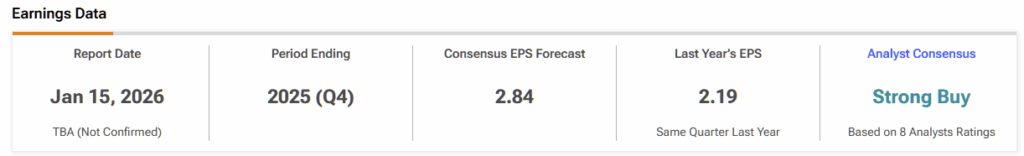

Taiwan Semiconductor Manufacturing Company (TSM), better known as TSMC, is set to kick off the tech earnings season—the traditional starting gun for the new year after a busy holiday stretch. Next Thursday, January 15, TSM is scheduled to report its Q4 results, with expectations already stretched between surging AI optimism and lingering macroeconomic anxiety.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Beyond the noise, however, TSMC remains the world’s dominant semiconductor foundry and appears poised to deliver strong momentum both in its upcoming report and in its 2026 outlook. While some investors worry that the stock’s relentless rally could invite a pullback, market indicators suggest shares remain undervalued. With revenue and earnings likely to continue accelerating through this year and beyond, I remain bullish on TSM stock.

Another Test of the TSMC Machine

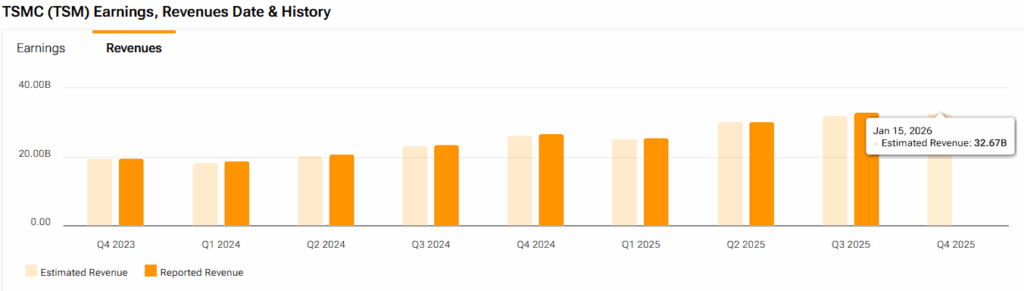

TSMC’s Q4 should largely mirror Q3 in terms of momentum, even if a modest slowdown is to be expected after six consecutive quarters of growth hovering between 30% and 40%. Last quarter, revenue increased more than 30%, and the company guided Q4 revenue to $32.2–$33.4 billion, targeting about 24% growth at the midpoint and another record quarter.

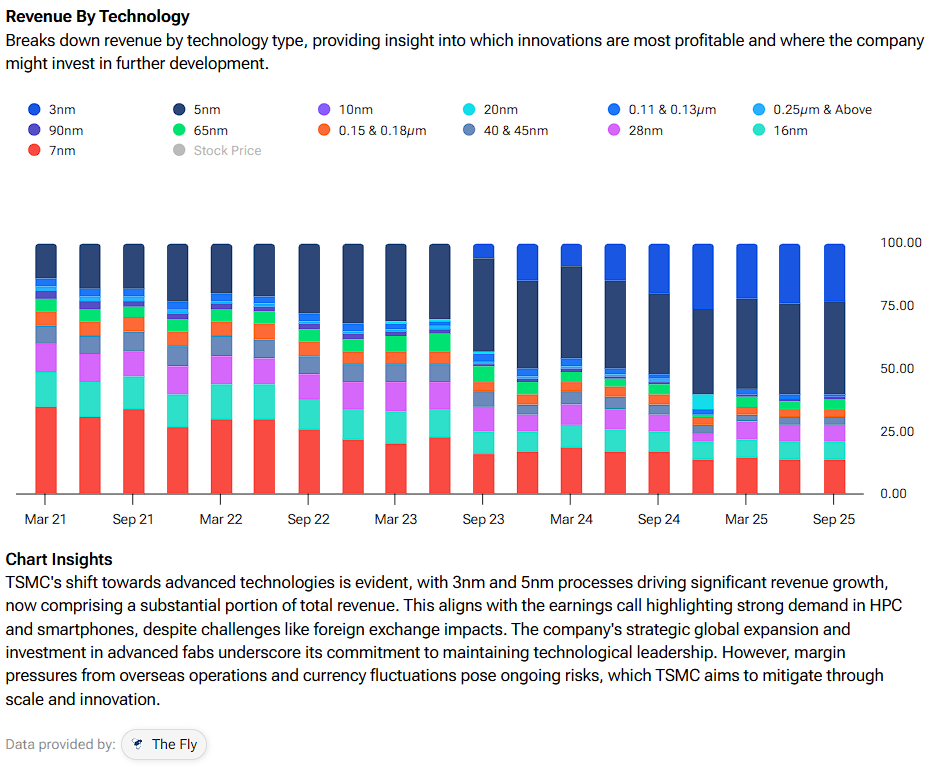

Behind those numbers sits a concentrated customer list and a strong product portfolio. Nvidia’s (NVDA) latest data-center GPUs, custom accelerators from the major cloud providers, and networking silicon that stitches AI clusters together all lean on TSM’s 3- and 5-nanometre lines. Apple (AAPL), in the meantime, is shipping iPhones and Mac processors on advanced nodes, keeping utilization high, and should prove to be another strong contributor in TSM’s top line.

