Carvana (CVNA) is one of the biggest and fastest turnaround stories we’ve seen in the market. The e-commerce platform for used cars, with its giant vending machines, saw its stock price plummet from a peak of $370 in 2021 to as low as $4 by the end of 2022. Yet, CVNA stock rebounded to $263 per share by November 2024. Even with concerns over a recent short-seller report factored in, I remain bullish on the company and its stock. Carvana seems on track to complete its turnaround and still has significant growth potential.

Carvana’s Sharp Stock Decline

Before diving into the bullish case for CVNA stock, it’s worth looking at where the company was not too long ago and how it managed such an impressive turnaround from its 2021 lows. Carvana was a “meme stock” in August 2021, when its share price shot up to $370 amid a market fueled by zero interest rates and COVID-19 stimulus. But things quickly took a turn post-COVID, from late 2021 to 2023. The company faced bloated inventory due to global supply chain disruptions and struggled with operational issues, even putting some of its dealership licenses at risk.

To make matters worse, Carvana was also dealing with the fallout of an overvalued stock amid a used car bubble that eventually burst, causing prices to plummet. As a result, Carvana reported operating losses of over $1.4 billion for the year 2022, compared to just $104 million in 2021. This period of crisis saw Carvana’s net debt balloon from $1.45 billion in 2020 to $8 billion by 2022. During this time, interest rates surged from 0.1% in 2022 to 5.3% in 2023, making debt servicing much more expensive. By the end of 2022, Carvana had only $434 million in cash reserves and $4.6 billion in current assets—a precarious position for any company.

In a bid to stay afloat, Carvana raised $1.2 billion through equity sales, further diluting shareholders. As a result, the stock tumbled from its $370 peak to just $4 per share in December 2022, a 98% decline. At this point, about 60% of its float was shorted and fears of bankruptcy were running high in the media.

A Miraculous Turnaround

A big part of my bullish outlook on Carvana comes from its incredible resilience and the remarkable turnaround it’s staged, transforming into a much stronger business than it was at its previous peak in 2021.

Starting in 2023, everything shifted for Carvana. Used car prices returned to normal levels after the pandemic spike, and as the bear market faded, the bulls came back to the stock market. This created a more positive environment for Carvana, which was also implementing some major changes to improve its operations. The company undertook significant cost-cutting measures, and as a result, Carvana posted an operating loss of just $66 million in 2023, a massive improvement from the $1.4 billion loss in 2022.

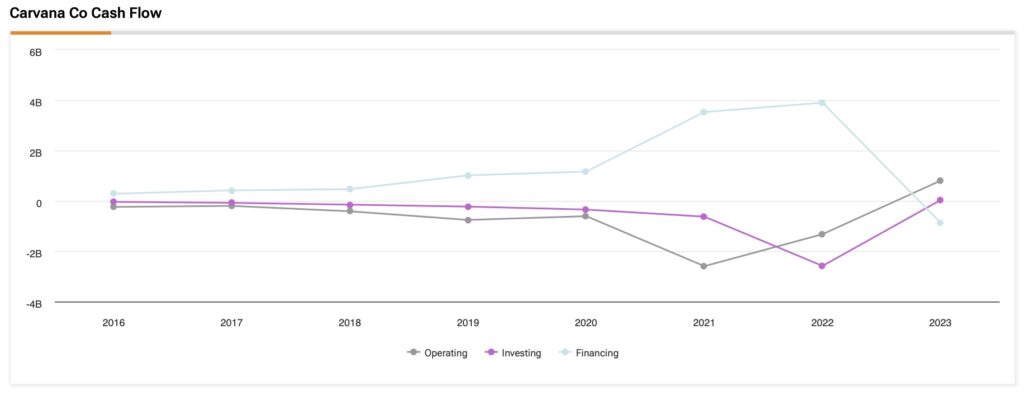

Even more impressive, Carvana flipped its negative cash flow from operations, which was -$1.32 billion in 2022, to a positive $803 million in 2023. Over the last 12 months, cash flow from operations has reached $619 million.

Arguably, the turnaround can be considered officially completed when you look at the company’s most recent results, which show that the market is still underestimating Carvana’s potential. In Q3 2023, the company reported earnings per share (EPS) of $1.14, far surpassing the estimated $0.31. On the revenue side, Carvana brought in $3.66 billion, beating estimates by $185 million, and showing an impressive 32% year-over-year growth.

Allegations from Hindenburg Research

Recently, a potential threat to the bullish thesis on Carvana emerged as the company was targeted by the well-known short-selling firm Hindenburg Research. In its report, Hindenburg accused Carvana of financial misconduct, highlighting the risks associated with the company’s subprime credit business and questioning the sustainability of its expansion. The report also revealed that Hindenburg had taken a short position in CVNA stock.

Following the release of the report, Carvana’s stock fell 2%—a drop that came after a period in which concerns over a more hawkish Fed in 2025 cutting rates at a slower pace, that likely halted the company’s rally last year. In fact, CVNA stock surged 284% last year due to growing confidence in its performance.

Despite the negative report, most analysts are still bullish on CVNA stock. Since early December, Carvana shares have struggled, but Wall Street analysts have stood firm in their support of the company’s recovery. For example, J.P. Morgan Chase (JPM) stated that its own research “has not suggested any red flags” and that the current share price presented a solid opportunity to “buy on weakness.”

Carvana’s Valuation

When you look at Carvana from the perspective of earnings multiples, it may appear overpriced, trading at a forward P/E ratio of 128 times future earnings. However, my bullish thesis on the company rests on a deeper look at other metrics that suggest Carvana is actually trading at more justifiable levels.

It’s important to compare Carvana with its competitors. One key factor is how Carvana uses its assets—specifically its inventory of used cars—to generate revenue. For instance, Carvana’s asset turnover ratio is 1.74 times, compared to 0.99 times for the average in the automotive retail industry. This reflects Carvana’s ability to rotate its inventory quickly, generating more revenue with less invested capital. In other words, Carvana is much more efficient in using its assets to drive revenue.

Given this competitive advantage, I believe Carvana’s price-to-sales (P/S) ratio of 1.8 times isn’t too unrealistic. Especially when you consider that the company is projected to grow sales at a compound annual growth rate (CAGR) of 17% from 2025 to 2027, which, adjusted for growth, results in a forward P/S of 1.1 times. This is not bad for a disruptive company in the retail car industry.

Is CVNA Stock a Buy?

Wall Street analysts have rated CVNA as a Moderate Buy, with eight analysts out of 14 recommending a Buy and the remaining six recommending a Hold. The average price target of $258.36 implies upside potential of 28.27% from current levels.

Conclusion

Usually, when a company drops 98% from its peak but doesn’t go bust, it’s a sign that the business is at least pretty resilient. Carvana today is definitely much stronger than it was in 2021. Recent progress shows the company is heading in the right direction. Even with challenges like a recent short-seller report weighing on its share price, I still see plenty of growth potential in Carvana’s stock. That said, I believe buying CVNA stock on current weakness could payoff through 2025.