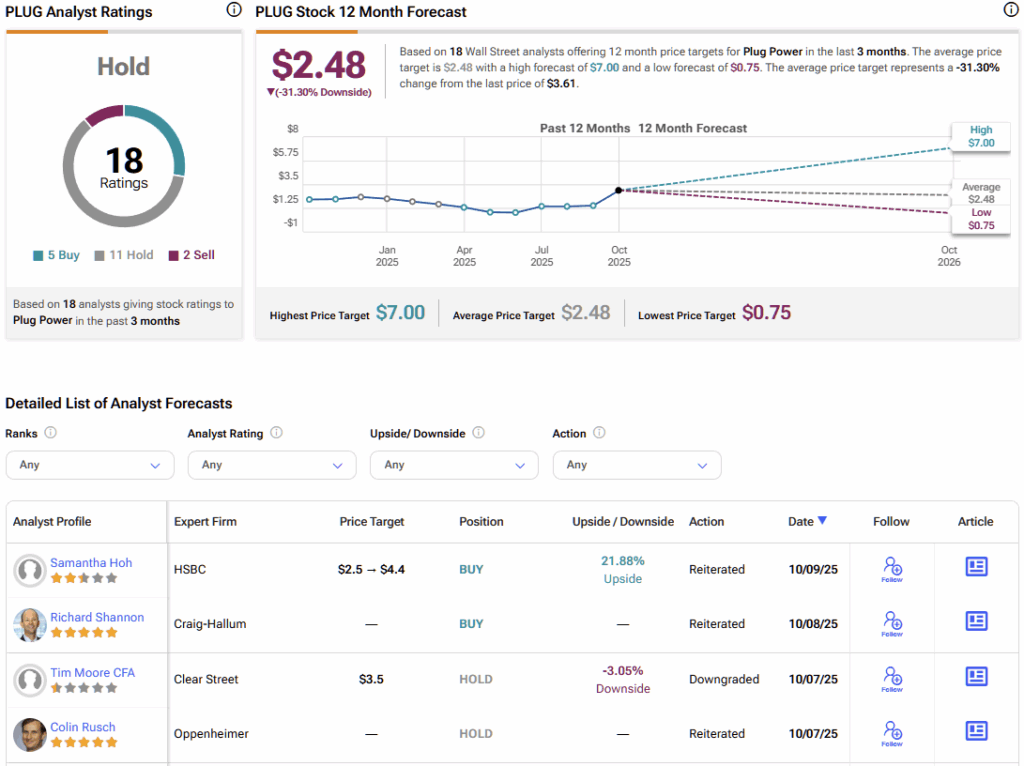

There are 18 analysts offering price targets on PLUG stock via TipRanks, forming a mixed consensus. Specifically, five analysts have rated the stock a Buy, 11 a Hold, and two a Sell. Notably, at $2.48, PLUG’s average stock price target implies about 31% downside over the next twelve months.

PLUG’s Rally Runs on Hype, Not Fundamentals

I understand the excitement around PLUG stock. There’s finally some visibility on electrolyzer deliveries, greater clarity on the 45V tax credit rules, and a massive power-demand narrative unfolding in the background. But this rally has been fueled largely by conditional optimism — capital flows, policy nuances, and short-covering dynamics — rather than fundamental improvement.

The key challenges remain: negative margins, heavy capital requirements, and the likelihood of further equity raises. With consensus still projecting losses and sales-based valuations already stretched, a pullback wouldn’t surprise me. I’m cautious here — and if I held PLUG after this surge, I’d be taking some profits.