As a longtime observer of Microsoft (MSFT), I’m particularly optimistic about the upcoming Build 2025 conference, the tech giant’s leading developer conference, scheduled for next week in Seattle.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The event can serve as a bullish price catalyst, especially as Microsoft showcases its deepening commitment to AI agent technology. This strategic pivot has meaningful implications for revenue growth, margin expansion, and long-term shareholder value, particularly through products like Microsoft 365 Copilot.

If Microsoft can effectively commercialize these AI capabilities, the financial upside could be substantial. However, the market has yet to fully reflect this opportunity in the company’s current valuation, so I’m firmly bullish on MSFT stock.

What to Expect from Build 2025

When Microsoft holds its Build 2025 conference, I’ll look for major announcements on AI convergence, particularly across Windows, Azure, and Microsoft 365. Following the direction established by last year’s advancements, I’m anticipating more sophisticated and autonomous AI agent functionality. We might, for example, witness sophisticated Copilot functionality that runs routine PC tasks on its own, transforming user productivity.

Azure could also be front and center, possibly announcing next-generation AI tools and potentially new hardware such as a second-generation Maia AI chip. This would position Azure as a leader in cloud-based AI services. Microsoft may also demonstrate new in-house AI models, reducing dependence on external providers and improving long-term profitability.

High-Margin Revenue from AI Agents

Perhaps most compelling is that Microsoft’s AI efforts represent its best opportunity to drive revenue and margin expansion in the future. Take Microsoft 365 Copilot, for example—a $30-per-user-per-month add-on to existing subscriptions, a nice upsell opportunity. With Microsoft’s enormous global user base, even low-single-digit adoption rates would translate to billions of dollars in incremental annual revenue, much of which would be high-margin.

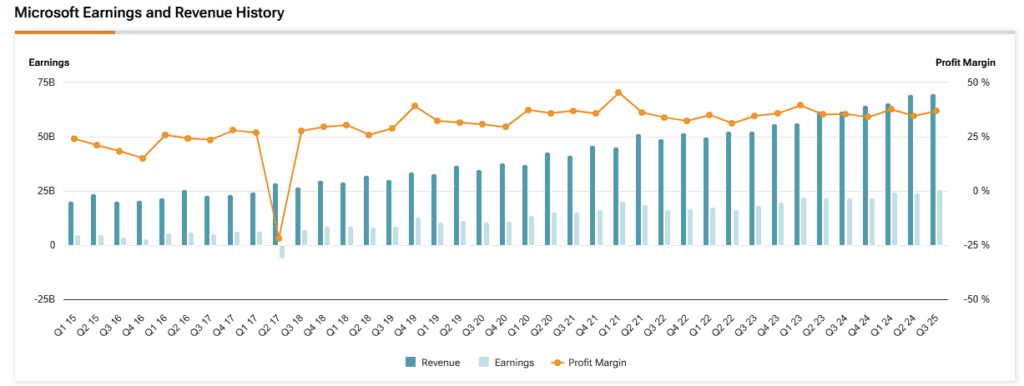

This new source of revenue is not just incremental but actually improves Microsoft’s profitability model. Microsoft’s recent quarterly results provide initial proof of this promise. Azure expanded by approximately 33%, with roughly half of that growth directly tied to new AI services.

With Microsoft’s planned $80 billion investment in AI infrastructure for FY2025, it’s obvious that management deeply believes AI is a key future growth driver with the potential to provide robust margins for many years to come.

AI Valuation and Monetization Growth

AI’s actual financial benefit for Microsoft is multilateral. Assuming AI agents induce sustainable, accelerating growth, Microsoft’s EPS will experience significant upside, far greater than the approximately 15% annual growth in recent years. Microsoft has already experienced a record 18% EPS growth in its most recent quarter, which captures the initial upside of its AI strategy.

Notably, a more lucrative earnings profile generated by high-margin AI services would warrant a premium valuation multiple. Traditionally trading at a price-to-earnings (P/E) multiple in the low 30s, Microsoft’s P/E multiple has recently traded up towards 35. Against the positive AI monetization environment, there exists further multiple expansion potential as investors start to price in the strong growth opportunity.

