Society is at a defining crossroads, as traditional “analog” paradigms continue to be disrupted across every industry. The air mobility sector will be no exception—it’s only a matter of time before it undergoes the same transformation. Convenient airborne travel for the average Joe isn’t just coming. It’s already here. The choice is clear: you can resist the change, or you can embrace it by investing in Joby Aviation (JOBY).

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Admittedly, compared to other investors, I’m late to the game. However, a glance at the chart for JOBY stock reveals everything that needs to be seen. This is a transformative investment, and therefore, it requires a different perspective to truly appreciate. So far this year, the stock has more than doubled, posting a 132% gain.

In the stock market, outcomes manifest in two distinct forms. The first is “static” outcomes—measurable, observable, and immediately verifiable. The second, less familiar, is “kinetic” outcomes—those that emerge gradually, shaped by momentum and conviction over time.

Though the concept may sound abstract, it’s really about forward belief. Consider Garry Kasparov’s legendary game against Veselin Topalov in January 1999, often hailed as the greatest chess match ever played. Kasparov sacrificed a rook—a move that seemed reckless in the moment. Yet by doing so, he set in motion a devastating attack that secured victory.

The match has since been dubbed “Kasparov’s Immortal,” because the match represented more than a game—the string of moves was a metaphor for foresight itself. The takeaway is that every bold move carries the weight of uncertainty, yet history favors those who move with conviction. What may look reckless in the moment can often become brilliance in retrospect.

On the surface, giving up valuable material looks like a losing play—until it isn’t. That same spirit of conviction, of seeing beyond the immediate, is what drives Joby Aviation.

A Picture Speaks a Thousand Words for JOBY Stock

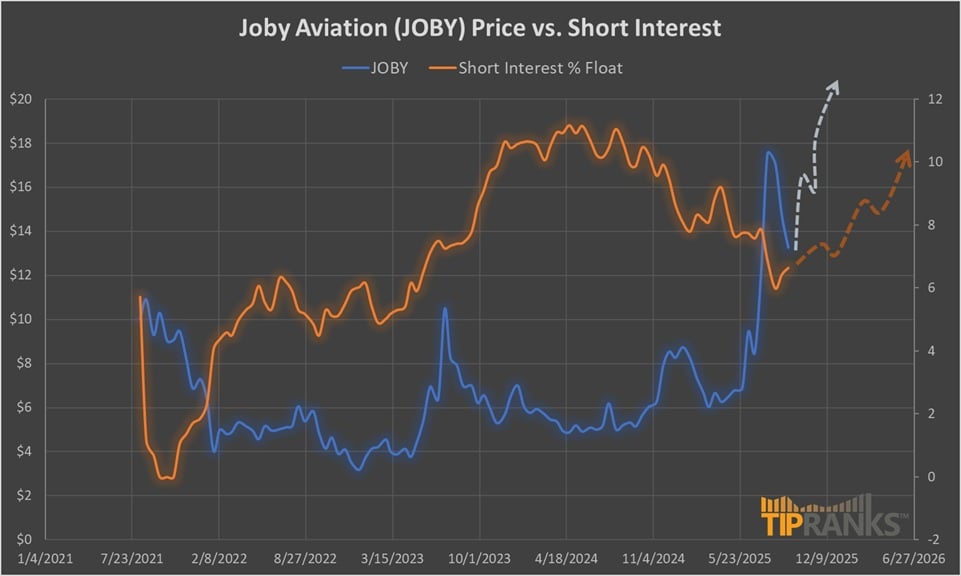

Since mid-April, JOBY has maintained an ascending trendline, reflecting a steady upward bias. Between July and now, however, the stock has entered a consolidation phase, forming a U-shaped base on the chart. In my view, this represents a temporary holding pattern, with the equity awaiting a catalyst that could drive the next leg of the upward trend.

