Shares of Replimune Group (REPL) surged over 100% on Wednesday to $7.55. The surge came after the sudden resignation of Vinay Prasad from the FDA’s biologics division. Overall, analysts view this as a significant win for the company’s lead therapy, RP1. Despite Wednesday’s sharp rebound, REPL stock remains down 37% year-to-date and was down more than 7% in Thursday’s pre-market trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Dr. Vinay Prasad was named Director of the Center for Biologics Evaluation and Research in in May, but stepped down in under three months amid criticism of recent regulatory decisions. Analysts see his exit as a favorable shift for the biotech sector.

What Does Replimune Group do?

Replimune Group is a biotech company developing cancer treatments using specially designed viruses that kill cancer cells and boost the immune system. Its main drug, RP1, is being tested for melanoma and other solid tumors.

Cantor Fitzgerald Upgrades REPL Stock to BUY

Following news of Prasad’s departure, analyst Li Watsek at Cantor Fitzgerald upgraded REPL stock from Hold to Buy.

Watsek sees Prasad’s resignation as a turning point for Replimune’s lead therapy, RP1. Watsek suggested that the recent FDA Complete Response Letter (CRL) for RP1, issued on July 22, may have been driven by top-level interference, possibly from Prasad, despite a more favorable internal review. With Prasad now out, Watsek believes a major barrier has been lifted, significantly boosting the chances of RP1 gaining accelerated approval. Cantor also noted that REPL shares could rebound to over $12 if the CRL decision is reversed.

Similarly, BMO Capital analyst Evan Seigerman called Prasad’s exit a positive development for the biotech industry, suggesting that his replacement is likely to be more supportive of innovation.

Is REPL a Good Stock to Buy?

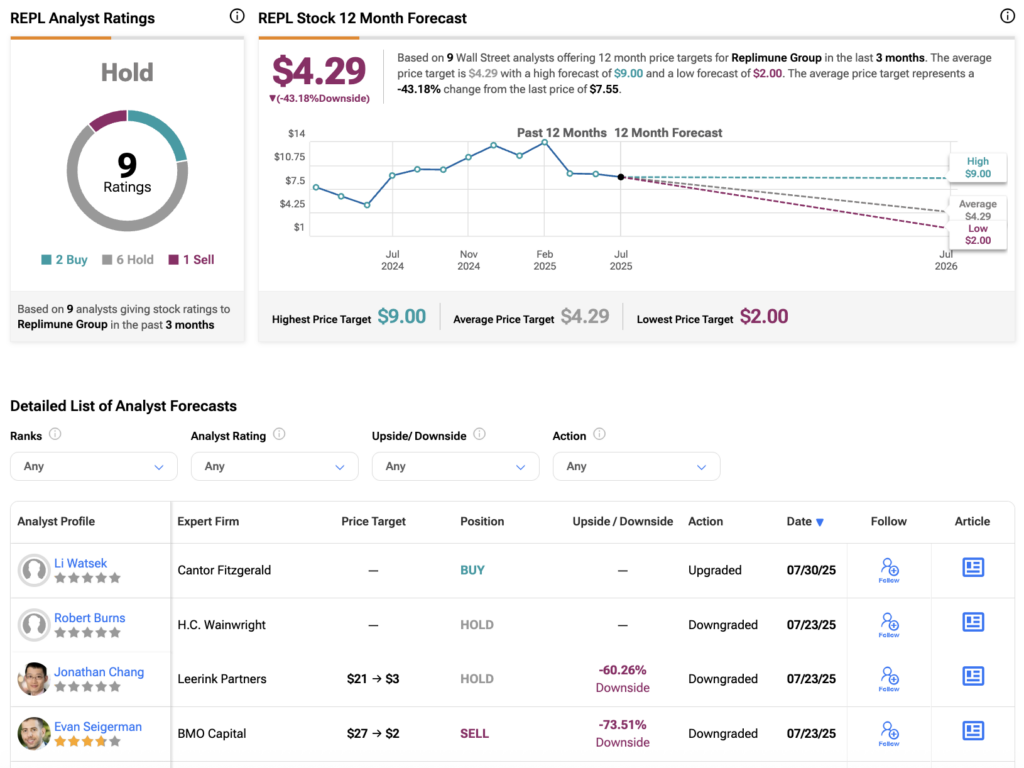

Turning to Wall Street, analysts have a Hold consensus rating on REPL stock based on two Buys, six Holds, and one Sell assigned in the past three months. Furthermore, the average Replimune stock price target of $4.29 per share implies 43% downside risk.