The more interesting subtlety is that the more “legacy” parts of the business are no longer dragging as hard. Smartphone and PC demand, which had been a headwind for nearly two years, has stabilised and even rebounded modestly. Given that TSM has flagged a late-year recovery in mobile chips as support for Q4, I believe the company will beat its guidance and consensus by a decent margin. Along with the 2-nanometer ramp currently underway, I believe the setup going into 2026 implies TSM’s momentum won’t slow down any time soon.

2026 Catalysts Include a 2-Nanometer Ramp

Heading into 2026, TSMC is preparing to ramp its first 2-nanometre (N2) lines. Market estimates point to capacity increasing from tens of thousands of wafers per month in late 2025 to more than 100,000 wafers per month in 2026. Demand is already oversubscribed, and management has been encouraging customers to commit to longer-term terms to secure allocation.

Note that pricing power flows directly from that bottleneck. It seems like TSM intends to push through mid-single-digit to high-single-digit price increases across several advanced nodes while positioning N2 at a premium to today’s 3-nanometre wafers. For customers designing billion-dollar AI training clusters, a modest uplift in wafer pricing is simply the cost of staying in the race, especially when energy and data center construction dominate total project budgets. So I don’t expect any price hikes to affect volumes here.

All of this sits on top of an AI capex wave that has not really slowed. We have seen that hyperscalers and leading internet platforms are still signalling double-digit annual increases in infrastructure spending, with a rising share of that spending earmarked for AI-centric compute. New Nvidia architectures showcased earlier this week, along with custom chips from the likes of Google (GOOGL) and Amazon (AMZN), continue to add design wins to TSM’s pipeline and reinforce its position at the center of the ecosystem.

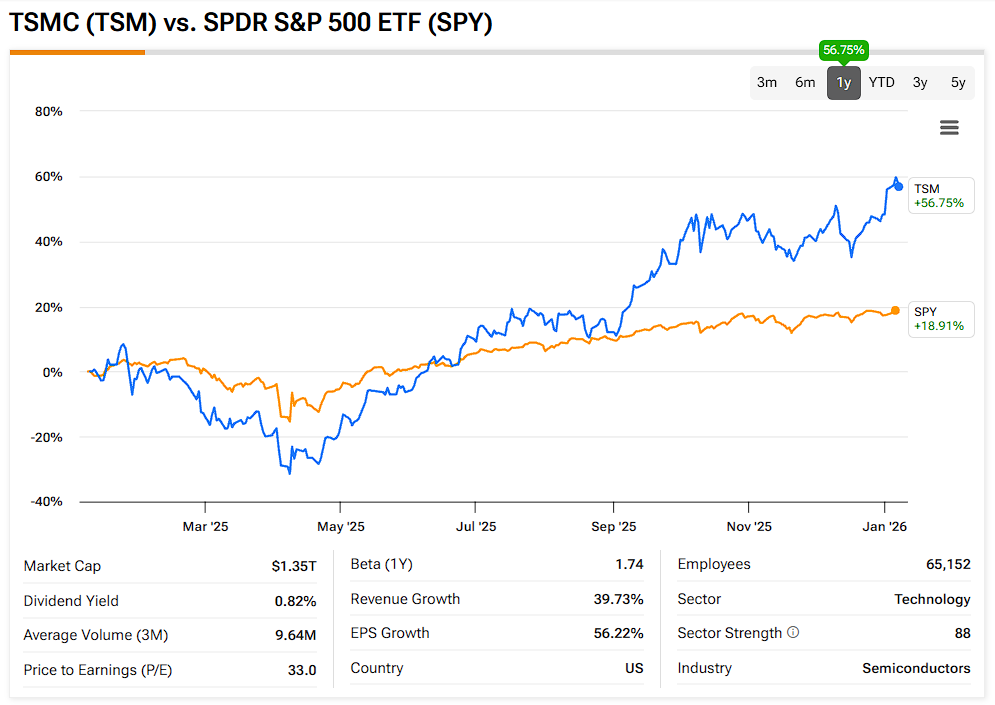

Secular Growth at a Cyclical Multiple

In recent conversations with tech investors, I have sensed a more cautious tone toward TSMC following its ~50% rally last year. I don’t share that concern. In fact, I believe the stock remains undervalued. The 2026 consensus EPS for TSM sits at $13.08, implying a forward P/E of 25x. Five years ago, I would have argued that this is a premium multiple for the stock. But we are no longer talking about a low-growth, boom-and-bust cycle. TSM today is a quasi-utility for advanced logic in the AI era.

