Nvidia (NVDA) delivered the goods once again in its Fiscal Q3, reporting another blowout quarter. As a long-term Nvidia bull, my bullish thesis remains intact, supported by a solid beat across the board, strong guidance for Q4, and a highly compelling growth story relative to its current valuation. While there were minor blemishes, such as a contraction in gross margins and guidance that didn’t fully exceed the market’s sky-high expectations, I believe that from a long-term perspective—and considering the stock’s current multiples—there is still plenty of room to make money by buying Nvidia at current levels.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In this article, I’ll dive into the details of what happened in Q3, why the initial market reaction fell short of bullish expectations, and why my bullish thesis remains as strong as ever.

Nvidia Had a Strong Quarter in Nearly Every Aspect

In its Q3 quarter, Nvidia took another step, strengthening my long-term bullish outlook for the company.

Nvidia exceeded expectations even amid such incredibly high expectations. Third-quarter data center revenue came in at $30.8 billion, well above the $29.1 billion that analysts had expected. Overall, revenue totaled $35.1 billion, surpassing the $33.25 billion anticipated by analysts. Adjusted earnings per share for Q3 were 81 cents, compared to the 74 cents that analysts had predicted. Gaming revenue reached $3.3 billion, slightly better than estimates, which have been volatile in recent quarters.

However, it is important to recognize that there were some hiccups. Perhaps the main concern for Nvidia this quarter lies in its margins. The company’s gross margin decreased from 75.1 to 74.6% in Q3 of Fiscal 2025, and management expects it to decline further to 73%-73.5% in the next quarter due to the implementation of Blackwell. Although management did not provide a specific timeframe for a recovery in gross margin to the mid-70% range, there are concerns that the gross margin in Q1 of Fiscal 2026 could be even lower.

What Must Nvidia Achieve to Satisfy Investors?

Not surprisingly, Nvidia’s shares initially fell despite the strong results across the board and the positive outlook. The market appeared to be fairly confident that Nvidia would beat estimates. The real question was how much and to what extent Nvidia would surpass consensus expectations.

It turns out that any outcome falling short of perfection would likely lead to a slip in the share price. A blowout fourth-quarter revenue forecast seemed necessary to maintain momentum, but in this case, it wasn’t quite a blowout. Management guided for sales of $37.5 billion—above consensus but below the highest expectations. This highlights the high bar set for Nvidia, as its $3.5 trillion valuation is only justifiable if growth estimates remain extremely optimistic.

Therefore, analysts now expect Nvidia to continue growing at an EPS CAGR of 35.4% over the next three to five years. Adjusting for this growth and using the forecasted P/E ratio of 49.3x for Fiscal 2025, I would argue that a powerhouse like Nvidia is reasonably priced at a 1.4x PEG ratio. Even at this multiple, it’s still a quarter below the average of its industry peers. That said, all of this becomes irrelevant if Nvidia fails to continue delivering flawless results. While margin constraints remain a significant concern, management’s guidance appears to be in line with expectations, which should help Nvidia maintain its attractive valuation when adjusted for growth, in my view.

