Ryvyl (RVYL) stock took a beating on Tuesday after the blockchain-based payment solutions company priced a public offering. This public offering includes 15,384,615 shares of RVYL stock, with each one coming with a warrant to purchase another share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The units being sold in this public offering are priced at 39 cents each, which is also the same price to exercise the included warrants. The warrants are immediately exercisable and expire in five years. Ryvyl expects the public offering to generate $6 million in gross proceeds.

Ryvyl stock was down 46.19% on Tuesday, extending a year-to-date loss of 49.88%. The shares have also decreased 68.06% over the past 12 months.

Is Ryvyl Stock a Buy, Sell, or Hold?

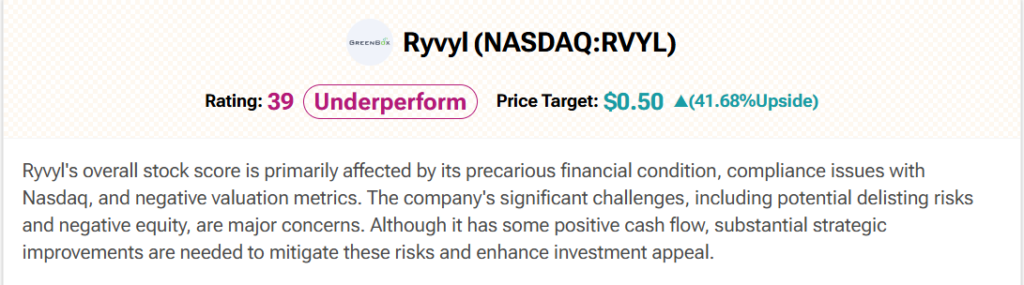

Turning to Wall Street, coverage of Ryvyl is thin. Fortunately, TipRanks’ AI analyst Spark has the stock covered. Spark rates RVYL an Underperform (39) with a 50-cent price target, suggesting a possible 41.68% upside for the shares. It cites “precarious financial condition, compliance issues with Nasdaq, and negative valuation metrics” as reasons for this stance.