Generation Essentials (TGE) stock rocketed higher on Monday after the French-based media and entertainment company announced a share repurchase program. Under this program, the company has agreed to buy back up to $5 million worth of its ordinary shares until January 31, 2026. The company said it will make these purchases via the open market at prevailing market prices, privately negotiated transactions, bilateral deals, block trades, and/or other legally permissible means.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Generation Essentials provided its reasoning for the share repurchase in a press release. The company stated that it believes shares of TGE stock are currently undervalued, based on its net asset value per share of $17.3 and total assets value per share of $25.7 as of June 30, 2025. The company also claimed it has seen significant short interest. As a result, it seeks to “promote stable, long-term share price growth and to encourage investors to focus on the Company’s intrinsic long-term value.”

Investors will also note that Generation Essentials is a subsidiary of AMTD Digital (HKD). This is a stock that rocketed on Friday alongside news of massive revenue gains for the first half of 2025. That news could also have drawn extra attention to TGE stock and further bolstered the shares alongside the repurchase announcement.

Generation Essentials Stock Movement Today

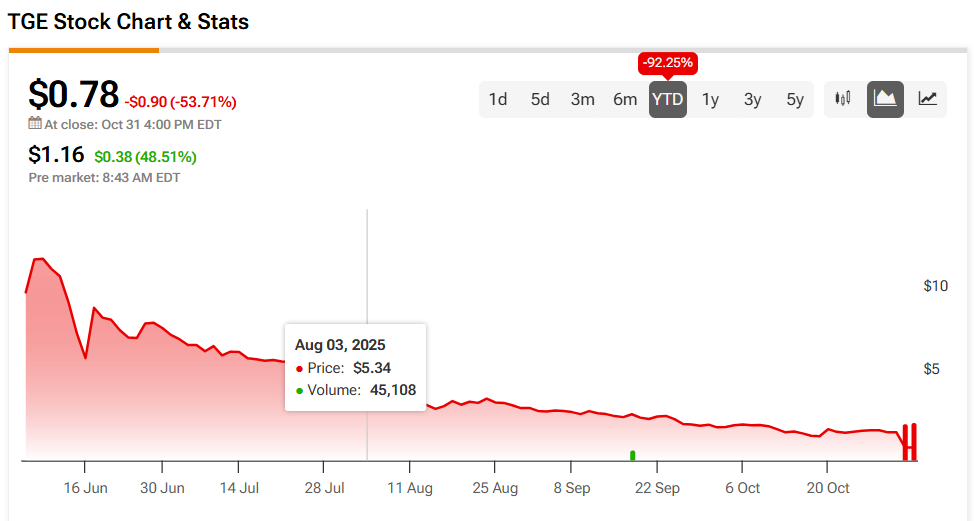

Generation Essentials stock was up 48.51% in pre-market trading on Monday, following a 53.71% fall on Friday. The shares were also down 92.25% year-to-date.

Today’s share repurchase news brought heavy trading to TGE stock. This resulted in more than 21 million shares traded as of this writing, compared to a three-month daily average of about 729,000 units. Investors will also note this follows heavy trading on Friday, when some 62 million shares changed hands.