Actelis Networks (ASNS) stock rocketed higher on Friday after the networking solutions company revealed a stock purchase agreement with White Lion Capital LLC in a U.S. Securities and Exchange Commission (SEC) filing. Under the terms of this agreement, the company has the right to require White Lion Capital LLC to purchase up to $30 million worth of ASNS stock.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Actelis Networks has some restrictions on the stock purchase agreement. For example, the shares issued to White Lion Capital LLC can’t take its stake in the company above 19.99% without shareholder approval. Additionally, the company has agreed to issue $750,000 worth of ASNS stock to White Lion Capital LLC as a commitment fee. This fee will increase if the company stops being listed on the Nasdaq Capital Market during the stock purchase agreement.

To go along with this, Actelis Networks and White Lion Capital LLC entered into a private placement. This covered 871,766 shares of ASNS, as well as pre-funded warrants for another 3,128,234 shares. Gross proceeds from this private placement were $850,000.

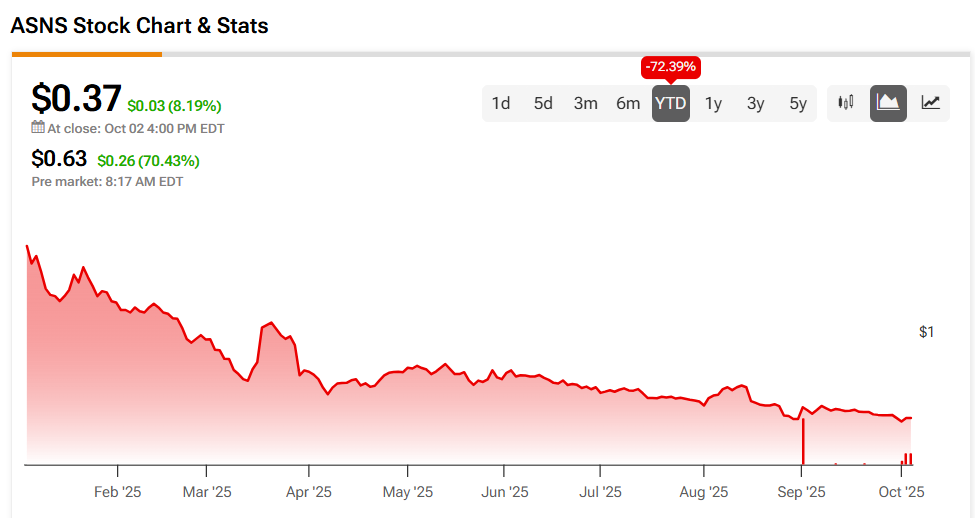

Actelis Networks Stock Movement Today

Actelis Networks stock was up 70.43% on Friday, following an 8.19% rally yesterday. However, the shares have dropped 72.39% year-to-date and 73.57% over the past 12 months. With today’s news came heavy trading, as some 102 million shares changed hands, compared to a three-month daily average of about 6.35 million units.

Is Actelis Networks Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Actelis Networks is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates ASNS stock a Neutral (42) with a 50-cent price target. It cites “significant financial challenges with ongoing losses and high leverage” as reasons for this stance.