Shares of C3.ai (AI) are down 2.2% in pre-market trading despite a healthy beat for the fiscal second quarter. The company posted an adjusted loss of $0.25 per share, narrower than the consensus estimate of $0.33 per share, but wider than the prior year period’s loss of $0.06 per share. Sales fell 20.4% year-over-year to $75.1 million, easily beating the consensus of $74.9 million.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The enterprise AI application software company faces ongoing leadership challenges in a fiercely competitive market and has no clear route to profitability.

C3.ai Falls Despite Upbeat Guidance

The company provided upbeat guidance for the third quarter and full year fiscal 2026. For Q3, the company guided for revenue between $72 million and $80 million, ahead of the consensus of $75.6 million (at the midpoint). Full year revenue is projected between $289.5 million and $309.5 million, also above the consensus of $298.7 million.

Nevertheless, investors appear daunted by C3.ai’s continued bottom-line losses. For FY26, C3.ai guided for operating losses in the range of $180.5 million to $210.5 million.

Analyst Reaction to C3.ai’s Results

Following the Q2 results, Citizens JMP analyst Patrick Walravens reiterated his Buy rating and $24 price target, which implies nearly 60% upside potential from current levels. He noted that C3.ai offers a broad suite of industry-specific AI and Gen AI applications, with notable strengths in predictive maintenance and supply-chain management. The company has built solid partnerships, including with Microsoft (MSFT), and now counts 100 customer agreements across 17 industries, with 24 joint agreements closed in Q2 FY26.

Walravens is also encouraged by C3.ai’s 89% year-over-year increase in federal bookings in Q2 despite the government shutdown, underscoring a robust federal pipeline within a large total addressable market (TAM) estimated at $271 billion in 2024.

He highlighted that C3.ai could be a lucrative acquisition candidate, with early-stage discussions and other options being considered. Walravens has confidence in new CEO Stephen Ehikian, whose leadership in scaling AI businesses and deep government procurement experience, including a stint as Deputy Administrator of the General Services Administration, are seen as strong catalysts for future growth.

Is C3.ai Stock a Buy, Hold, or Sell?

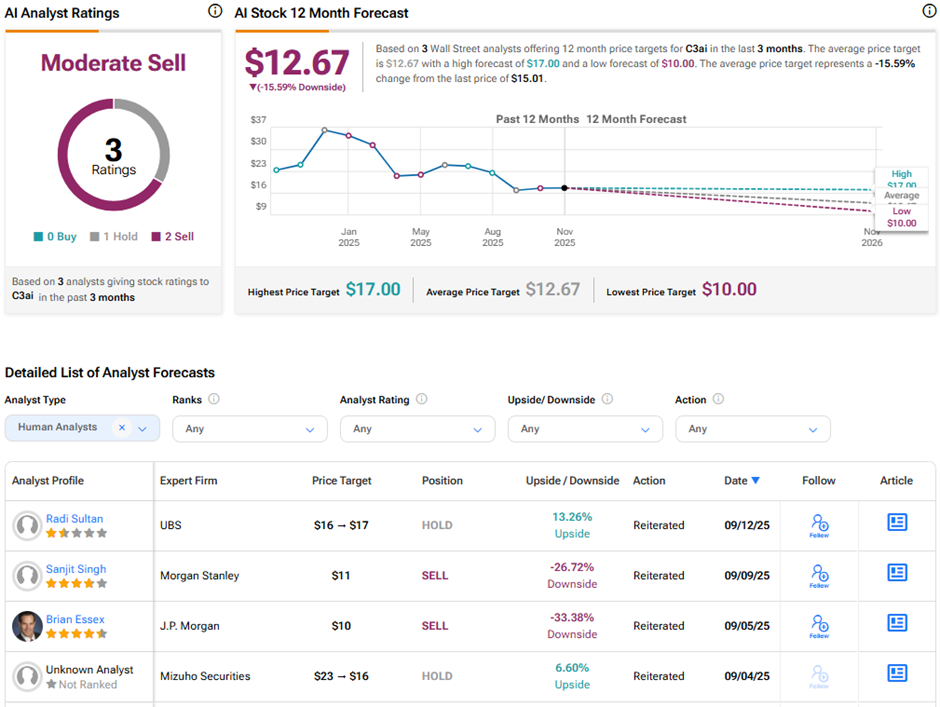

Not all analysts share the same enthusiasm about C3.ai stock. On TipRanks, C3.ai stock has a Moderate Sell consensus rating based on one Hold and two Sell ratings. The average C3.ai price target of $12.67 implies 15.6% downside potential from current levels. Year-to-date, AI stock has lost nearly 56%.