Mobile-health Network (MNDR) stock rocketed higher on Thursday after the healthcare technology company announced a Memorandum of Understanding (MOU) with PP GRID. This will have it acquire two artificial intelligence (AI)-optimized data centers in Malaysia and the related infrastructure for them.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mobile-health Network intends to invest up to $120 million in this AI data center deal. The company will obtain the funds to do so through the issuance of 3 million shares of MNDR stock. This deal hasn’t been finalized yet, and the finer details of it could change when it is.

Mobile-health Network noted that the MOU with PP GRID is designed to “strengthen and expand” its AI-powered health and technology ecosystem.

Mobile-health Network Stock Movement Today

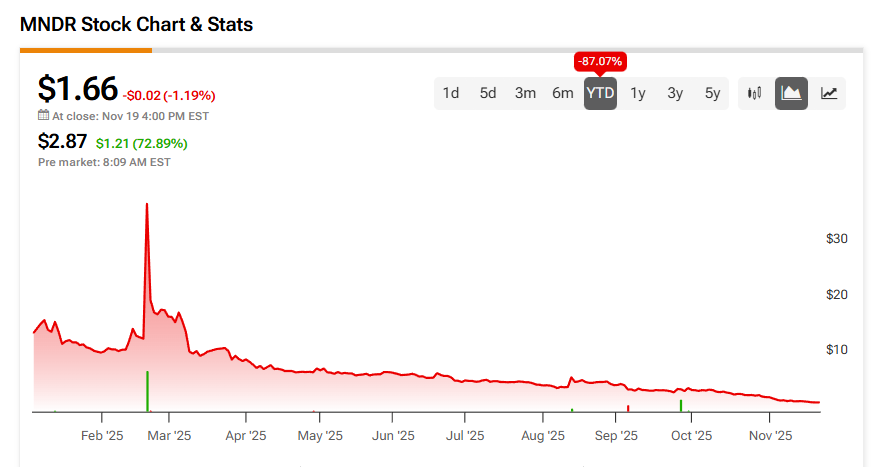

Mobile-health Network stock was up 72.89% in pre-market trading on Thursday, following a 1.19% fall yesterday. The stock has decreased 87.07% year-to-date and 85.4% over the past 12 months.

With today’s AI data center news came heavy trading of MNDR stock. As of this writing, more than 29 million shares have changed hands. To put that in perspective, the company’s three-month daily average trading volume is about 200,000 units.

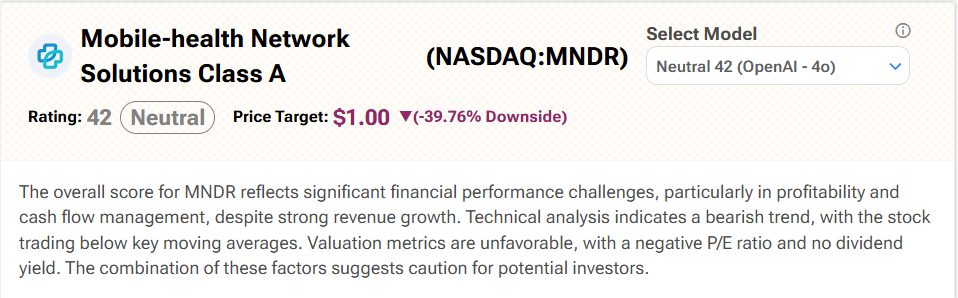

Is Mobile-health Network Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Mobile-health Network is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates MNDR stock a Neutral (42) with a $1 price target. It cites “significant financial performance challenges, particularly in profitability and cash flow management, despite strong revenue growth” as reasons for this stance.