Shares of U.S.-based Oklo Inc. (OKLO) surged more than 18% in early trading today after Meta Platforms (META) announced deals with three nuclear power providers. As Meta works to secure energy for its growing AI projects, nuclear stocks surged, with Oklo and other energy companies posting strong gains. Vistra Corp. (VST) also rose 17% in early trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Oklo develops compact nuclear microreactors aimed at providing reliable, low-carbon power for commercial and industrial use.

Meta Signs Nuclear Energy Deals

Meta has teamed up with Vistra, TerraPower, and Oklo—all working in nuclear power—to supply energy for its Prometheus supercluster, currently under construction at a data center in New Albany, Ohio. The company said that its collaboration with the three nuclear firms could add 6.6 gigawatts of power by 2035, enough to meet the entire energy demand of New Hampshire.

To be precise, Meta plans to support several small nuclear reactors being developed by Oklo over the next decade.

The deals are the latest step in Meta’s push to secure the energy needed for its AI infrastructure as the company works toward Mark Zuckerberg’s goal of building superintelligent AI.

What Meta’s Deal Means for OKLO

While Meta didn’t reveal the contract values, deals of this size could bring billions of dollars in revenue to electricity providers. Being selected by a Big Tech company like Meta also boosts Oklo’s credibility, making it easier to attract investors, partners, and customers.

Additionally, the partnership gives Oklo steady demand and support for its small nuclear reactors, which could help speed up construction and production. Meta noted that Oklo’s advanced nuclear technology campus in Pike County, Ohio, is expected to be operational by 2030.

Overall, the deal positions Oklo as a leading player in next-generation nuclear energy, potentially opening opportunities for more large-scale energy contracts in the future.

Is OKLO a Good Stock to Buy?

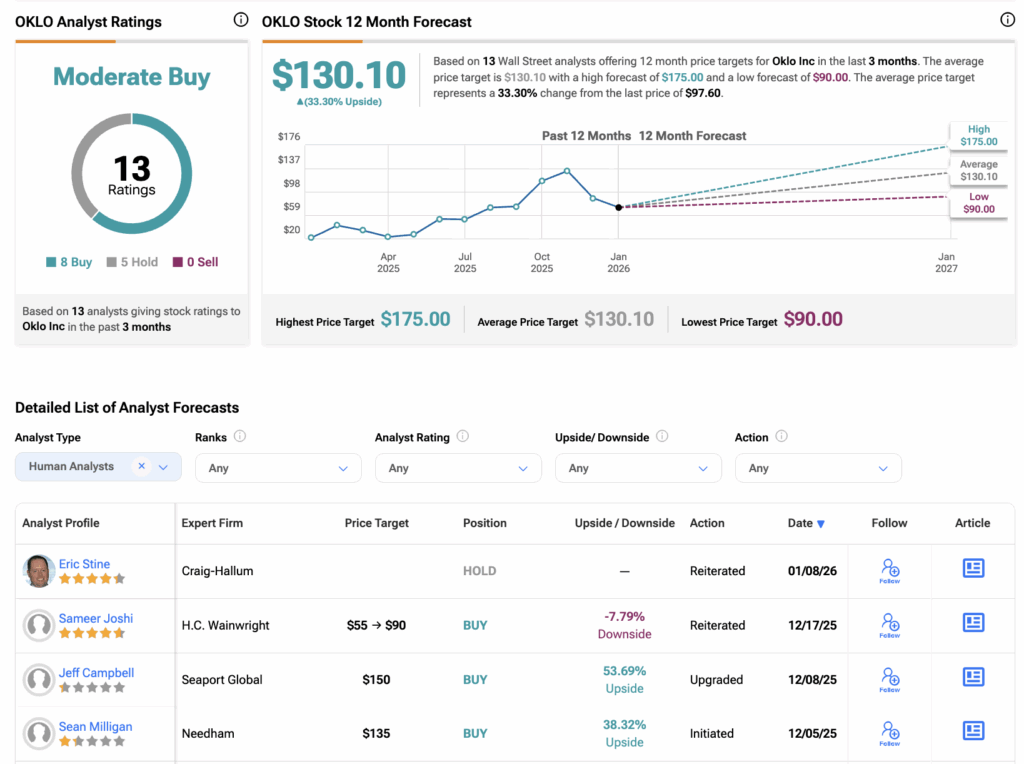

Overall, Wall Street has a Moderate Buy consensus rating on OKLO stock, based on eight Buys and five Holds assigned in the last three months. The average share price target for Oklo is $130.10, which implies an upside of 33.3% from current levels.