As an investor who’s watched Intel’s (INTC) challenges unfold over the past few years, I’m genuinely excited about Lip-Bu Tan stepping in as CEO. Tan’s approach is both bold and strategic—the exact combination Intel desperately needs. He’s already making aggressive moves to restructure the company, ramp up investments in manufacturing and AI, and put the foundry business at the forefront. Despite the plethora of both internal and external turmoil, INTC stock has managed to post a flat first six months of 2025.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Tan is steering Intel not only to reclaim its former dominance but potentially to exceed it. I’m bullish on the outlook—but realistic, too—knowing it will take time for Intel to solidify its AI foothold and deliver meaningful returns in the years ahead.

Deep Cuts Streamline Intel Operations

Since taking the helm as CEO in March 2025, Tan has wasted no time launching a significant restructuring to slash layers of middle management that have long bogged down Intel’s innovation and decision-making. The plan calls for reducing the workforce by about 20%—a tough but necessary move to streamline the organization and accelerate its agility.

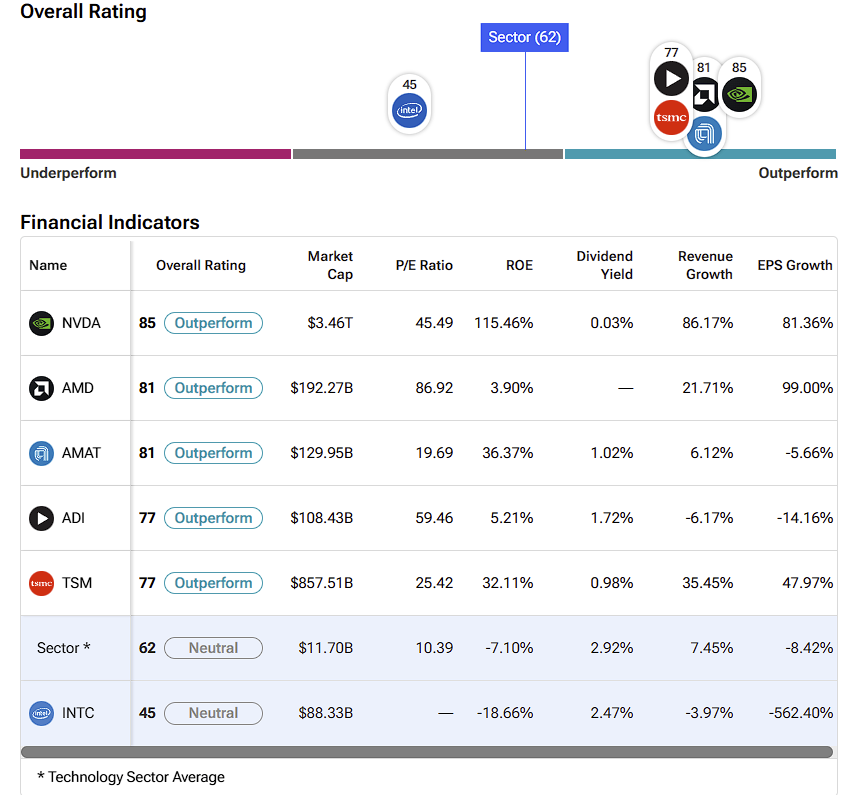

This isn’t just about trimming costs; it’s about making Intel leaner and faster. The company aims to reduce operating expenses to around $17 billion by FY 2025. While layoffs are never easy, Intel has grown bloated compared to rivals and now faces an intensely competitive market where survival—and success—demand swift action. As things stand, Intel lags behind its sector peers on several key metrics.

I’m confident that a leaner Intel will be sharper, faster, and better positioned to innovate boldly and prove its strength to the competition. However, Tan must handle the workforce cuts with care, focusing on retaining key talent and maintaining morale through a strong, principled leadership approach.

Intel Bets Big On Advanced Manufacturing Growth

Arguably, Tan’s boldest move is his unwavering commitment to Intel’s advanced manufacturing, especially the cutting-edge 18A node (1.8nm) technology. Set to power Intel’s Panther Lake CPUs by late 2025, this breakthrough could dramatically boost energy efficiency and performance, potentially allowing Intel to finally compete toe-to-toe with giants like TSMC (TSM) and Samsung (SSNLF).

On the foundry front, Intel Foundry Services (IFS) is gaining serious momentum. High-profile deals—most notably with Microsoft (MSFT)—to utilize Intel’s 18A process could transform Intel into a fierce contender in the foundry market. Securing a few more marquee contracts from the likes of Nvidia (NVDA) or Apple (AAPL) would be a game-changer, sparking a significant surge in investor confidence and substantially lifting Intel’s valuation.

That said, delays in the massive Ohio manufacturing facility, now pushed back to around 2030, raise concerns about capacity constraints and potential missed opportunities if chip demand suddenly spikes. Intel’s challenge going forward will be striking the right balance in capital allocation and maintaining a nimble leadership team ready to seize emerging market opportunities quickly.

Robust Financials Keep Intel Fighting for Greatness

Looking ahead to 2028, Intel’s financial health will largely depend on how well it executes its strategy. Analysts project relatively flat to slightly declining revenue in FY 2025, hovering between $50 billion and $53 billion, with a modest recovery expected afterward. Earnings per share of around $0.30 for 2025 seem reasonable, given the current margin pressures.

In my base-case outlook, Intel modestly rebounds to about $60 billion in revenue by 2028, with earnings per share approaching $3.00. This scenario would support a share price rising to around $40 from today’s $20—a steady but unspectacular return over three years, especially with the dividend still cut during the turnaround.

However, in a bull-case scenario, if Intel secures major foundry contracts and capitalizes on strong AI-driven demand, earnings per share could reach $5.00 by 2028, pushing shares into the $70 to $90 range. Conversely, if Intel falters in execution, revenue stagnates, and growth stalls, the stock could remain stuck in the $20s with limited upside potential.

Competitive Risks Can Be Overcome

Intel is facing significant challenges, and execution, especially talent retention and deployment, will be critical. Any delays or yield issues with the 18A node could undermine confidence and push foundry customers toward competitors like TSMC. Additionally, Intel faces intense competition in chip design from Nvidia (NVDA) and AMD (AMD).

Still, I believe the opportunities outweigh the risks. Despite dominant rivals, Intel’s valuation remains attractively low, with a price-to-sales ratio under 2, compared to TSMC’s 8.5, leaving plenty of room for multiple expansion as earnings momentum improves and investor sentiment turns positive. History shows that undervalued companies staging a comeback can deliver compelling investment stories.

Is Intel a Buy, Sell, or Hold?

When it comes to INTC, most of Wall Street is sitting on the fence. Intel carries a consensus Hold rating, backed by two Buys, 25 Holds, and four Sells. INTC’s average stock price target is $21.29, suggesting roughly 6.5% upside over the next year.

Although this suggests it may be premature to expect significant gains, investors who buy now and hold through the stagnation phase could reap rewards if sentiment improves—truly a case of being better off being early than too late.

Intel’s Comeback: A Tough Road Ahead, But Worth the Bet

There’s no guarantee Intel will pull off a complete turnaround, but the company is clearly taking bold steps to tackle years of bloat, strategic drift, and technological lag. Still, winning over a competitive market dominated by entrenched giants won’t be easy—it will require grit from management, sharp strategic vision, and a bit of luck. That said, for portfolios seeking value-driven upside, a modest stake in Intel could be a worthwhile investment. I’m cautiously optimistic.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue