ReShape Lifesciences (RSLS) stock plummeted on Monday after the medical device company announced the pricing of a public offering for its shares. The company priced its stock at $2.50, and the public offering will include 1,054,604 shares. This has the company expecting to raise $2.6 million in net proceeds.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It makes sense that ReShape Lifesciences stock would fall after it announced the pricing of its public offering. The $2.50 price is well below its previous closing price of $4.18 per share. Additionally, offering more shares dilutes the stakes of current investors.

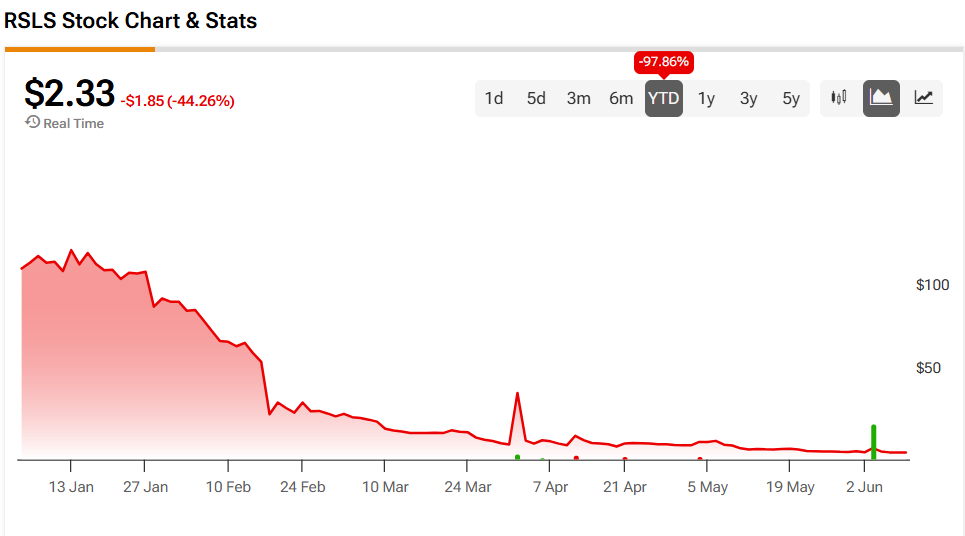

RSLS stock was down 44.26% on Monday morning and has fallen 97.86% year-to-date.

Is ReShape Lifesciences Stock a Buy, Sell, or Hold?

Wall Street’s coverage of ReShape Lifesciences stock is thin, but TipRanks’ AI analyst, Spark, is making up for that. Spark has an Underperform (37) rating for RSLS stock and offers no price target. It cites “significant financial challenges, with persistent losses, negative equity, and cash flow issues” as reasons for this bearish rating.