Sportswear giant Nike (NKE) shares rose more than 2% in pre-market trading on Wednesday, extending Tuesday’s gains after two senior insiders bought the stock. Tim Cook, the CEO of Apple (AAPL), and Nike independent director Robert Swan both disclosed recent share purchases, signaling confidence in the company’s outlook.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to filings, Cook bought 50,000 shares of Nike’s stock on December 22 at an average price of $58.97, investing about $3 million. The purchase lifted his direct stake in Nike to 105,480 shares. Separately, Swan acquired 8,691 shares at an average price of $57.54, adding to the positive signal from insider buying.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Earnings Beat, But Challenges Remain

The insider buys came shortly after Nike reported Q2 earnings. Earnings per share reached $0.53, well above estimates of $0.38, even as profit fell 32% from a year ago. Revenue edged up 1% to $12.4 billion, also ahead of expectations.

Despite the beat, Nike stayed cautious. Management warned of a softer holiday season, pressure from tariffs, and weak demand in China.

Notably, Nike stock has been under pressure from weak demand, rising costs, and stiff competition. Shares are down about 22% year-to-date, making the recent insider buying more meaningful.

Is NIKE Stock a Buy, Sell, or Hold?

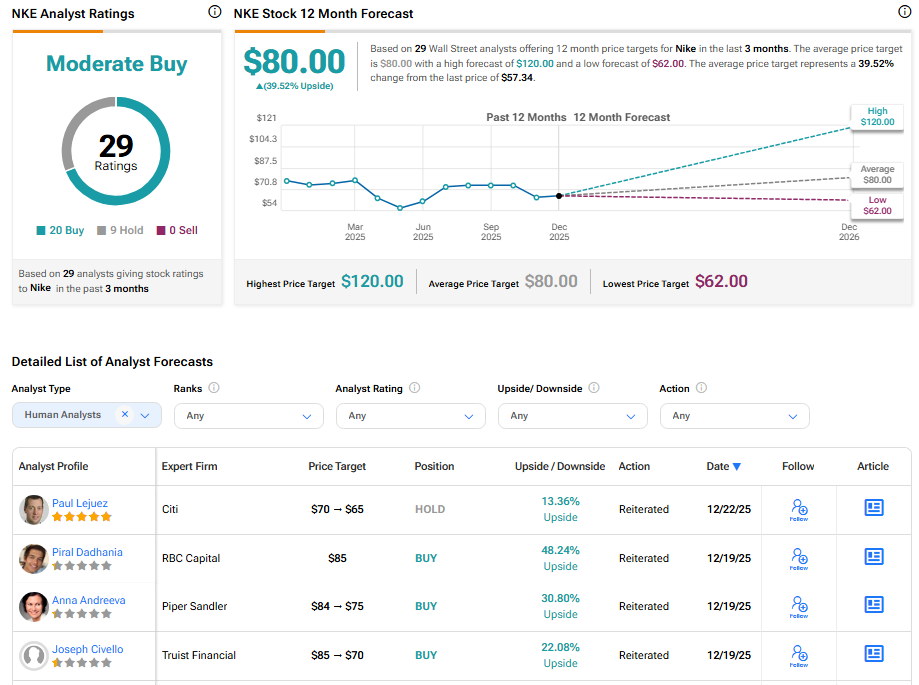

Overall, Wall Street has a Moderate Buy consensus rating on Nike stock based on 20 Buys and nine Holds, as indicated by the graphic below. The average NKE stock price target of $80.00 indicates 39.52% upside potential.