Wall Street’s Increasing Confidence

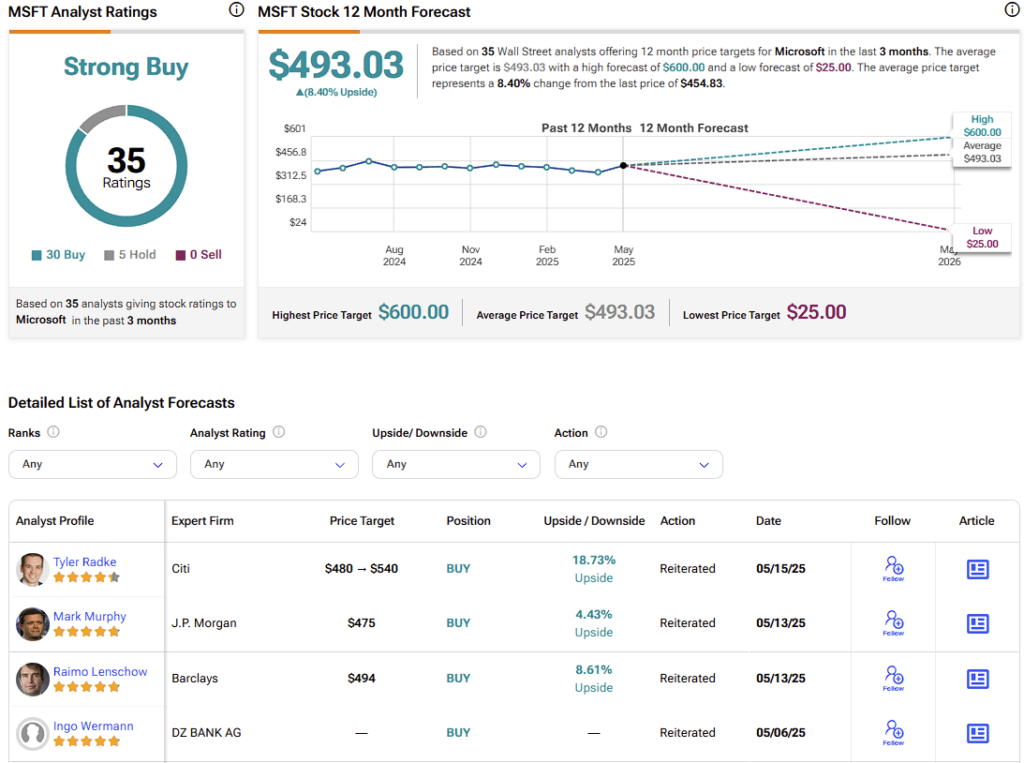

I’m not the only one who’s bullish—Wall Street analysts are also growing more confident in Microsoft’s AI-powered future. Following strong recent quarter results, Wedbush analysts and Morgan Stanley raised price targets, citing AI monetization as a key driver of growth. Now, Morgan Stanley considers Microsoft an outright generative AI leader, a sign that the company’s current valuation is rich with upside.

Wedbush analyst Dan Ives has cited surveys indicating broad corporate use of Microsoft’s AI agents within the next few years. That adoption could drive massive incremental revenue growth, benefiting Microsoft’s bottom line and competitive standing. Wall Street’s consensus optimism indicates broader institutional faith in Microsoft’s prospects for successfully executing and monetizing its AI initiatives.

Why Microsoft Is Beating Google and Amazon at AI

When comparing Microsoft’s AI monetization strategy to those of peers like Google (GOOGL) and Amazon (AMZN), Microsoft stands out with a distinct competitive edge: stronger pricing power and deeply entrenched enterprise integration.

The company’s decision to premium-price Copilot on par with—or above—similar offerings from competitors underscores the market’s perception of its value. For large enterprises already embedded within Microsoft’s productivity and cloud ecosystems, adopting its AI solutions is both seamless and compelling, enhancing Microsoft’s ability to drive monetization.

While Google and Amazon remain formidable rivals, their approaches differ meaningfully. Google’s AI strategy is technically robust but more vulnerable to pricing pressures and lacks Microsoft’s depth of enterprise penetration.

Amazon’s AWS maintains a leadership position in cloud infrastructure, yet it doesn’t offer consumer-facing AI productivity tools at the scale of Microsoft 365 Copilot. As a result, Microsoft’s unique combination of enterprise software dominance and cloud capability positions it exceptionally well to scale AI-driven revenue, reinforcing its growth potential relative to its peers.

Is Microsoft a Buy, Hold, or Sell?

On Wall Street, Microsoft has a consensus Strong Buy rating based on 30 Buys, five Holds, and zero Sell ratings. The average MSFT price target is $493.03, indicating an 8.4% upside potential over the next 12 months. While this outlook is somewhat modest, I think it’s understated. Personally, I believe $550 is well within reach.

MSFT is Primed for Upside Going Into Build 2025

With Build 2025 on the horizon, my confidence in Microsoft’s outlook is stronger than ever. I believe the market is only beginning to recognize the transformative financial potential of the company’s AI agent strategy.

As Microsoft scales high-margin AI-driven offerings, the resulting acceleration in EPS growth and the possibility of valuation-multiple expansion position the stock as one of the most compelling opportunities in the technology sector today.