CERo Therapeutics (CERO) stock plummeted on Thursday after the immunotherapy company revealed a delisting notice from the Nasdaq exchange. This delisting notice was sent to the company due to its failure to comply with Nasdaq Listing Rule 5550(b)(1), which requires it to maintain stockholders’ equity of at least $2.5 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CERo Therapeutics has had on-and-off trouble maintaining a listing on the Nasdaq. It was granted an extension in January 2025 to give it time to address the issue, and it did so. However, it ran into trouble again in August when it sold marketable securities at a substantial discount. This caught the interest of a Nasdaq panel, which sent another delisting notice to the company.

While CERo Therapeutics intends to appeal the delisting decision, trading of the company’s shares is set to be suspended tomorrow. CERo Therapeutics also noted that it’s in the process of preparing for a switch from the Nasdaq to an OTC market listing. However, the company said that there’s no guarantee it will succeed and warned that such a move could negatively affect the price of CERO stock.

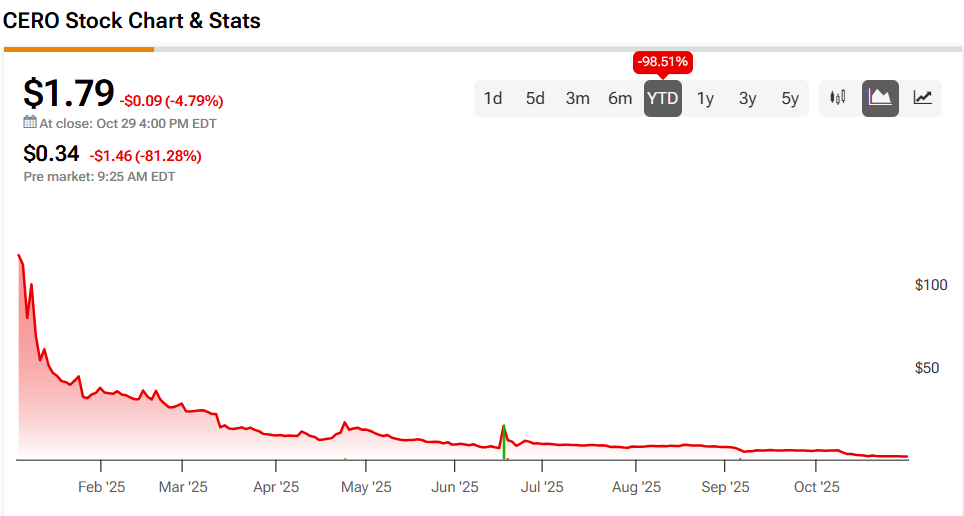

CERo Therapeutics Stock Movement Today

CERo Therapeutics stock was down 81.28% in pre-market trading on Thursday, following a 4.79% fall on Wednesday. This extends a 98.51% drop year-to-date and a 90.96% decline over the past 12 months.

Today’s delisting news resulted in some 5 million shares trading hands, compared to a three-month daily average of about 241,000 units.

Is CERo Therapeutics Stock a Buy, Sell, or Hold?

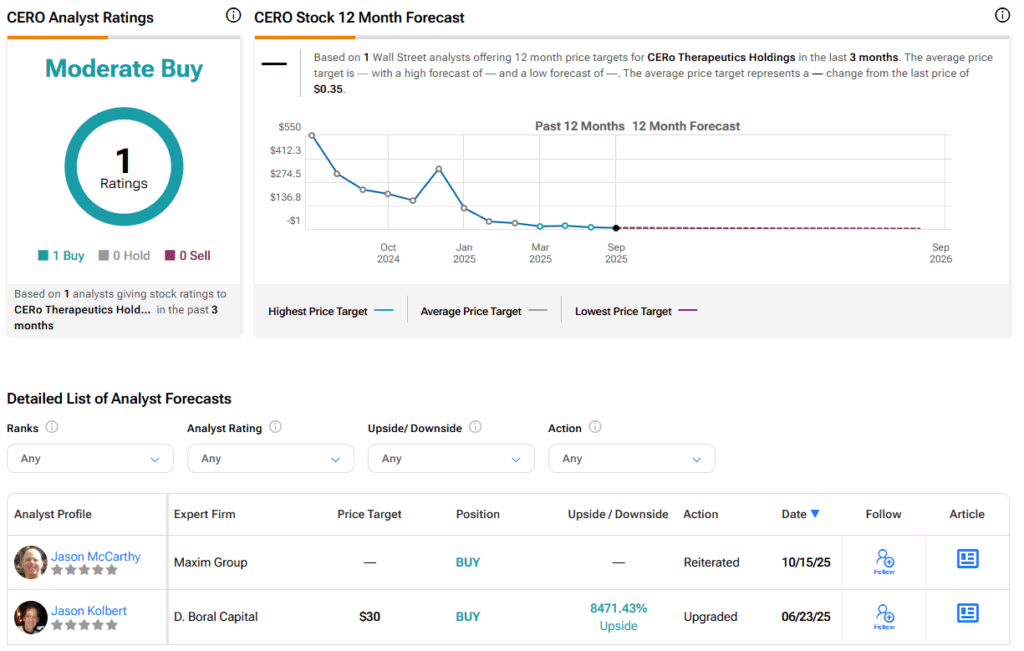

Turning to Wall Street, the analysts’ consensus rating for CERo Therapeutics is Moderate Buy, based on a single Buy rating over the past three months. However, this will likely change following the company’s delisting announcement.