According to The Information, JPMorgan Chase & Co. (JPM) recently froze bank accounts tied to two fast-growing stablecoin startups, Blindpay and Kontigo. The move highlights the growing tension between traditional banks and crypto firms, even as stablecoins gain wider use across global markets.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The account freezes were linked to business activity in high-risk regions, including Venezuela, and to gaps in customer identity checks. While stablecoins are designed to track the U.S. dollar, banks that support these firms must still comply with strict rules governing who can move money and where it flows.

As a result, JPMorgan acted after seeing rising disputed transactions and chargebacks tied to these accounts. The bank said the decision was based on risk controls, not opposition to stablecoins themselves.

Why Banks Remain Cautious

Stablecoins are widely used in countries facing weak local currencies. They allow people and companies to move dollars across borders with speed and low cost. However, banks remain cautious because they serve as the bridge between crypto and real dollars.

Blindpay and Kontigo accessed U.S. dollar accounts through a payments firm called Checkbook. This setup allowed them to offer virtual accounts to customers outside the U.S. Over time, disputed payments increased, which raised alarms inside JPMorgan.

In addition, Kontigo promoted crypto transfers without customer identity checks for some transactions. While crypto rules differ by region, U.S. banks are still responsible for meeting anti-money laundering and sanctions laws.

As a result, JPMorgan paused the accounts while it reviewed the activity. In response, Blindpay later tightened its customer checks and reduced access in high-risk countries.

What This Means for Investors

The case shows that banks remain the key gatekeepers for crypto firms that rely on U.S. dollars. Even with a more crypto-friendly policy climate, compliance standards have not eased.

For investors, this signals that stablecoin growth depends not only on demand but also on bank partnerships. As reported, access to the U.S. banking system remains a critical risk factor for private and public companies operating in the crypto space.

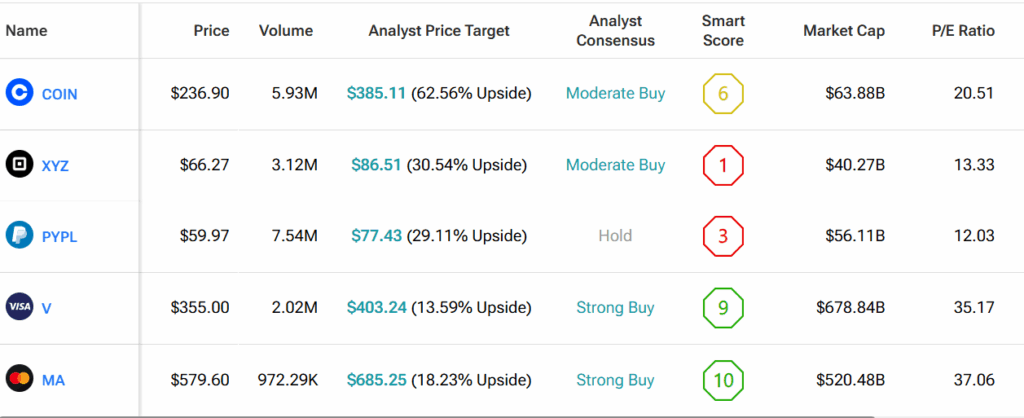

Using TipRanks’ Comparison Tool, we have identified major companies that use stablecoins as part of their payment, settlement, and digital dollar strategies.