Co-founder and CEO Jack Dorsey chopped Block (XYZ) employees earlier this week to reduce the financial services company’s bloat. These job cuts took place in three sections. The first hit was for strategy reasons and reduced Block’s headcount by 391, the second focused on employee performance and targeted 460 workers, and the third saw it drop 80 managers to simplify the company’s hierarchy.

In addition to the job cuts, Block also largely froze hiring plans. That saw it close open calls to fill 748 roles at the Square and Cash App owner. The exceptions are candidates for whom the company has already started the hiring process, critical roles that need to be filled, and management positions.

What’s Behind the Block Layoffs?

Dorsey addressed the reason for the layoffs in a leaked internal email obtained by TechCrunch. In it, he stated, “None of the above points are trying to hit a specific financial target, replacing folks with AI, or changing our headcount cap.” Instead, they are focused on “strategy, raising the bar and acting faster on performance, and flattening our org so we can move faster and with less abstraction.”

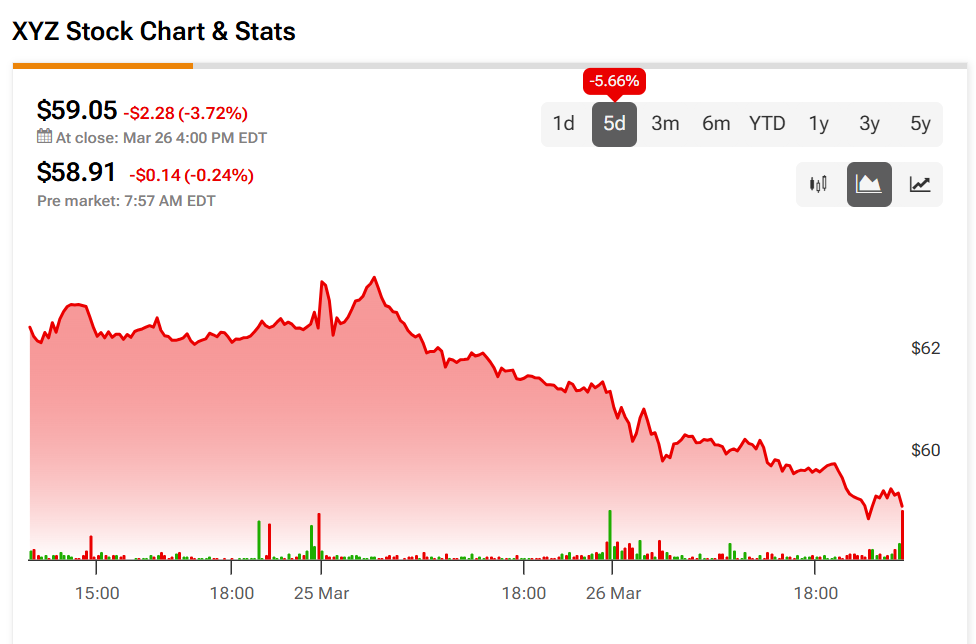

The Block layoffs, and the news about them, first broke on Tuesday. While shares of XYZ enjoyed a rally that morning, they quickly dropped afterward. The stock has fallen 5.66% this week, with an additional 0.24% decrease in pre-market trading today.

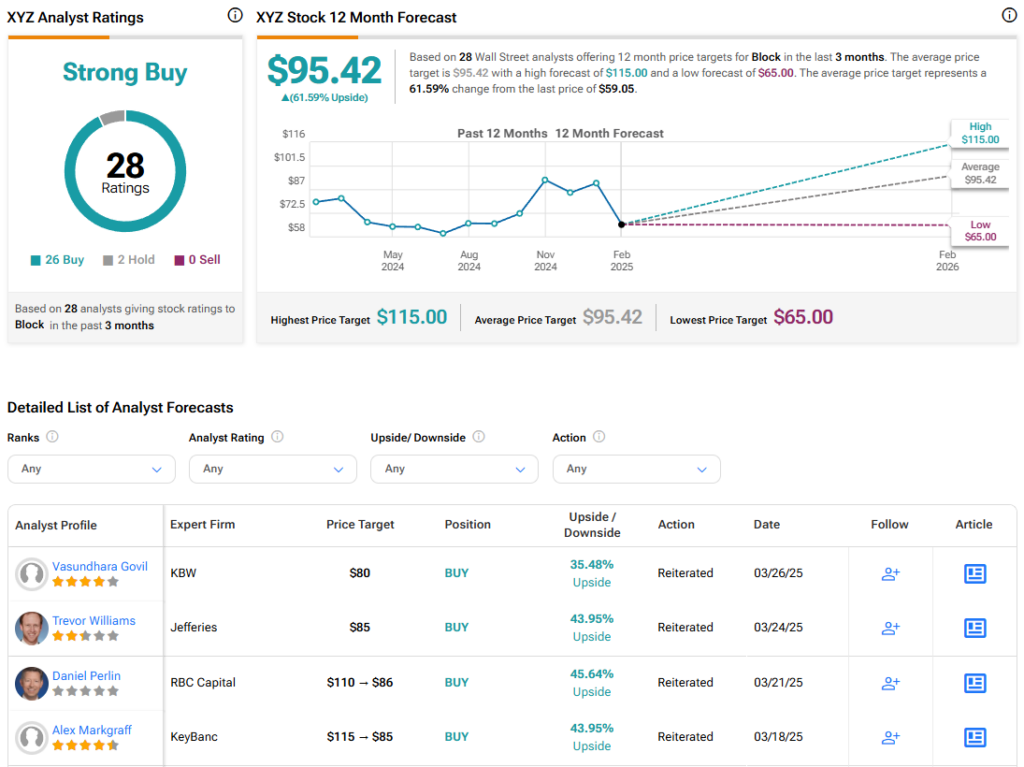

Is XYZ Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Block is Strong Buy based on 26 Buy and two Hold ratings over the last three months. With that comes an average price target of $95.42, a high of $115, and a low of $65. This represents a potential 61.59% upside for XYZ stock.