Shares in Zeta Global Holdings (ZETA), the data-driven marketing platform provider, climbed about 4% on Tuesday morning, marking a return to its recent rally after a modest drop on Monday.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While there appears to be no immediate development driving the rally, several recent positive updates from Zeta could be the lever for the price appreciation. The company powers consumer intelligence for businesses using its AI-enhanced and cloud-based marketing platform.

Zeta Sees Higher Platform and AI Use

At the start of this month, Zeta reported seeing 153% higher usage of its platform by enterprise brands, compared to a year ago. This was fueled by the record $44.2 billion holiday sales generated by American retailers during this year’s five-day Thanksgiving-to-Cyber Monday stretch.

Zeta also reported a 25% year-over-year (YoY) uptick in its AI agent activity during the period. This is even as data from Adobe Analytics (ADBE) also indicated that AI-driven visits to retail sites rose 805% from a year ago during this year’s Black Friday holidays.

Zeta Rides on Robust 2026 Outlook

Another possible reason for the rally could be Zeta’s robust financial outlook. The company expects its revenue to grow by 21% YoY to $1.54 billion by the end of its Fiscal Year 2026.

Similarly, Zeta, in its Q3 2025 earnings results released in early November, reported growing its revenue by 28% YoY to $337 million. It also expanded its adjusted earnings before interest, taxes, depreciation, and amortization by 46% to $78 million. Moreover, the company’s GAAP net loss of $3.6 million during the quarter marked an improvement from the previous year’s loss.

Is Zeta a Good Stock to Buy?

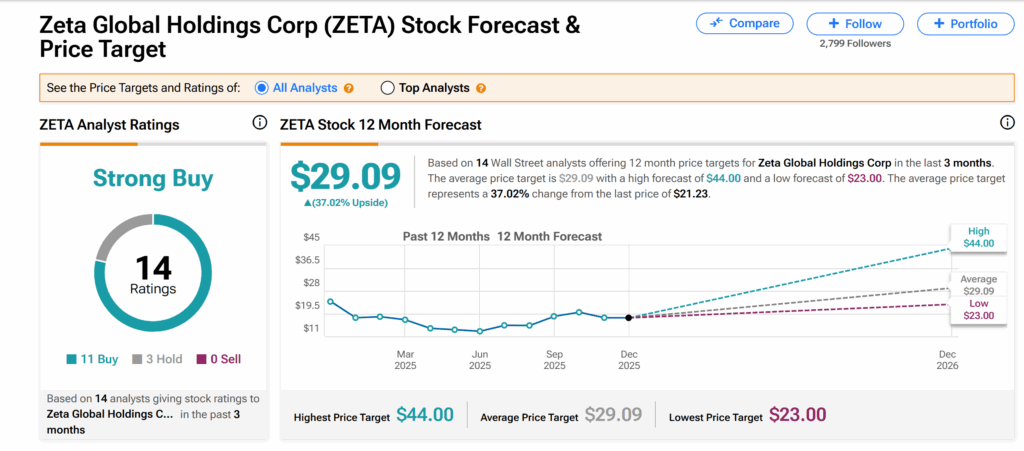

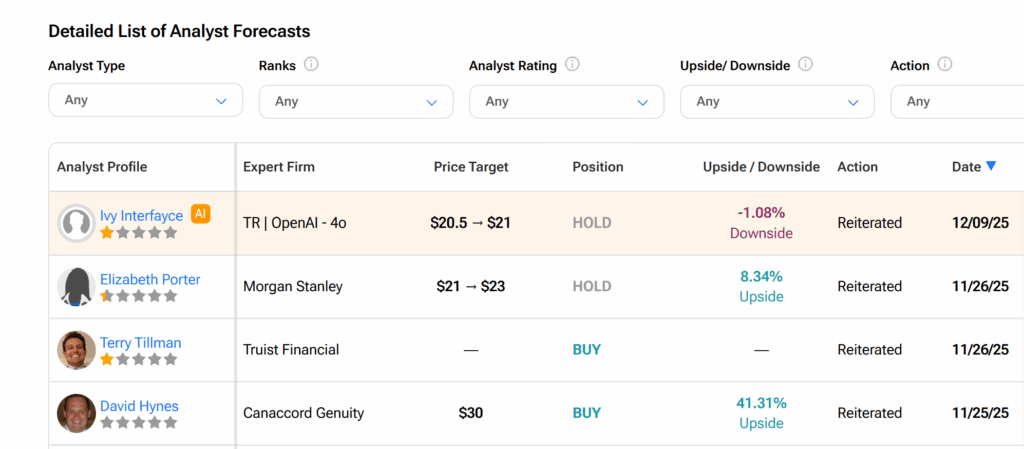

On Wall Street, Zeta’s shares currently hold a Strong Buy consensus rating based on 11 Buys and three Holds issued by 14 analysts over the past three months.

In addition, the average ZETA price target of $29.09 implies over 37% upside from current trading levels.