On most forecasts, TSM can compound earnings well into the double digits as 3- and 2-nanometre nodes ramp up and AI content per server continues to rise. TSM clearly controls the majority of leading-edge foundry capacity and, by some estimates, more than 90% of AI accelerator logic. That is an impenetrable moat built on an ecosystem and years of accumulated learning that no rival will be able to challenge anytime soon. In that context, I believe TSM remains cheap and should post a strong gain in 2026, driven by EPS growth and the potential for sustained valuation expansion.

What could weigh on sentiment is, of course, the ongoing geopolitical tensions around Taiwan, which remain an unavoidable overhang, and execution risk in overseas fabs in Arizona, Japan, and Europe. There, costs are higher, and learning curves are still forming. But if you don’t see this risk as a binary catastrophe, I believe today’s valuation still looks like a discount for such a unique, high-quality name.

Is TSMC a Good Stock to Buy?

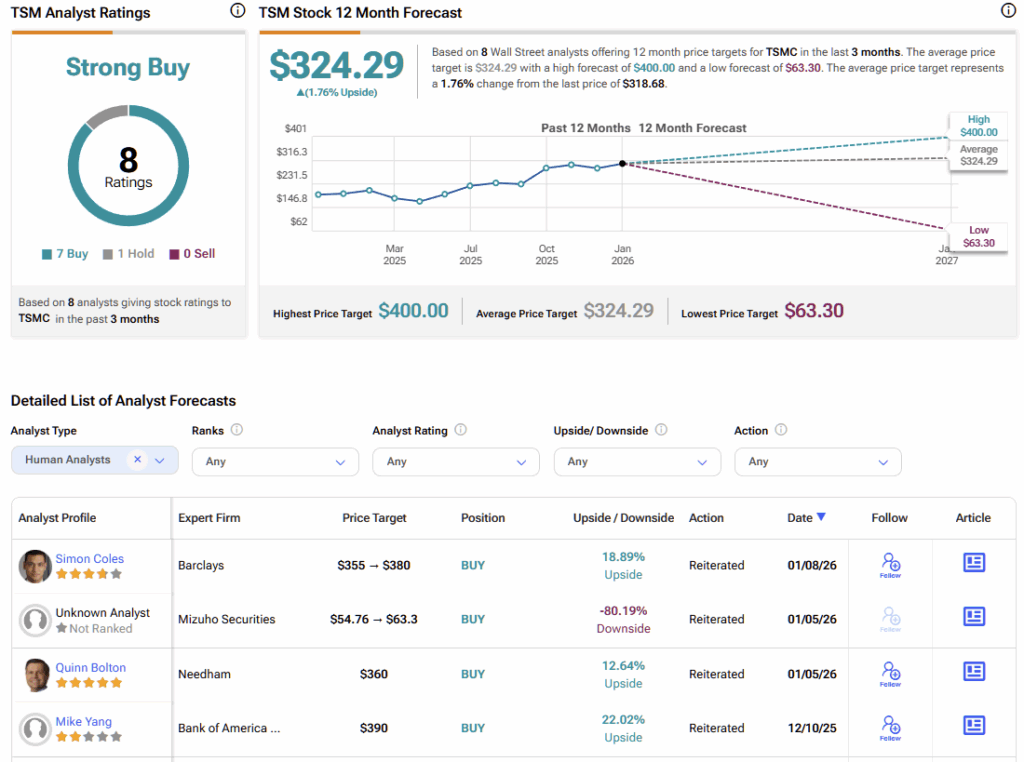

On Wall Street, TSM stock boasts a Strong Buy consensus rating, based on seven Buy and one Hold ratings. While no analyst rates the stock a Sell, TSMC’s average stock price target of $324.29 implies the stock is already priced to perfection. Even so, the market’s constructive stance suggests targets could move higher, provided the company continues to deliver strong operating traction.

TSMC’s Secular Growth Story Still Looks Mispriced

TSM’s upcoming earnings report should mark another checkpoint on a powerful runway, where surging AI demand and tightening 2-nanometer capacity continue to drive earnings higher. With price increases increasingly likely, the next few quarters could bring a meaningful catalyst for both revenue and margins.

At roughly 25× forward earnings, a business capable of growing profits at around 20% annually over the medium term still appears attractively valued. In that context, TSM looks less like a cyclical trade and more like a secular compounder—one that the market has yet to fully reprice.