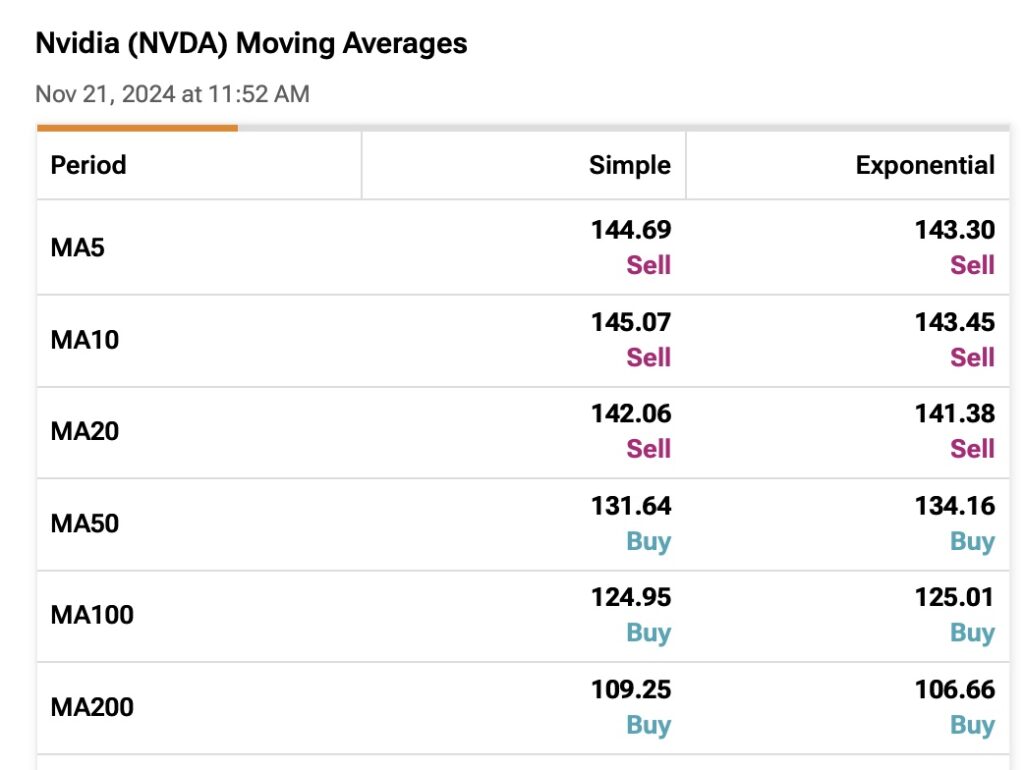

Nvidia’s Long-Term Momentum Backed by Moving Averages

Nvidia’s growth story can be broken down into two main points. First, the market still sees Nvidia as being in the early-to-mid stages of hypergrowth. Just look at the last three quarters: revenues have grown at 262% year-over-year, followed by 122%, and most recently 94%. The other side of the story, however, is more bearish: some argue that the stock is overpriced and that a bubble could form, given its nearly 2,600% rise over the past five years. Also, with the stock trading near its all-time highs, there is potential for a significant selloff.

While I believe those who have seen their Nvidia investments grow by four digits should consider trimming their positions. However, for those still on the outside or who have bought the stock recently, it suggests there’s still money to be made—as long as Nvidia continues to deliver.

And in my opinion, Nvidia has been delivering. The company has been consistently beating consensus estimates and providing positive guidance. These two factors in Nvidia’s growth story contribute to its high stock volatility. As a result, attempting to time buy and sell decisions based on shorter-term moving averages can be overly risky. That’s why I prefer a simple strategy: buy the stock whenever it’s below the 200-day moving average and sell when it’s above. It’s that simple.

Currently, Nvidia shares trade well above the 200-day moving average of $109.25, with the stock price around $146 (at last check), signaling a bullish trend. However, short-term moving averages (like the 5-day and 20-day) are showing a bearish signal. Therefore, I believe it makes sense to focus on the long-term trend using the 200-day moving average, as this is a strong indicator of a sustainable growth cycle, as has been the case with Nvidia.

Is NVDA a Good Buy?

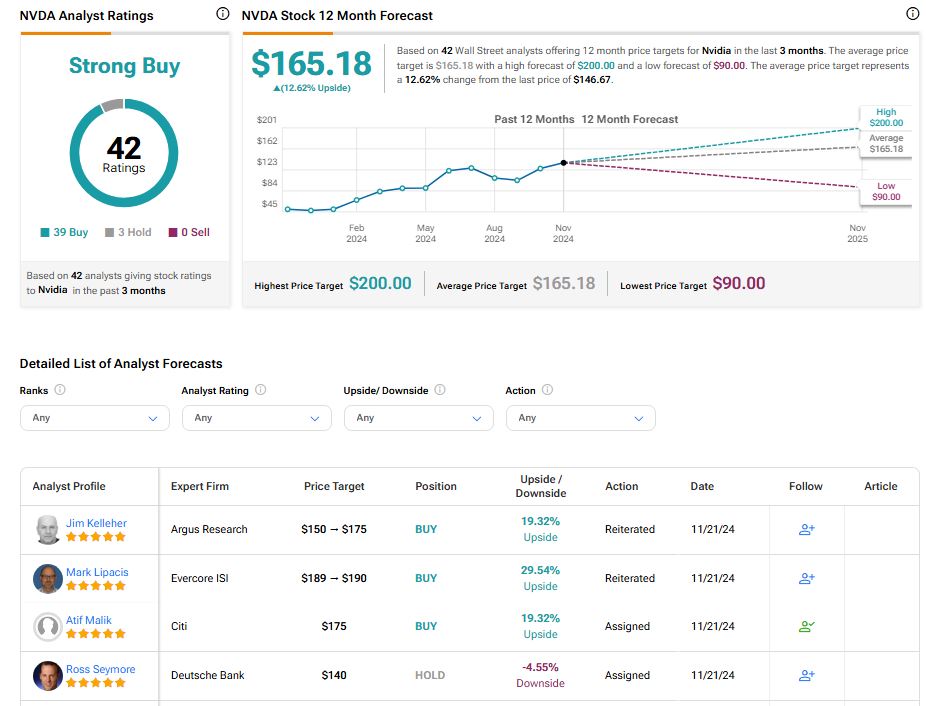

At TipRanks, the Wall Street consensus for Nvidia is a Strong Buy, considering 39 out of 42 analysts with bullish recommendations on the stock and only three neutral ones. The average NVDA price target is $165.18, implying an upside potential of 12.62%.

The Bottom Line

In conclusion, Nvidia continues to deliver strong results despite the sky-high bar set for it. While the stock carries some risks, such as margin compression, its growth story remains as compelling as ever. As the company transitions from the early to mid-stages of hypergrowth, if Nvidia meets—or even exceeds—its forward guidance, I believe the current valuations are de-risked enough to justify maintaining a Buy rating.