DigitalBridge Group (DBRG) stock is surging in pre-market trading today after Bloomberg reported that SoftBank Group (SFTBF) is in talks to acquire the digital infrastructure investment firm, with a deal potentially announced as soon as Monday. Currently, DBRG has a market value of about $2.6 billion, with an enterprise value near $1.73 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While no agreement has been finalized, the report has fueled investor interest. The news indicates SoftBank CEO Masayoshi Son’s renewed push into AI-linked infrastructure.

DigitalBridge focuses on digital infrastructure investments, including data centers, cell towers, fiber networks, and edge computing assets, which are seeing rising demand as AI workloads grow.

DigitalBridge Group Stock Movement Today

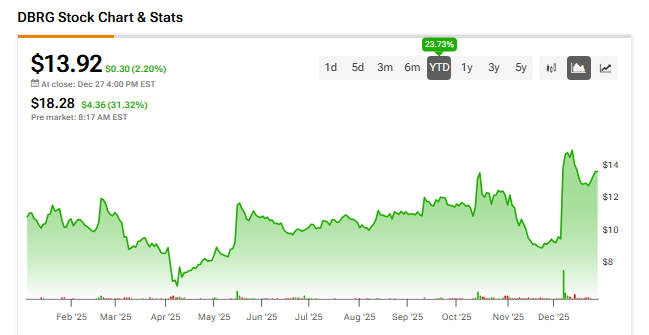

Shares of DigitalBridge jumped 31.3% in pre-market trading on Monday, building on a 2.2% gain from Friday. The stock is now up about 24% year to date, reflecting growing optimism around its strategic value in the AI infrastructure ecosystem.

With the stock jumping sharply on takeover speculation, much of the near-term upside could already be priced in. Until there is confirmation of a deal, shares may remain volatile as traders react to headlines.

Is DigitalBridge Stock a Buy, Sell, or Hold?

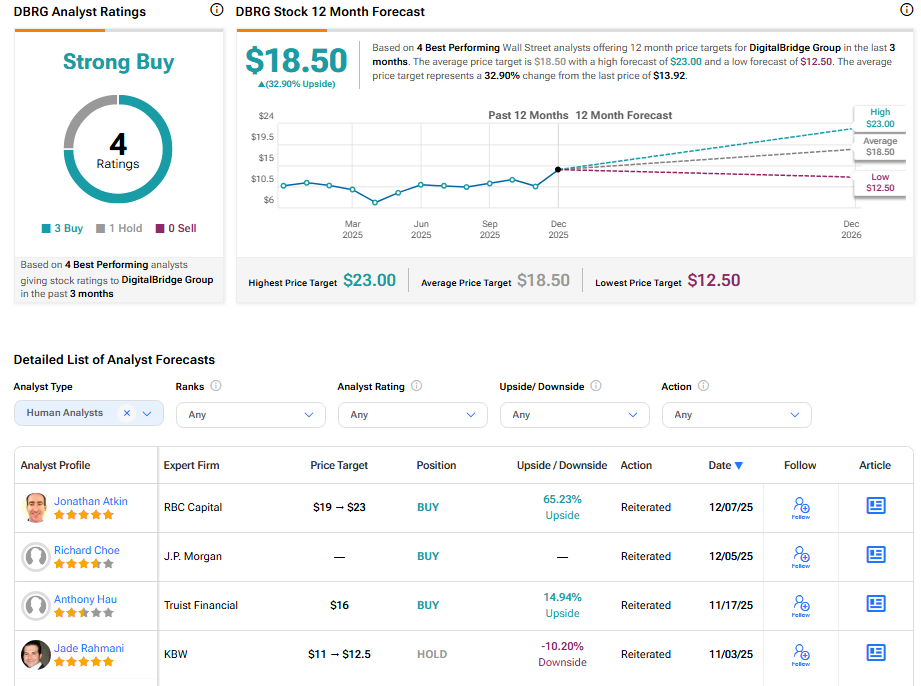

Turning to Wall Street, the analysts’ consensus rating for DigitalBridge is Strong Buy, based on three Buys and a single Hold rating over the past three months. With that comes a DBRG stock price target of $18.50, representing a potential 32.90% upside for the shares.