It’s hard to call Nvidia (NVDA) cheap, but its long-term growth potential may justify the premium. Sometimes, paying up is the cost of elite returns, and with Nvidia expanding into the sovereign AI market, including large-scale national computing clusters, the runway looks even longer. Europe, in particular, offers compelling growth prospects, and I remain bullish on the stock’s future.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The stock has barely kept pace with the S&P 500 so far this year, posting a 1.8% comparative gain, which indicates sluggish performance. However, as you’ll soon notice, NVDA has a significantly better record over the past three years.

Moreover, NVDA may even be on the receiving end of European-based catalysts on the horizon.

Europe and the UK’s Big Bet on AI

Europe is rapidly scaling its AI capabilities, and Nvidia is positioned at the center of this transformation. France’s €100 billion France 2030 plan includes the €8.5 billion Paris AI supercomputing campus, driven by a partnership between Nvidia, Mistral AI, and Bpifrance.

Meanwhile, Germany’s Digital Strategy 2025 is accelerating AI investment, with its upcoming Blue Lion supercomputer set to run on Nvidia’s Vera Rubin GPUs, following Jupiter—the continent’s first exascale system, also powered by Nvidia.

In the UK, the National AI Research Resource has committed £300 million through 2025, while Bristol’s Isambard-AI supercomputer features 5,000 Nvidia GH200 chips. EU-wide, the Digital Europe Programme targets €20 billion annually in AI funding, putting cumulative sovereign AI and data center investment on track to exceed €200 billion by 2030, all of which signals long-term opportunities for Nvidia.

All of the above add up to a strong bullish outlook for NVDA, building upon the already aggressive expansion in the U.S. market, which includes a $500 billion investment in the Stargate initiative. Realistically, Nvidia will likely capture a significant share of the global sovereign GPU/cloud market, thanks to its dominant 80-90% market position in GPUs.

Although NVDA’s stock performance has barely caught up to broader benchmarks year-to-date, a 3-year horizon reveals that NVDA shareholders have little to complain about with a 700%+ outperformance over the S&P 500 (SPX).

Nvidia’s CEO, Jensen Huang, has mentioned that sovereign AI demand is diversifying revenue away from Big Tech companies and boosting long-term visibility. Combined with the looming growth opportunity in robotics, I believe there are numerous reasons to remain long-term bullish on Nvidia.

Nvidia’s Premium Is Justified by Market Leadership

Nvidia is likely to grow its earnings per share at a compound annual growth rate of approximately 30% over the next three years, before facing the risk of a cyclical pullback. This is remarkably strong when compared to the consensus of 15% for the sector. This helps to illustrate why Nvidia deserves its premium P/E GAAP ratio of 46, compared to the sector’s average of 28. Ironically, based solely on these metrics, Nvidia could be deemed somewhat undervalued.

Technically, the stock exhibits bullish momentum, but it doesn’t appear overvalued because of the unique monopoly status the company enjoys. At a 14-week Relative Strength Index value of 60, the stock remains within the optimal range for buying, even though it’s trading above the 50-week moving average in price.

Robotics is the Next Frontier for NVDA

With the robotics market projected to reach about $160-260 billion by 2030, Nvidia will be enjoying massive growth in the AI compute portion of the opportunity. Within a decade, robotics could offer Nvidia a multi-billion-dollar incremental annual revenue stream, not dissimilar from the AI data center growth trajectory we’re currently witnessing.

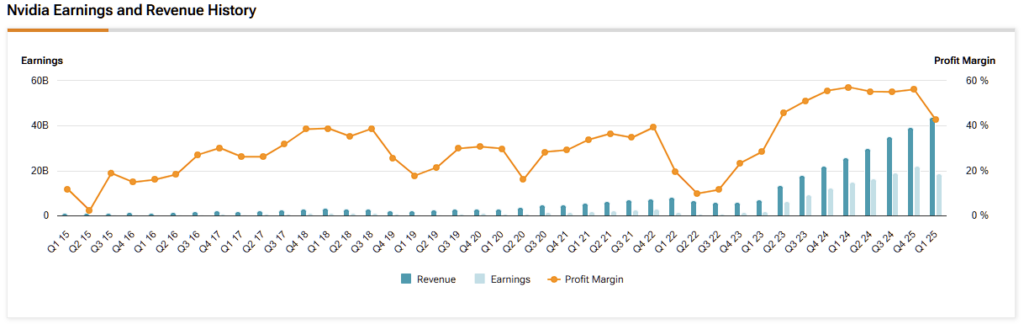

Also, Nvidia’s recurring revenue prospects from software and cloud-based simulation services for robotics add major further (and sustainable) upside. Examining NVDA’s earnings and revenues in more detail reveals a concerted revenue acceleration as of Q4 2023.

That said, it’s worth bearing in mind that Tesla (TSLA) and others will be dominating the robotics market with vertically integrated solutions. But Nvidia is strategically positioned as the robotics “arms dealer,” enabling robot builders rather than competing directly with end products.

What excites me most about the robotics opportunity for companies like Nvidia is its unpredictability, much like the early days of AI. At first, there were only hints of its potential, and then it exploded. I believe we’re in the early stages of a similar story with robotics. When the moment arrives, it won’t be gradual—it’ll be a breakthrough. That’s a wave I want to be riding, which is why I hold both Nvidia and Tesla in my portfolio.

Is Nvidia stock a Buy, Sell, or Hold?

On Wall Street, Nvidia has a consensus Strong Buy rating, based on 35 Buys, four Holds, and one Sell rating over the past three months. The average NVDA stock price target is $173.19, indicating an 18% upside potential over the next 12 months.

This is a strong outlook, and I’ve personally set a take-profit at $200, which I’ll reassess around $175 to see how cyclical dynamics are evolving. I’m growing increasingly confident that Nvidia won’t face a cliff as it expands into the robotics and sovereign AI opportunities.

Nvidia’s AI-Powered Uptrend is Far from Over

Some may argue that Nvidia’s growth is decelerating and use that as a reason for caution, especially given its premium valuation. But that view overlooks the broader picture. While growth may be moderating, it remains strong and is underpinned by long-term opportunities in areas like robotics and sovereign AI. I remain bullish and invested, keeping a close eye on Jensen Huang’s leadership as a guide for navigating what’s next with Nvidia.