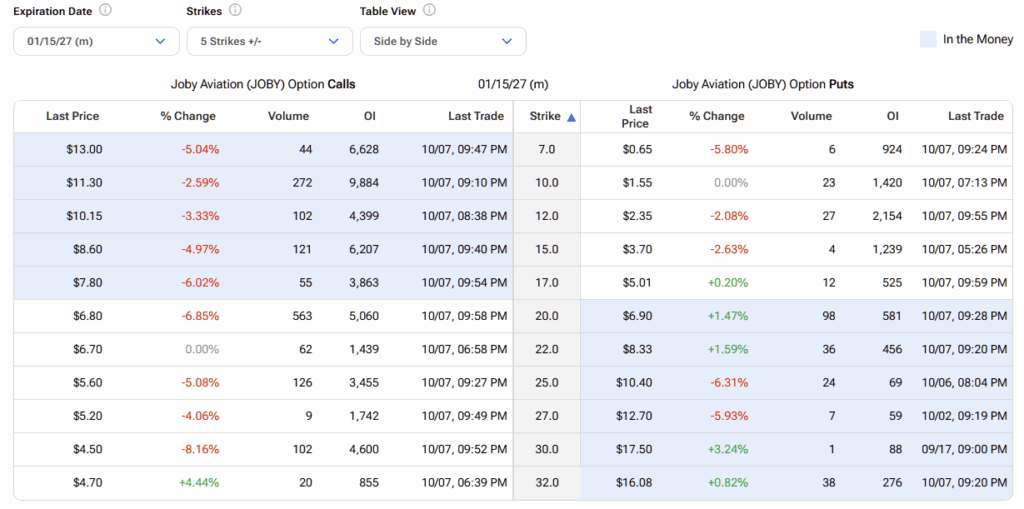

Of course, there’s no precise way to predict when the breakout will occur. With that in mind, I’ve taken a position through LEAPs—long-dated call options with a $20 strike price. I also plan to accumulate shares directly in the open market, particularly when they trade below $20.

Beyond the technical argument — which, admittedly, is a heuristic — lies the elevated short interest. Currently, the metric stands at 10.9% of the float, while the underlying ratio is 1.75 days to cover. Generally speaking, a short interest reading of 10% or higher represents a warning sign that the targeted security could tumble.

However, short traders are always in great danger of experiencing tail risk — the ever-rising threat of an obligatory payment as the underlying risk becomes fully realized at the extreme ends of the distribution. This threat is a functional consequence of the credit-based nature of short transactions.

Ultimately, when a trader shorts a stock, the speculator must first borrow the shares to be sold. If the target security falls in value, the bearish entity can reacquire the shares at a discount and return them to the broker, pocketing the difference as profit. However, if the stock moves in the unintended direction, the speculator ends up pocketing losses.

Of course, no upside ceiling exists, so the target security could rise indefinitely. Subsequently, a true short trader theoretically risks unlimited liability. It’s this deliberate effort to send the target security in the wrong direction for the bears that drives the phenomenon known as the short squeeze. JOBY stock could face such a circumstance, making it awfully compelling for patient, bullish speculators.

Watching and Waiting for Liftoff

Another intriguing detail about JOBY stock and its relationship to short traders is that the magnitude of short interest has dipped conspicuously. Notably, in the back half of April 2024, short interest stood at 11.17% of the float. Around early September of this year, the metric fell to 6.64%.

As mentioned earlier, the latest estimates indicate that short interest stands at 10.9%. Predictably, as JOBY stock has risen in value — gaining almost 36% in the trailing month — the bears have been busy aggressively placing bets against the underlying business.

In that sense, the skeptics are committing Topalov’s error by focusing mostly on Joby’s static truth; basically, that the company is suffering from persistent net losses and negative cash flows. They’re not focused on what really matters, which arguably are the certification progress and strategic acquisitions.

From a static perspective, skeptical investors see a lot of red ink and pie-in-the-sky valuations. However, the bulls will argue that eventually, there will be pie in the sky — you just have to trust that it will be there.

