RxSight (RXST) stock plummeted on Wednesday after the healthcare company cut its revenue guidance. It now expects 2025 revenue to range from $120 million to $130 million, compared to its prior outlook of $160 million to $175 million. That would see its revenue fall 14% to 7% year-over-year, and miss Wall Street’s estimate of $167.56 million.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

RxSight CEO Dr. Ron Kurtz addressed the guidance cut. He said, “Guided by insights from our second quarter underperformance and building on our long-term vision, we are evolving our commercial approach to re-direct more of our focus toward supporting customer success within new and existing practices.”

To go along with that revenue cut, RxSight reported preliminary Q2 revenue of roughly $33.6 million, which was down 4% year-over-year and 11% sequentially. This will also miss analysts’ Q2 revenue estimate of $38.5 million.

RxSight Stock Movement Today

RxSight stock was down 49.88% in pre-market trading on Wednesday, following a 2.9% rally yesterday. The shares have also decreased 62.8% year-to-date and 74.98% over the past 12 months. Today’s dip came with 3.5 million shares traded, compared to a three-month daily average of about 665,000 shares. This suggests the guidance cut and earnings news have triggered a selloff.

Is RxSight Stock a Buy, Sell, or Hold?

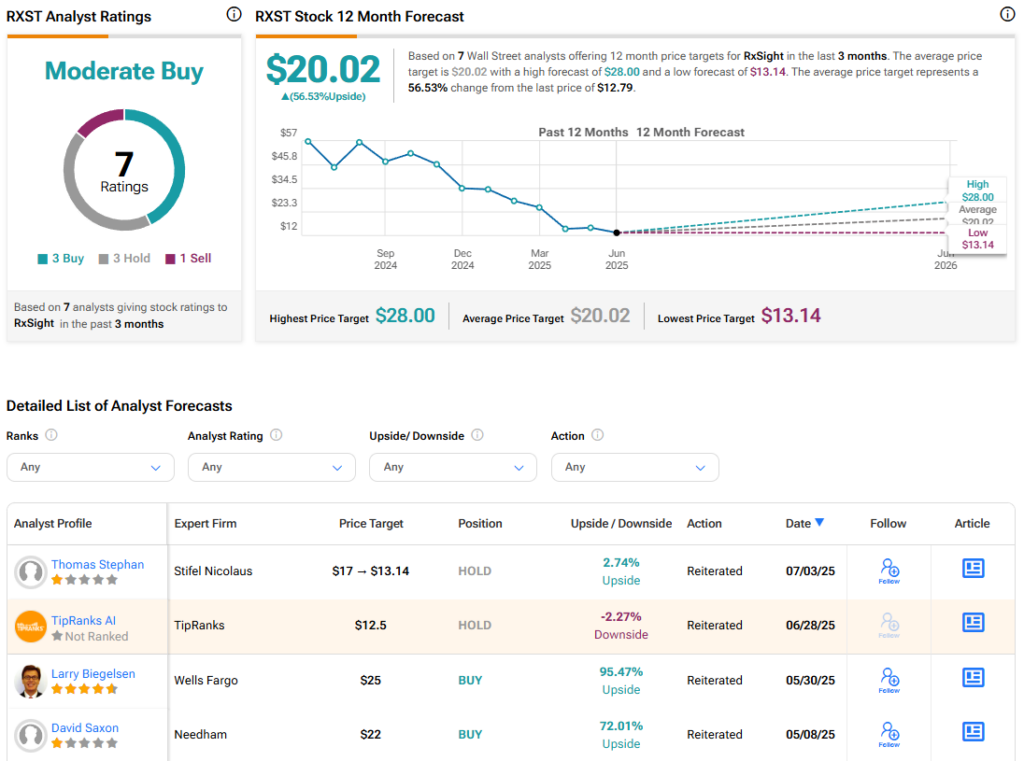

Turning to Wall Street, the analysts’ consensus rating for RxSight is Moderate Buy, based on three Buy, three Hold, and a single Sell rating over the past three months. With that comes an average RXST stock price target of $20.02, representing a potential 56.53% upside for the shares. That rating and price target could change in light of the company’s guidance and earnings update.