By standard measures, department store retail chain Kohl’s Corp. (KSS) is a terribly risky investment. Yes, one can point to its trailing six-month performance, where KSS stock gained over 92% while the S&P 500 (SPX) has added a modest 16%. That’s an absolutely remarkable return. At the same time, the underlying fundamentals are not necessarily conducive to sustained upside.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Primarily, the latest jobs data suggests that the labor market is visibly decelerating — and that’s not the trend you want to see when targeting the discretionary retail space. After all, e-commerce giant Amazon (AMZN) is practically moving into every subsector of the retail space. Unless there’s a compelling reason to buy KSS stock, it’s probably prudent to avoid it.

Ironically, the one reason to consider Kohl’s is the very skepticism it attracts. Theoretically, the market works like a tug-of-war. When a sufficient number of participants are on one side of the trade, they can influence the trajectory of the target stock. However, if this unbalanced position is excessively overexposed, an unexpected shift toward the opposite direction can create panic. That’s the essence of the short squeeze — and it could be the fuel that continues to drive KSS stock higher.

Understanding Why the Short Squeeze is So Powerful

In a typical transaction, an investor initiates a position by buying to open a new position. Subsequently, the main hope is that the security’s value rises. If it does, the investor can choose to exit the position with a sell-to-close transaction. This is relatively straightforward, but in the context of short transactions, the process is essentially reversed.

When a short trader initiates a position, the transaction involves selling to open a position. These securities didn’t just materialize from thin air but were instead borrowed from a broker. Thus, all actual short positions are credit-based transactions because at the end of the day — irrespective of whatever happens to the stock — the broker must be made whole.

Essentially, the aim of a short trade is for the target security to fall in value. If it does, the speculator can buy back the security at a discounted price relative to the original sale price. At that point, the short trader returns the borrowed securities to the broker, pocketing the difference as profit.

Now, that’s all fine and well, so long as the target security moves in the right direction. Suppose it moves in the “wrong” direction (as in upward). In that case, panic ensues due to the inherent tail risk — the threat of an obligatory payment as the underwritten risk becomes fully realized at the extreme ends of the distribution.

As such, prudent short traders exit their positions early. On the other end, stubborn traders face the possibility of portfolio implosion. That’s because if a margin call doesn’t kick in, losses can spiral to the point of ruin. As is famously noted in trading circles, the market can stay irrational longer than you can stay solvent.

While short trading can be lucrative, it can also be hazardous. Given that short traders must buy to exit their positions, their desire to jettison their bearish positions actually creates a pernicious feedback loop. That’s the heart of the short-squeeze phenomenon — and it’s the primary reason why bullish contrarians actively look for heavily shorted securities like KSS stock.

Setting the Crosshairs on KSS Stock

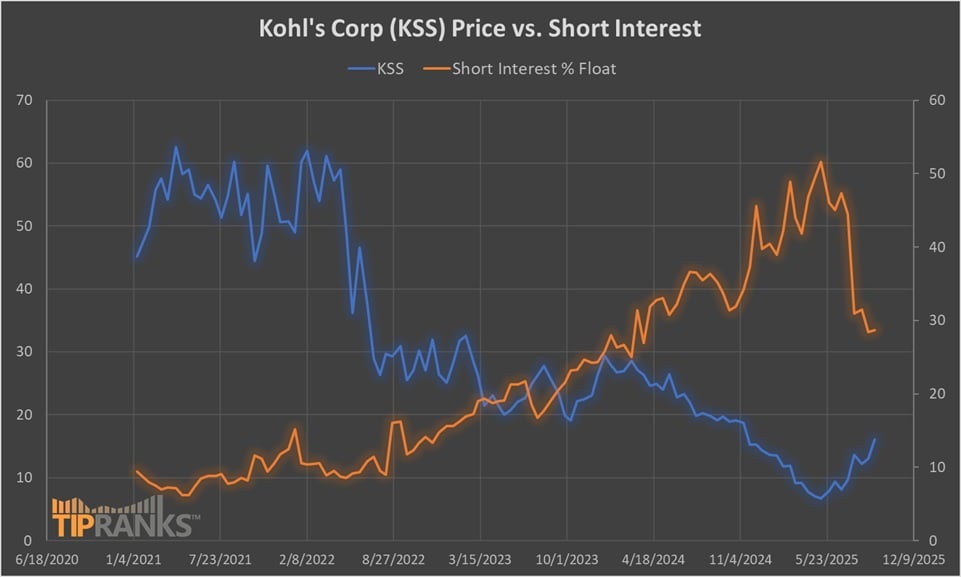

Currently, the short interest of KSS stock stands at 28.69% of its float. In other words, of the Kohl’s shares publicly available for trading, almost 30% of this pool is sold short. To be clear, this figure doesn’t necessarily mean that every trader is bearish. Some of the short transactions could be tied to other activities, such as hedging or market making.

However, as mentioned earlier, all short trades are credit-based transactions. Eventually, the lending creditor must be made whole, which is why a buying frenzy could ensue because of the elevated short interest.

Not only that, the short interest ratio clocks in at 5.15 days to cover. This is significant because if all the short traders wanted to fully unwind their exposure, the subsequent buybacks would take a little over one business week (based on average trading volume).

Stated differently, if a short squeeze does materialize right now, bearish speculators wouldn’t be able to exit KSS stock quickly.

Interestingly, it does appear that the bears are trying to leave their exposure to Kohl’s as quietly as possible. Back in late March, KSS’s short interest was around 42%. However, with KSS more than doubling since then, the bears have lost a ton of money. As such, the short interest has dropped below 30%. But that’s still a very high figure, meaning that the bulls could still have the edge.

