Lately, people have been nervous that the S&P 500’s (SPY) steady climb to new highs might be turning into a bubble, according to Yahoo Finance. Indeed, a lot of this concern comes from how expensive the index looks compared to company profits. Critics say that most of the gains this year have come from just five huge tech companies. But if you look more closely, tech giants like Nvidia (NVDA), Microsoft (MSFT), Meta (META), and Alphabet (GOOGL) actually deserve their higher prices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In fact, their profits are growing so fast that their price-to-earnings ratios have actually gone down even as their stocks have gone up. This means that the growth in earnings is keeping up with or even outpacing stock price gains. As a result, the bigger concern may instead be with the rest of the market. Interestingly, when you remove tech, the S&P 500 has still gone up 13% in the past year, but profits outside of tech have only grown about 6%, according to data compiled by Bloomberg Intelligence. Some sectors, like materials, have done even worse, with stocks rising while earnings are falling.

According to analysts at Seaport Research Partners, this suggests that the real speculation may not be in tech stocks, but rather in everything else. In fact, since the bottom of the 2022 bear market, the S&P 500 has surged by 83%, but earnings have only grown 16%. As Ed Clissold from Ned Davis Research explains, that means valuations are stretched across the board, not just in tech, because even the cheapest stocks in the market are now considered expensive.

Is SPY Stock a Good Buy?

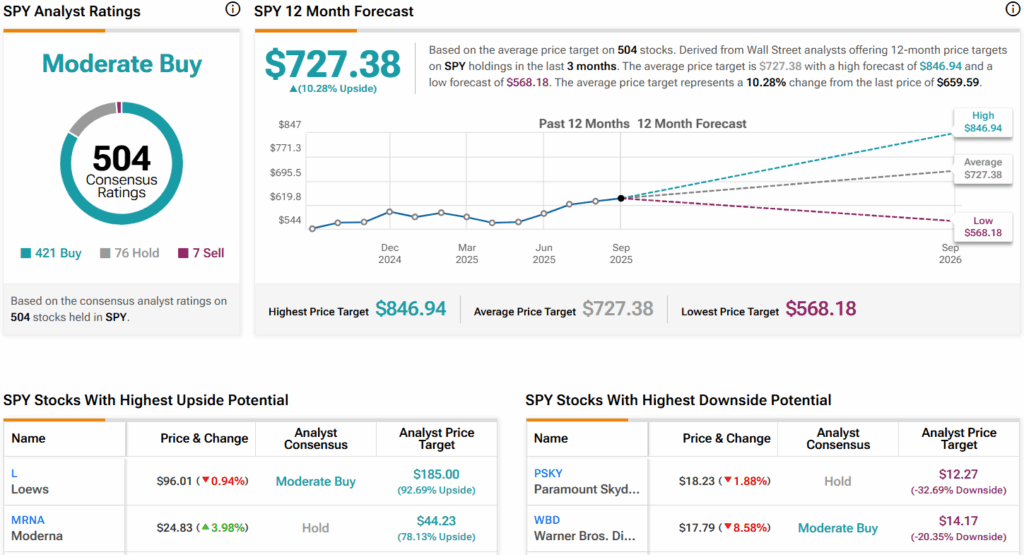

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SPY based on 421 Buys, 76 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $727.38 per share implies 10.3% upside potential.