Digital residential real estate platform Opendoor Technologies (OPEN) recently revealed plans to allow crypto payments for property transactions in the future, sending its stock ~14% higher earlier this week. In fact, this week’s price action has propelled Opendoor stock to a 388% YTD gain. However, those gains were rather short-lived as the past few days have seen heavy selling.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The newly appointed CEO, Kaz Nejatian, who joined after a stint as the COO of Shopify (SHOP), shared his crypto plans on X, confirming that the company is planning to prioritize Bitcoin payments. Although allowing Bitcoin payments seems like a step in the right direction, the company is likely to face increased regulatory scrutiny at a more practical level.

Since July this year, the stock has staged a seemingly miraculous turnaround — turning a deepening disparity with the S&P 500 (SPX) into a sudden surplus.

Moreover, I believe investors should look beyond these crypto plans to understand the fundamental challenges that have limited Opendoor’s growth in the recent past. Therefore, I am Bearish on the prospects for Opendoor as I believe the company’s current valuation already accounts for years of future growth.

Embracing Crypto Payments is a Bold Bet on the Future

Although I remain bearish on Opendoor’s near-term prospects, I believe its decision to eventually enable crypto payments is a smart strategic move for long-term growth. Despite ongoing regulatory uncertainty, global momentum behind crypto transactions is undeniable—and being the first major U.S. player to cross that Rubicon could prove meaningful down the line.

In April, Rilea Group completed the first-ever wallet-to-wallet crypto residential sale in the U.S., valued at roughly $530,000—a landmark shift for the domestic property market. Previously, crypto-based home sales required converting digital assets to U.S. dollars before closing. Internationally, the United Arab Emirates has taken the lead in crypto-enabled real estate by creating the Virtual Assets Regulatory Authority, allowing major developers to accept crypto directly.

Donald Trump’s son, Eric Trump, spoke at a Bitcoin conference in Abu Dhabi last year.

Portugal and Switzerland have also shown greater regulatory openness toward crypto property payments. Opendoor’s move, therefore, aligns with an emerging global trend rather than a speculative detour.

Looking ahead, Opendoor may also explore the tokenized real estate space once crypto payments are established. According to Deloitte, roughly $4 trillion in real estate assets could be tokenized by 2035, up from less than $0.3 trillion in 2024. Tokenization is already gaining momentum in markets like Dubai, where investors can buy into tokenized property funds and even real estate-backed loans. As property ownership itself evolves, Opendoor appears intent on positioning for the next phase of digital real estate innovation.

Opendoor’s Crypto Pivot Can’t Outrun a Brutal Housing Reality

Although I believe Opendoor’s move to embrace crypto is strategically sound for the long term, the market’s reaction appears to overlook the company’s underlying challenges. The macro environment remains highly unfavorable, with mortgage rates hovering near 6.4% and consumer sentiment toward homebuying at multi-year lows. According to a Fannie Mae National Housing Survey from April, only 23% of respondents said it’s a good time to buy a home.

These figures underscore the severe affordability pressures facing buyers amid persistent inflation and elevated financing costs. Additional red flags include a 25% year-over-year drop in clearance rates during Q2 and decade-high delisting activity, both pointing to a sluggish housing market.

As a result, Opendoor’s near-term outlook looks weak. Management has already guided for a sharp sequential revenue decline in Q3 to $800–$875 million, down from $1.57 billion in Q2, and expects adjusted EBITDA to swing to a loss of at least $21 million, compared with a $23 million profit in the prior quarter.

Opendoor’s Crypto Ambition Adds a New Layer of Risk

Beyond the macro headwinds, I believe Opendoor’s decision to accept crypto payments could add another layer of volatility to its stock. Holding crypto assets on the balance sheet would expose the company to market risks unrelated to real estate, introducing a new source of financial instability.

Even if Opendoor opts to instantly convert crypto payments into fiat, the associated transaction fees would erode already thin margins. With management projecting adjusted EBITDA losses for the upcoming quarter, the company is in no position to absorb additional pressure on profitability.

