OceanPal (OP) stock was down on Friday after the ocean-going transportation services company revealed plans for a public offering. That preliminary prospectus included plans to sell 9,316,770 shares of OP stock for an assumed price of $1.61 each. The shares would come bundled with warrants, which will allow holders to exercise them for additional shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The expected offering price of $1.61 per share is well below OP stock’s prior closing price of $2.20, explaining why shares have fallen today. Additionally, the increase in outstanding shares will dilute the stakes of current investors, which is another factor that weighed down OP stock on Friday.

Shares of OP stock were down 20% as of Friday morning, following a 24.14% drop on Wednesday. Investors will note that markets were closed yesterday for Juneteenth.

Is OceanPal Stock a Buy, Sell, or Hold?

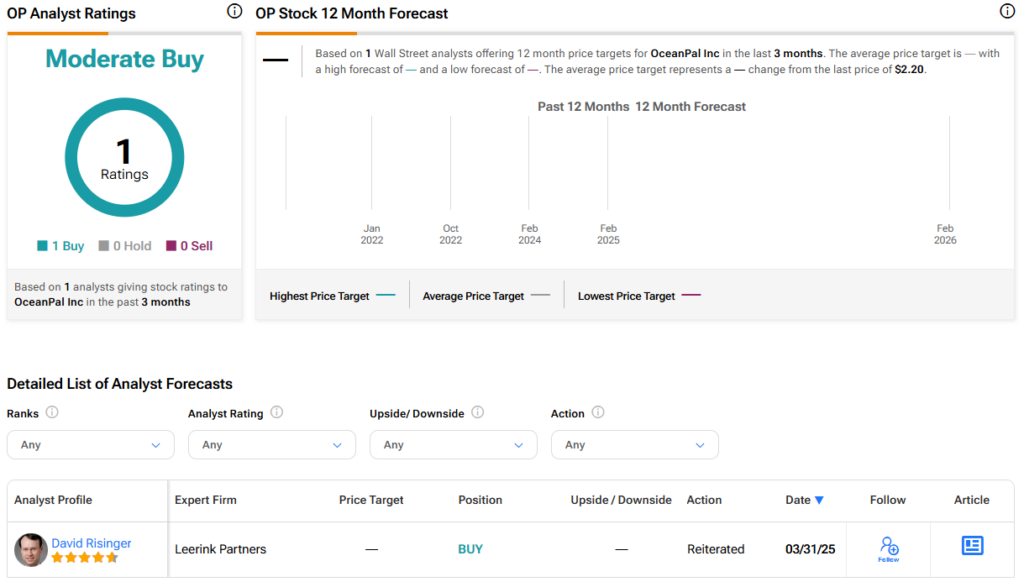

Turning to Wall Street, four-star Leerink Partners analyst David Risinger offers the only coverage of OceanPal. He has a Buy rating for the shares with no price target. Spark, TipRanks’ AI analyst, rates OP stock a Neutral (46) with no price target. It cites “significant financial challenges, including negative profitability and cash flow issues” as reasons for this rating.