Alphabet (GOOGL) stock has been on a tear following the company’s latest quarterly results, surging to fresh all-time highs around $280 per share after trading near $150 in April. I was among those urging investors to buy back then — but staying true to my contrarian instincts, I now believe the prudent stance is to become neutral on the stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Valuation has simply gotten ahead of itself. Despite continued operational strength, the stock valuation has become stretched on multiple technical and fundamental indicators. Markets can only sustain so much sentiment-driven enthusiasm before reality bites back. For now, I remain Neutral on GOOGL.

A Stalwart Trading in Temporary Excess

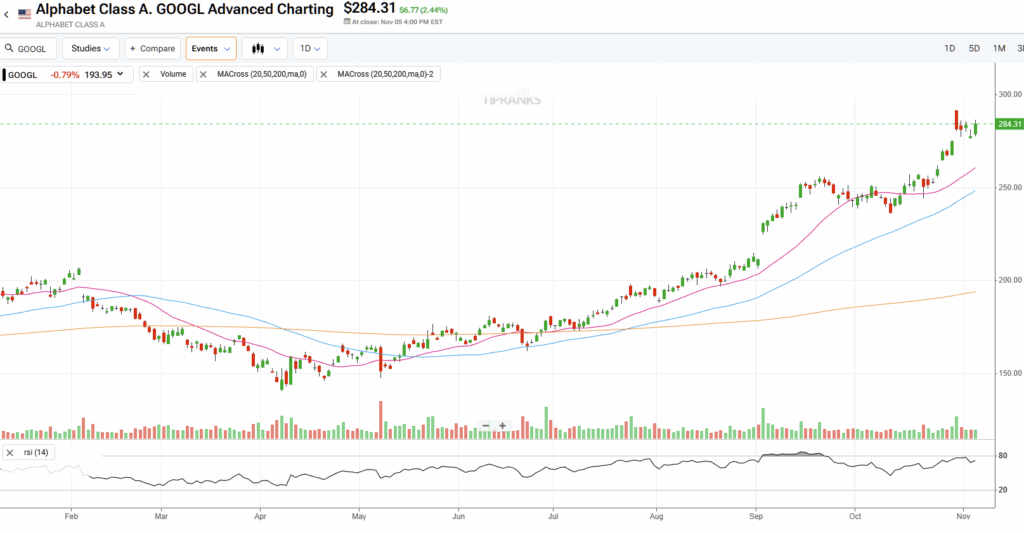

Currently, Google’s 14-week RSI sits above 75 — a level typically signaling overbought conditions. The stock also trades significantly above its 50-week moving average ($280 versus $195), suggesting limited near-term value for new buyers. In other words, while momentum remains strong, the entry point does not.

Operationally, Google remains one of the most diversified technology franchises globally. Its vast distribution network gives it a potential advantage in scaling AI adoption, even as competition from OpenAI intensifies. According to OpenAI CEO Sam Altman, ChatGPT now boasts over 800 million weekly active users, implying ~3.5 billion monthly users. By contrast, Google’s Gemini app currently has around 650 million users.

The company’s enduring strength lies in Google Search, which serves an estimated 5 billion users worldwide as of 2025. By embedding AI “overviews” and new generative features directly into Search, Google aims to preserve engagement and ad relevance — a critical defense against OpenAI’s rapid ascent. However, mouse clicks have never been as elusive as they are today, as evidenced by GOOGL’s ongoing struggle with acquisition costs, which continue to climb year-over-year.

Given these competitive dynamics and the maturity of Google’s business model, even if it succeeds in defending its share of internet navigation and information retrieval in the AI age, I think there’s little operational reason for above-average valuation. It’s worth mentioning that GOOGL’s forward PEG ratio stands ~17.5% above the sector average, signaling that its valuation already prices in much of its near-term promise.

Even if Google succeeds in defending its market share in the AI era, there’s limited justification for further multiple expansion at these levels. Any moderation in enterprise AI demand could prompt a noticeable re-rating.

Energy Constraints Could Negate the Bullish Case

Energy availability may be one of the least appreciated headwinds for large-scale AI deployment — and Alphabet is no exception. Although the company has improved energy efficiency through custom accelerators, U.S. grid operators such as PJM and ERCOT are openly modeling significant data-center constraints in the coming years. These pressures could ultimately affect cloud economics and ROI for AI workloads, thereby moderating GOOGL’s growth trajectory.

To its credit, Alphabet has taken proactive steps to mitigate these risks. The company signed a record 8 GW of clean-energy contracts in 2024 and continues to pioneer 24/7 carbon-free energy initiatives. These efforts should help stabilize long-term power costs and reduce exposure to grid volatility, though they are not an absolute safeguard.

Looking ahead, investors should monitor whether Google Cloud’s backlog growth continues to outpace capital expenditure increases through 2026 — a dynamic that would support accelerating free cash flow per share. Continued AI integration across Google’s ecosystem could also drive incremental advertising revenue, particularly if Search maintains its central role in information discovery.

Is Alphabet (GOOGL) a Buy, Hold, or Sell?