Granted, it’s a high-risk, high-reward proposition. Still, with innovation occurring at breakneck speeds across multiple fields, the air mobility space will almost certainly see positive disruption. Enticingly, this dynamic could send JOBY stock marching higher, which in turn could attract even more skepticism.

Ultimately, I believe Joby Aviation will continue making steady progress in the certification process, rendering the short thesis increasingly untenable. Once that inflection point arrives, a short squeeze could propel JOBY shares to new all-time highs. In my view, the January 15, 2027, $20 call option presents an excellent opportunity—and I plan to continue building my position.

Is JOBY Stock a Good Buy?

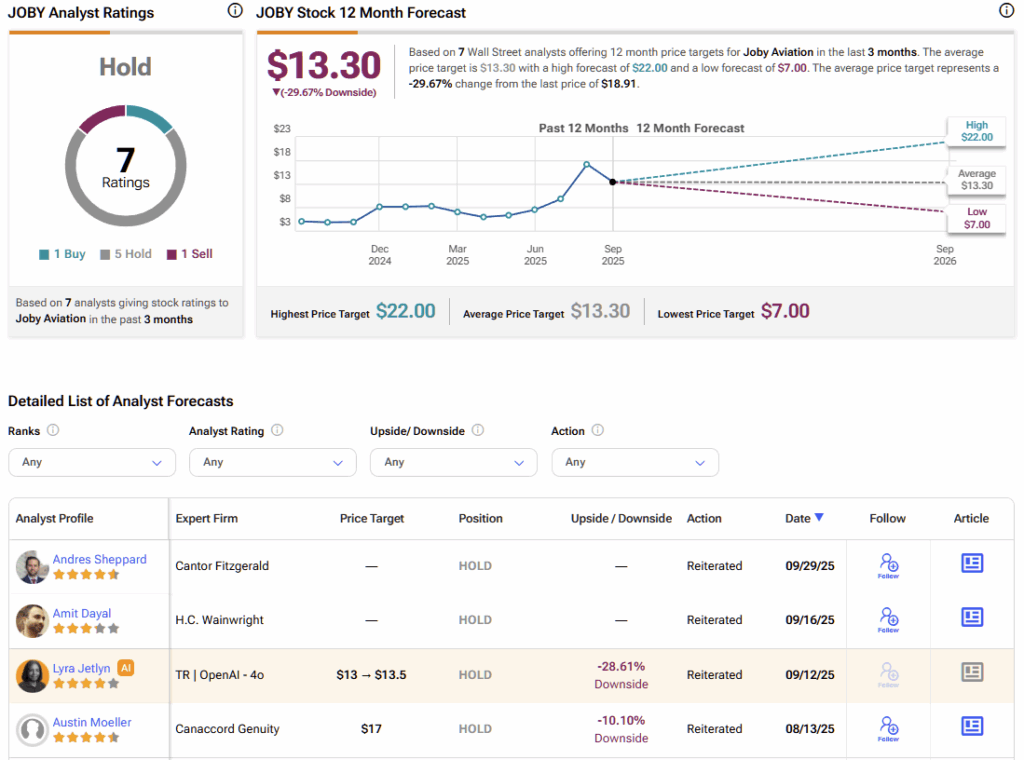

Turning to Wall Street, JOBY stock carries a Hold consensus rating based on one Buy, five Holds, and one Sell rating. The average JOBY price target is $13.30, implying almost 30% downside risk over the coming year.

Putting Capital Behind Conviction

Ordinarily, I prefer to write about securities in which I don’t hold positions, allowing for an entirely objective analysis. But with Joby, excessive analysis risks obscuring the obvious. The global economy is in the midst of a sweeping paradigm shift—and air mobility will not be spared. I believe Joby is positioned to lead this transformation, which is why, in this instance, I’m putting capital behind conviction.