Denny’s (DENN) stock surged on Tuesday after the restaurant chain announced an agreement to be acquired by a group of investors. The investors that will take Denny’s private include private equity firm TriArtisan Capital Advisors LLC, investment firm Treville Capital Group, and owner-operator Yadav Enterprises, which is one of the largest Denny’s franchisees.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Denny’s agreement with these investors will result in it being purchased for $620 million. This will have holders of DENN stock receive $6.25 per share in cash, representing a 52.1% premium to the stock’s closing price on Monday. This is also a 36.8% premium to the stock’s 90-day volume-weighted average share price. The deal is set to close in the first quarter of 2026, following approval from shareholders and regulators.

Kelli Valade, CEO of Denny’s, said, “After careful consideration of all options and in consultation with external financial and legal advisors, the Board is confident the transaction maximizes value and has determined it is fair to and in the best interests of stockholders and represents the best path forward for the Company.”

Denny’s Stock Movement Today

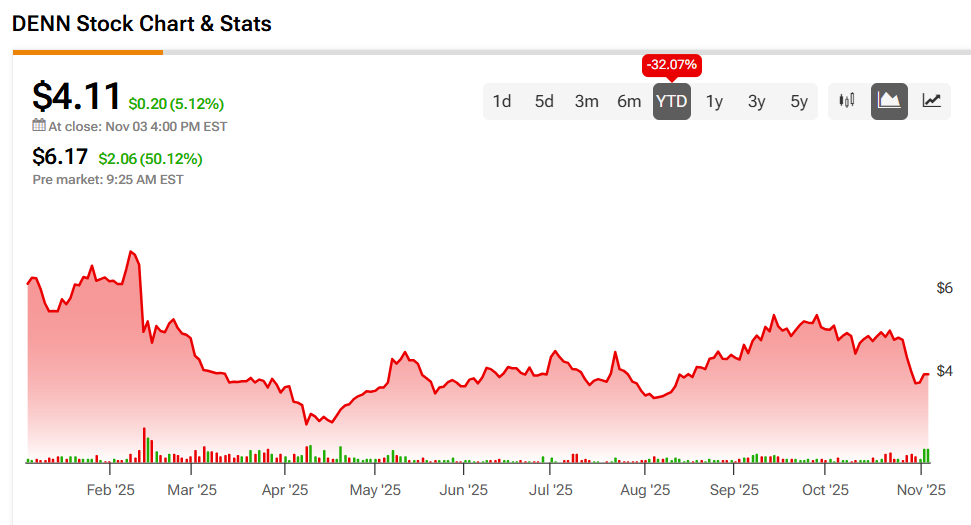

Denny’s stock was up 50.12% on Tuesday, following a 5.12% rally yesterday. However, DENN stock has fallen 32.07% year-to-date and 41.78% over the past 12 months.

Today’s news comes with heavy trading, as more than 10 million DENN shares have changed hands. For the record, the company’s three-month daily average trading volume is about 813,000 units.

Is Denny’s Stock a Buy, Sell, or Hold?

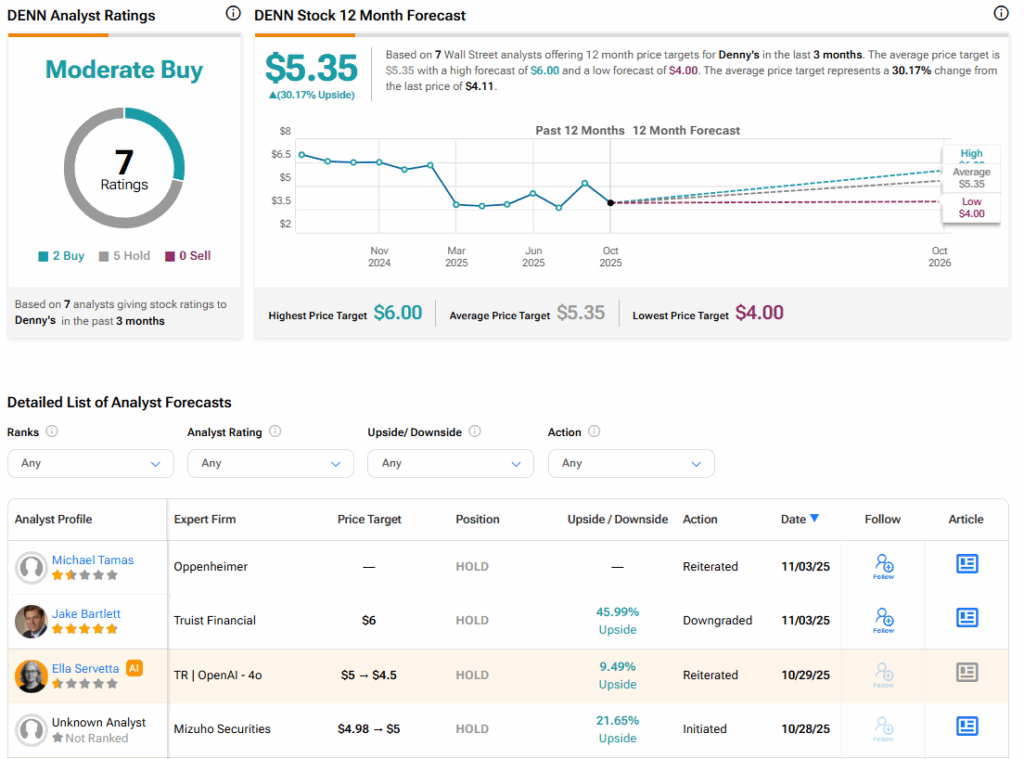

Turning to Wall Street, the analysts’ consensus rating for Denny’s is Moderate Buy, based on two Buy and five Hold ratings over the past three months. With that comes an average DENN stock price target of $5.35, representing a potential 30.17% upside for the shares.