Palantir (PLTR) shares are climbing over 4% as of this writing on Monday. Despite the lack of company-specific news, the move appears tied to a weekend operation in Venezuela involving the extraction of President Nicolás Maduro by U.S. forces. Palantir, which provides the U.S. government with data analytics and AI software, frequently reacts after any U.S. defense-related operations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, the U.S. detained Nicolás Maduro and Cilia Flores in Caracas, Venezuela, on January 3 on drug trafficking charges. President Trump said the U.S. would oversee Venezuela until a safe transition, pointing to the country’s large oil reserves. However, critics argue the drug charges may not be the real reason, citing U.S. interest in Venezuela’s oil.

What U.S.–Venezuela Tensions Mean for Palantir

Following the U.S operation in Venezuela, PLTR stock trended among retail traders.

Increased military and security activity typically boosts spending on data analytics and AI platforms—areas where Palantir has strong ties with the U.S. government and defense agencies. Notably, more than half of Palantir’s revenue comes from U.S. government contracts. In its most recent quarter, the company delivered 63% overall revenue growth, with revenue from U.S. government customers rising 52% year over year.

U.S.–Venezuela tensions could be a near-term positive for Palantir, as rising geopolitical friction often drives higher demand for defense and intelligence software. Such situations also underscore the need for real-time data integration and decision-making, reinforcing the relevance of Palantir’s technology. Overall, heightened tensions can improve investor sentiment toward defense- and government-linked tech stocks, supporting PLTR shares in the short term.

Over the longer run, sustained geopolitical stress could lead to expanded government contracts and greater adoption of Palantir’s platforms across defense, homeland security, and allied agencies.

Is Palantir Stock a Buy?

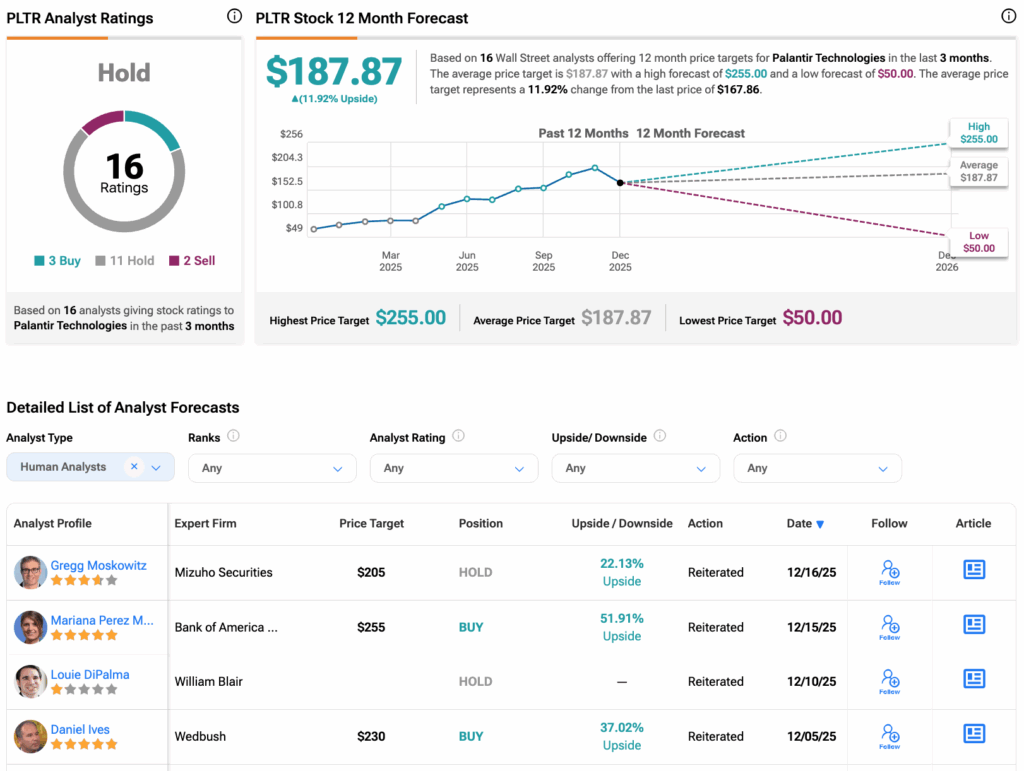

Turning to Wall Street, PLTR stock has a Hold consensus rating based on three Buys, 11 Holds, and two Sells assigned in the last three months. At $187.87, Palantir’s average stock price target implies an upside of 12% from the current level.