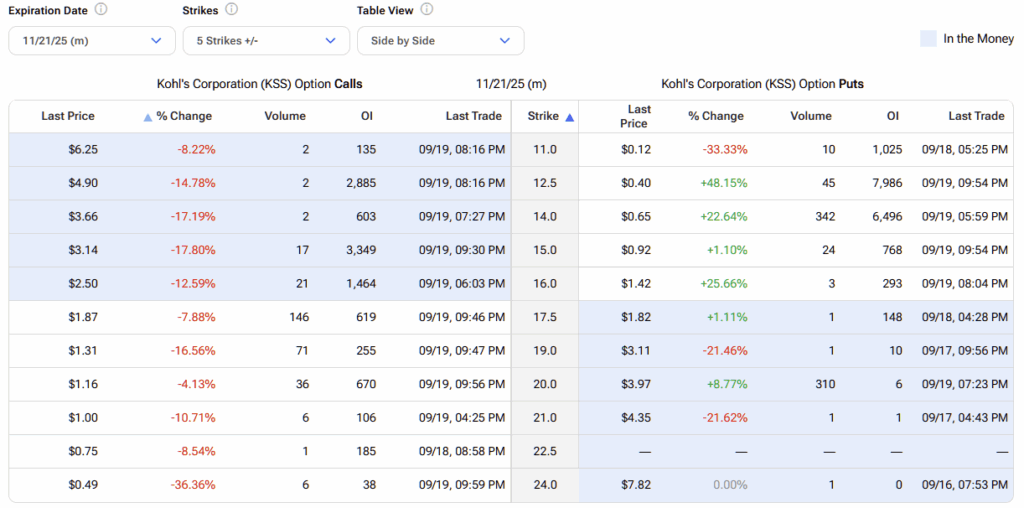

In terms of a specific idea to exploit the current setup, I would take a long look at the 17.50/20.00 bull call spread expiring November 21st. This transaction involves buying the $17.50 call and simultaneously selling the $20 call, for a net debit of $97 (the maximum possible loss on the trade). The company’s next quarterly earnings data is also due the following week on November 25th.

Should KSS stock rise through the second-leg strike price of $20, the maximum profit would be $153, a payout of nearly 158%. With the $20 target likely representing a psychological target for the bulls, it’s a natural level to place a wager on.

Is KSS a Good Stock to Buy?

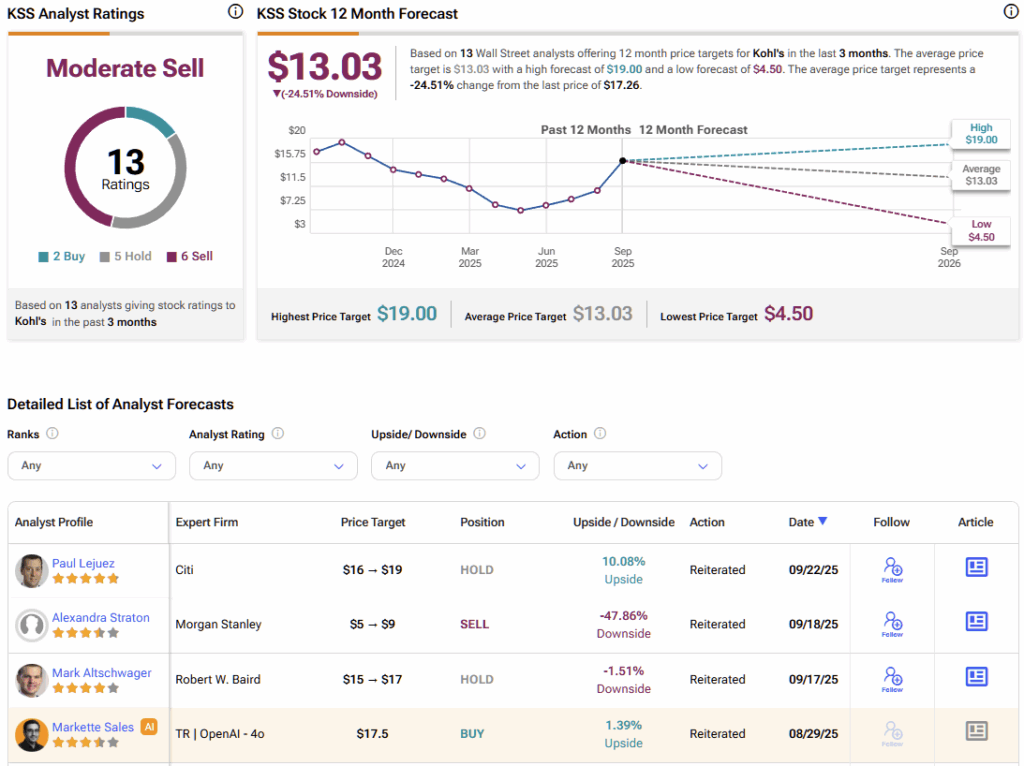

Turning to Wall Street, KSS stock carries a Moderate Sell consensus rating based on two Buy, five Holds, and six Sell ratings, obtained over the past three months. The average KSS stock price target is $13.03, implying ~24.5% downside risk over the coming 12 months.

Why Traders May Want to Buy, Not Short, KSS Stock

Based on broader fundamentals, Kohl’s would likely be deemed a dangerously risky investment. However, because so many traders may be betting against KSS stock, the potential for a sustained short squeeze exists. As such, the tactical approach may be to buy KSS, not to sell it.