Wolfspeed (WOLF), a silicon carbide tech company, jumped more than 65% in pre-market trading today after the company received court approval for its Plan of Reorganization. The company expects to complete its Chapter 11 process — a U.S. court-managed bankruptcy restructuring — within weeks. Once it exits, Wolfspeed will cut about 70% of its debt, giving it more room to focus on recovery and growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CEO Robert Feurle called the approval an “important milestone” that clears the path to complete restructuring and refocus on innovation.

It is important to note that WOLF stock had fallen about 15% in the past three months after the company filed for Chapter 11 to carry out its restructuring in June. Today’s sharp rebound signals that investors are more optimistic about Wolfspeed’s ability to repair its balance sheet and move forward.

Wolfspeed Aims to Solidify Its Position

The company has faced heavy financial pressure in recent quarters as it expanded production and invested in silicon carbide, a material used in electric cars and clean energy systems. Before restructuring, Wolfspeed carried about $6.5 billion in debt with limited cash available.

The approved plan will eliminate roughly $4.6 billion of that debt (around 70%), reduce annual interest costs by 60%, and provide $275 million in new financing. These steps should ease pressure on cash flow and place the company on a firmer financial footing.

With its debt burden lowered, Wolfspeed plans to shift focus back to its growth opportunities in EVs and clean energy markets. Still, investors will be watching closely to see how smoothly the company emerges from Chapter 11 and whether it can return to profitability amid ongoing competition and thin margins.

Is Wolfspeed a Good Stock to Invest In?

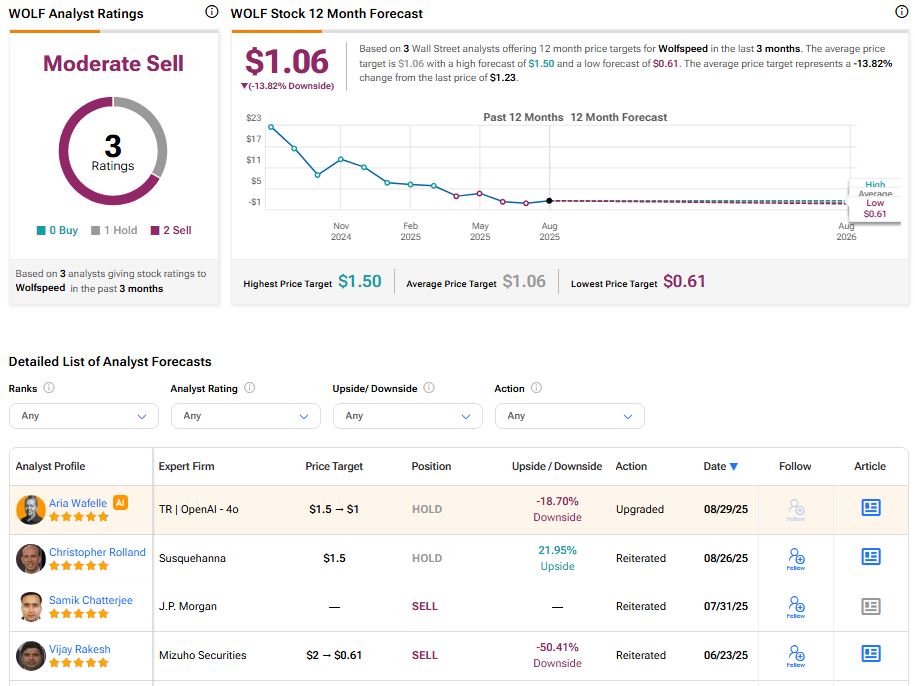

On TipRanks, WOLF stock has a Hold consensus rating based on one Hold and two Sell ratings. Also, the average Wolfspeed price target of $1.06 implies 13.82% downside potential from current levels.