In the meantime, Opendoor’s Price-to-Sales ratio of 1.13, compared to the sector median of 4.38, suggests that the stock has taken a severe beating and is therefore priced like a bargain.

Is Opendoor a Good Stock to Buy?

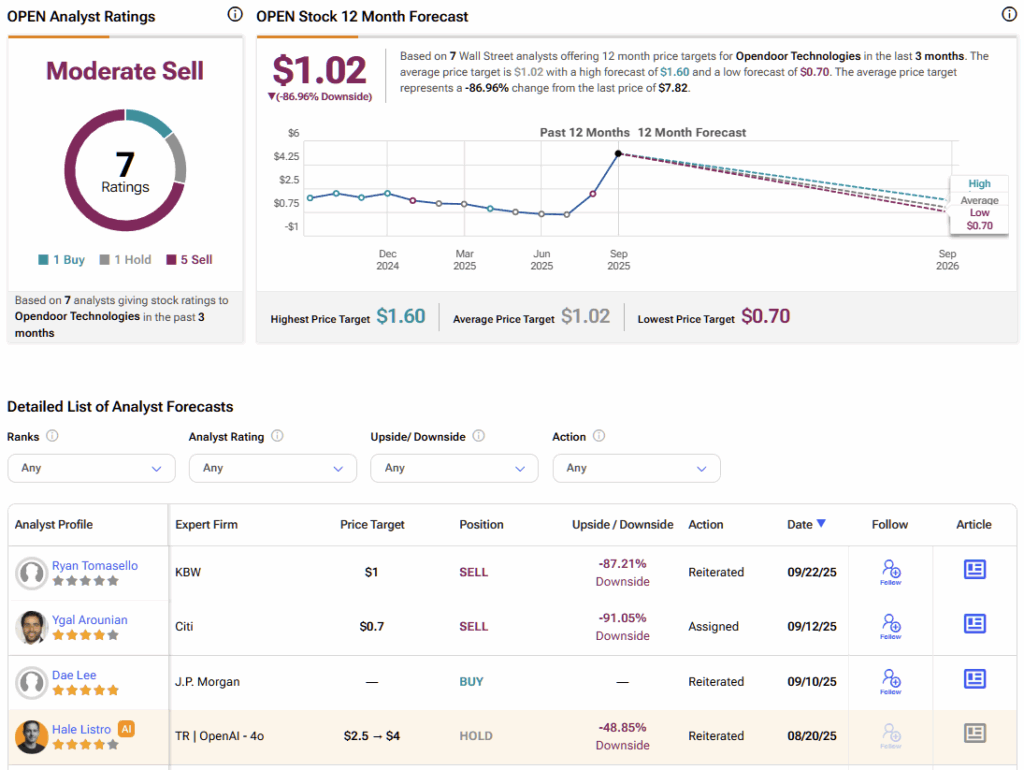

The short answer is no. On Wall Street, OPEN stock carries a Moderate Sell consensus rating based on one Buy, one Hold, and five Sell ratings over the past three months. OPEN’s average stock price target of $1.02 implies a staggering 87% downside potential over the next twelve months.

I share this bearish view given that the company is making substantial losses and is also finding it difficult to grow (only three quarters of YoY revenue growth in the past 10 quarters). The challenging operating conditions facing Opendoor suggest, on the other hand, that the company’s financial performance is unlikely to turn a corner in the foreseeable future as well.

Opendoor’s Crypto Buzz Can’t Cover Weak Fundamentals

Opendoor’s stock has surged over the past year, yet the company’s financial performance continues to lag. Recent comments from the newly appointed CEO hinting at plans to enable crypto payments for real estate transactions have sparked another rally.

While this strategy could hold long-term promise, investors should be careful not to let the excitement overshadow the company’s deep-seated fundamental challenges. I remain bearish on Opendoor’s outlook, as I believe its weakening fundamentals will ultimately weigh on the stock.