ModivCare (MODV) stock was on the move Friday after the technology-enabled healthcare services company filed for voluntary Chapter 11 protection. The company said it will use this bankruptcy to enact a comprehensive restructuring transaction supported by the majority of its key stakeholders. Over 90% of First Lien Lenders and more than 70% of Second Lien Lenders have entered into a Restructuring Support Agreement (RSA) with ModivCare.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The RSA will provide ModivCare with $100 million in debtor-in-possession (DIP) financing, which the company will use to fund the restructuring process and continue ongoing operations. It will have over $100 million in liquidity and reduce its debt by $1.1 billion after the bankruptcy. This will also reduce its annual cash interest.

According to ModivCare, this restructuring will result in a “stronger, sustainable organization, positioned for growth and well-equipped to meet the critical needs of members across its non-emergency medical transportation, personal care services and remote patient monitoring service lines.”

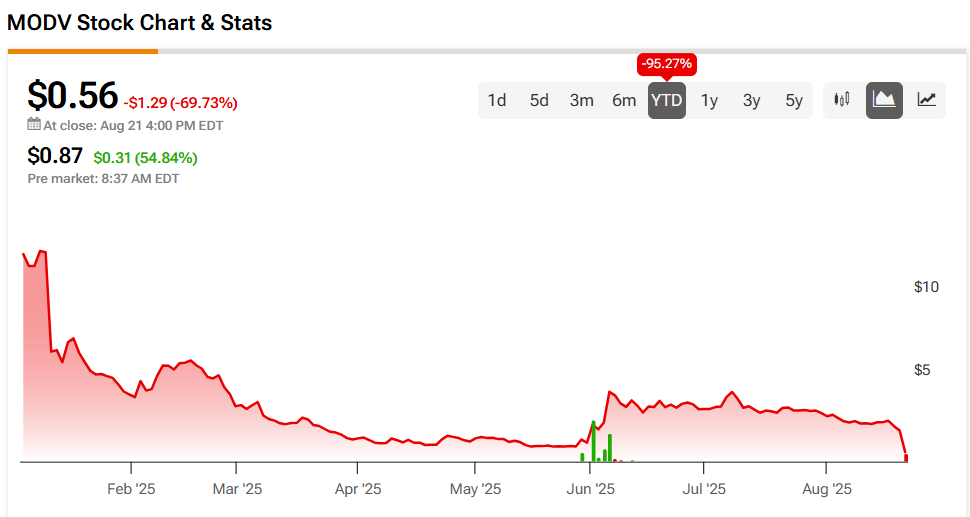

ModivCare Stock Movement Today

ModivCare stock has been on a wild ride since its bankruptcy announcement. MODV stock was up 54.84% in pre-market trading on Friday, following a 69.73% drop yesterday. The shares have also fallen 95.27% year-to-date and 97.9% over the past 12 months.

Today’s news brought heavy trading to ModivCare stock. This saw some 46 million shares traded as of this writing, compared to a three-month daily average of about 350,000 units.

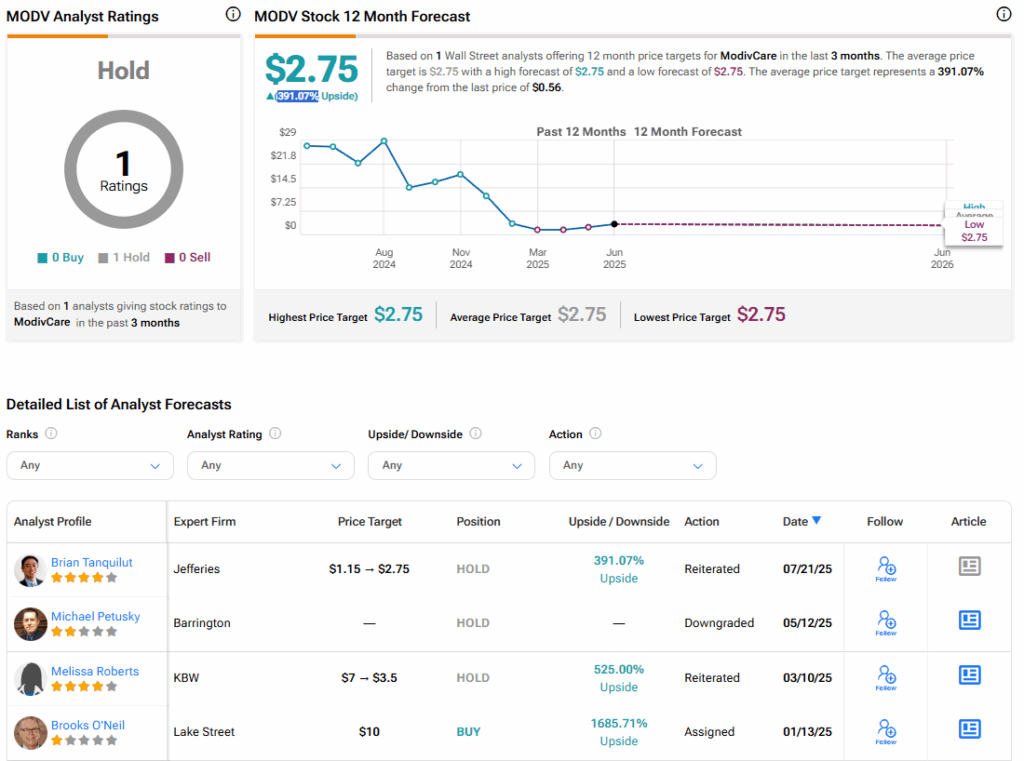

Is ModivCare Stock a Buy, Sell, or Hold?

Turning to Wall Street, only one analyst has covered ModivCare stock in the past three months. Four-star Jefferies analyst Brian Tanquilut rates MODV stock a Hold with a $2.75 price target, representing a potential 391.07% upside for the shares. The analyst’s stance may change following today’s bankruptcy news.