Nexalin Technology (NXL) dove on Thursday after the medical device company’s shares underwent a major rally on Wednesday. That rally was fueled by its updated clinical trial data for Gen-2 Nexalin DIFS as a treatment for Alzheimer’s disease. The company’s study found that Gen-2 Nexalin DIFS improved cognitive performance and enhanced brain network connectivity in patients with mild Alzheimer’s.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nexalin Technology noted that its Gen-2 SYNC 15 mA DIFS is already approved for use in China as a treatment option for depression and insomnia, and in Brazil and Oman for anxiety, depression, and insomnia. With this newest data, the company intends to submit applications to other regulatory bodies for approval, including the U.S. Food & Drug Administration.

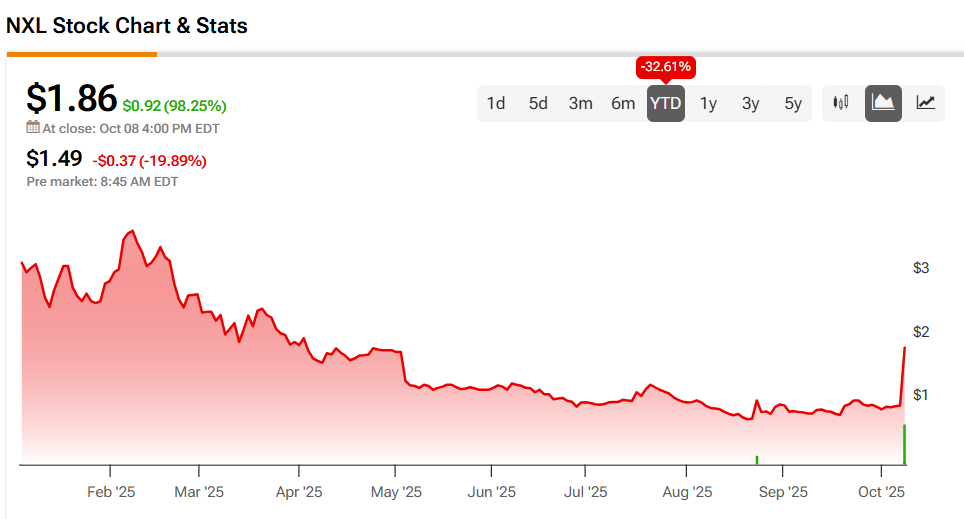

The clinical trial data drew investor interest in Nexalin Technology yesterday, as the Alzheimer’s market is expected to reach $20 billion annually. This saw NXL stock rocket 98.25% higher yesterday as some 196 million shares traded, compared to a three-month daily average of about 2.01 million units.

Nexalin Technology Stock Movement Today

Unfortunately for investors, Nexalin Technology stock wasn’t able to maintain its heightened price. The shares have fallen 19.89% in pre-market trading on Thursday but are still above the stock’s price before the clinical trial news was released. Traders will also note that NXL stock was down 32.61% year-to-date and is up 192.45% over the past 12 months.

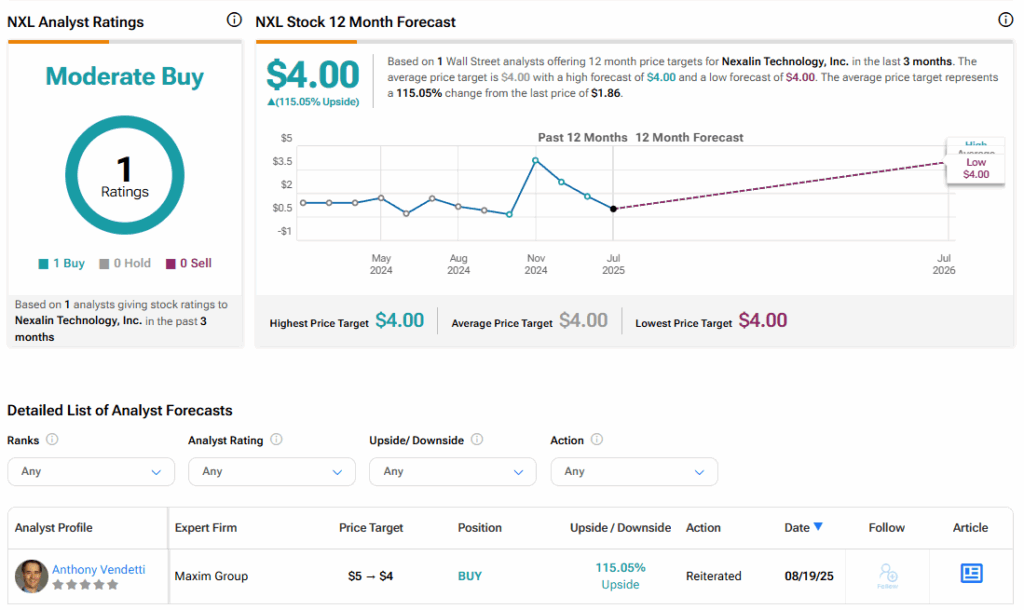

Is Nexalin Technology Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Nexalin Technology is Moderate Buy, based on a single Buy rating over the past three months. With that comes a $4 price target for NXL stock, representing a potential 115.05% upside for the shares.