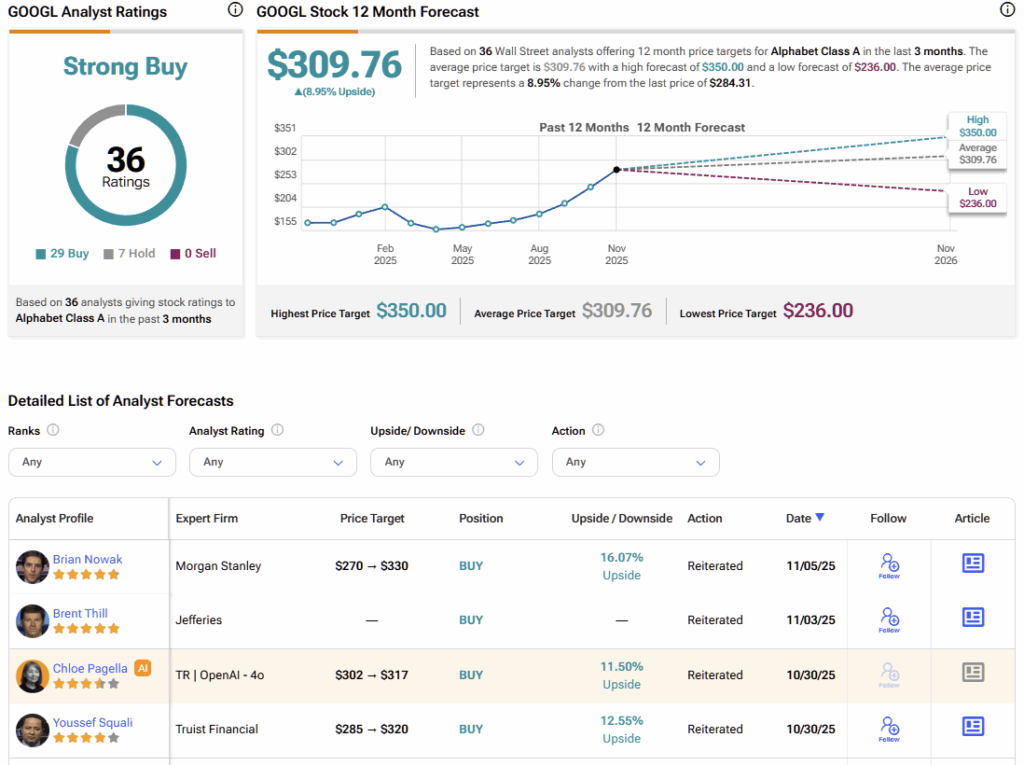

Wall Street remains broadly bullish on Google. Among 36 analysts covering the stock, 29 rate it a Buy and seven a Hold, with an average price target of $309.76, implying almost 9% upside over the next 12 months.

I take a more conservative view. While a bull case could yield a 10% gain in the next year, my base case is closer to 5%, which doesn’t justify a new Buy recommendation at current levels. Consensus forecasts also point to a slowdown in normalized EPS growth to roughly 5% in FY2026, before re-accelerating to around 14% in FY2027 — suggesting that volatility could re-emerge before that growth rebound is fully priced in.

In other words, I expect a modest correction before the next leg higher, at which point I would likely revisit the stock.

What Do Hedge Funds Think About GOOGL?

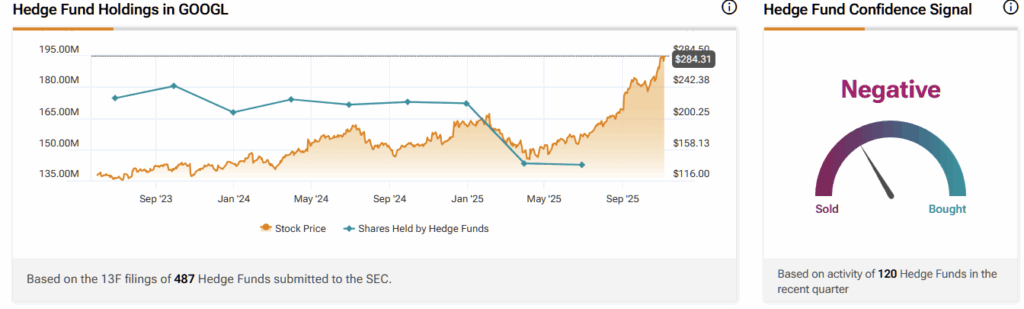

Despite its headline-grabbing exploits, the smart institutional money doesn’t seem to like GOOGL.

According to TipRanks’ hedge fund tracker, GOOGL is currently seen with low confidence by hedge fund managers on Wall Street.

According to 13F filings from 487 hedge funds submitted to the U.S. SEC throughout 2024, as GOOGL has seen higher highs, hedge fund managers have reduced their stakes from around 180 million shares in September 2023 to around 140 million today. The current Confidence Signal based on 120 leading hedge funds is negative.

Google is a Stalwart but Not an Elite Alpha Stock

Google remains a world-class franchise with unmatched reach, dominant infrastructure, and a resilient business model. Yet at present, valuation has run ahead of fundamentals, and structural headwinds — notably energy constraints — could limit near-term upside.

At current levels, buying Google means chasing momentum rather than value. My stance is neutral, and I would look to re-enter the stock on a meaningful pullback, ideally at a price below $250 per share.