Roku (NASDAQ:ROKU) delivered a mixed Q3 performance. While its top line surpassed Wall Street’s forecast, the company generated a wider loss per share compared to analysts’ predictions. Nonetheless, Roku stock is up about 18.43% in Wednesday’s after-hours of trading as its Q4 outlook exceeded Street’s expectations. Let’s delve deeper.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q3 Performance and Q4 Outlook

Roku, which provides streaming devices, smart TVs, and related audio devices, delivered revenue of approximately $912 million, up about 20% year-over-year. Moreover, it exceeded the Street’s projection of $857 million. In addition, Roku reported a positive adjusted EBITDA of $43 million compared to the analysts’ expectations of a $29 million loss. While the company’s top line and adjusted EBITDA exceeded analysts’ forecasts, its net loss of $2.33 per share was wider than Wall Street’s estimate of $2.04 per share.

Nonetheless, Roku anticipates generating revenue of about $955 million in Q4, higher than the Street’s estimate of $952 million. Furthermore, the company expects to deliver adjusted EBITDA of $10 million compared to the consensus estimate of a loss of $52 million.

Roku experienced a solid rebound in video ads during the third quarter. Moreover, the company expects the momentum to be sustained in Q4 as well. This will drive its top line. In addition, cost reductions and a focus on further reducing its operating expenses will cushion its adjusted EBITDA. However, management remains cautious, given the uncertainties in the macro environment, and an uneven ad market recovery.

With this backdrop, let’s look at what Wall Street recommends for Roku stock.

What is the Prediction for Roku Stock?

The continued shift of ad dollars from linear TV to connected TV, the expected recovery in ad revenues, and cost cuts will support Roku’s financial performance and could drive its share price higher. However, macro headwinds keep most analysts sidelined.

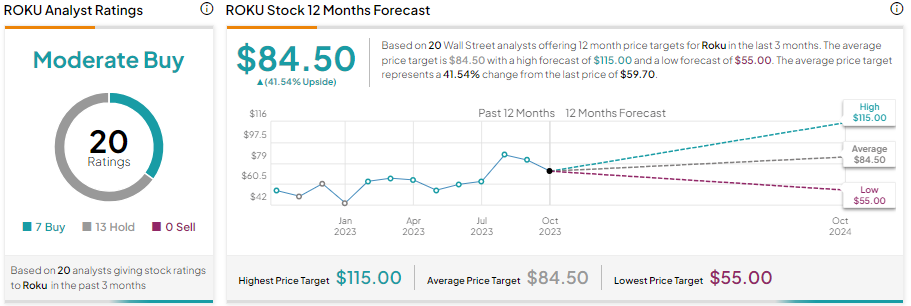

With seven Buy and 13 Hold recommendations, Roku stock has a Moderate Buy consensus rating. Further, the average ROKU stock price target of $84.50 implies 41.54% upside potential from current levels.

It’s worth noting that the recommendations and price targets for Roku stock were issued before the upbeat Q4 guidance announcement. Consequently, investors can expect a potential upward revision in the price targets for Roku stock.