Hims & Hers Health (HIMS) has captured significant market attention in 2025 with its dramatic stock swings, starting the year around $25, soaring above $70, dipping back near $25, and now rebounding past $52. Despite the volatility, the stock is up over 120% year-to-date, ranking it among the best-performing mid- to large-cap names, with a market valuation exceeding $13 billion.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

So, what’s behind this massive surge in value? Hims’ unmatched ability to capitalize on the booming demand for GLP-1 drugs has been a significant catalyst for the platform. And even with recent limitations on compounded versions, other treatments and services across its telehealth platform have continued to deliver strong growth in both revenue and profit. The management team is confident and has laid out some bold targets for the next five years.

That said, after a ~240% re-rating in the past twelve months, the stock is peaking and flirting with overvalued territory. In other words, after a boom, there could well be another bust — if recent history is anything to go by. Given the extreme volatility and elevated short interest, it might make sense to stay on the sidelines for now. Therefore, I remain neutral on HIMS while being cognizant of the temptation to evaluate short-term bearish trading opportunities, knowing full well that HIMS is a swing stock.

How Hims & Hers Turned GLP-1s Into Gold

Hims & Hers is a San Francisco-based telehealth company that offers a wide range of healthcare services and products directly to consumers through its online platform. Since 2023, demand for GLP-1 drugs used for weight loss and diabetes—like Novo Nordisk’s (NVO) Ozempic and Eli Lilly’s (LLY) Mounjaro—has skyrocketed. Hims has taken full advantage of this trend by making these in-demand medications more affordable and accessible through telemedicine, eliminating the need for in-person doctor visits.

During the widespread drug shortages in 2023 and 2024—particularly for Ozempic and Mounjaro—Hims offered compounded versions of these medications through its network of partner compounding pharmacies. That’s something most physical clinics simply can’t do at scale. This flexibility gave HIMS a major advantage, though not without controversy. The use of compounded GLP-1s sparked lawsuits and eventually led the FDA to ban their sale in 2025.

Even so, by capturing that surge in demand, Hims & Hers saw its revenue soar, reaching $1.8 billion in 2025, up from just $100 million in 2019. That represents a massive 79% compound annual growth rate (CAGR) over five years. By then, Hims had already shown it could move fast, adapt quickly, and scale in ways traditional clinics can’t.

Beyond Weight Loss, Hims & Hers Are Rewriting Healthcare

But it’s not just GLP-1 demand driving Hims & Hers’ growth. Even when the company doesn’t directly offer certain medications, it still benefits users as they explore other treatment options on the platform. The actual engine has been the millions of new customers subscribing to a wide range of services—from mental health to sexual wellness—all powered by an asset-light model that lets Hims turn high-margin revenue into real profitability.

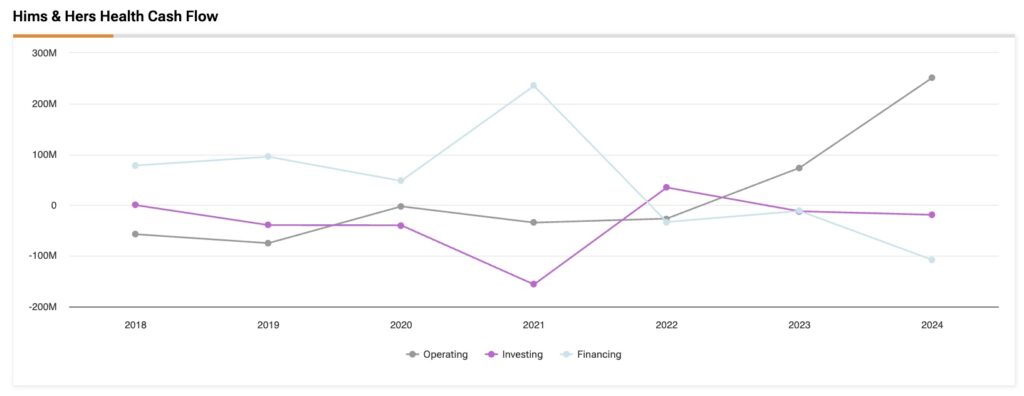

And it’s not just top-line growth. The company’s cash flow from operations has recently gone from negative $100 million in 2019 to positive $300 million. At the same time, returns on invested capital (ROIC) have jumped from negative 130% to positive 22%, signaling not just growth, but a business that’s becoming sustainably profitable and scalable.

Beyond weight loss, Hims & Hers already operates in massive total addressable markets (TAMs)—like mental health, where it offers therapy and coaching, sexual health, and hair loss treatments. One of the most promising opportunities? The hybridization of digital therapy and prescription refills creates what’s essentially a “digital psychiatrist” layer—something that’s scalable, sticky, and potentially transformative.

HIMS also offers low-cost consultations for primary care and preventive health, positioning itself ahead of the curve. By continuously collecting patient data, applying AI for personalized treatment, and integrating human coaching (not bots), Hims is quietly building a next-gen healthcare platform.

In short, GLP-1s may have been the accelerant, but they’re not the engine. The surge in demand gave HIMS a major boost, but the company’s long-term potential lies in becoming a trusted, personalized, and affordable healthcare delivery system—one that scales far beyond weight loss.

What HIMS’ Guidance Tells Us About Its Future

Hims & Hers delivered a standout first-quarter 2025 earnings report, showcasing triple-digit year-over-year growth in both revenue and net income.

Revenue surged to $586 million—a 111% increase—while net income climbed 345% to $49.5 million. The company’s subscriber base expanded to 2.4 million, up nearly 40% from the prior year, and average monthly revenue per subscriber rose 53% to $84. These results highlight robust customer growth and the company’s increasing effectiveness in monetizing its platform.

The long-term guidance shared by management stood out even more than the quarterly results. The company projects that by 2030, it will reach at least $6.5 billion in revenue and $1.3 billion in adjusted EBITDA, implying an EBITDA margin of 20%. This forward-looking plan is built on expanding into new therapeutic areas, enhancing personalization of care, growing follow-up services, and entering new geographic markets, all of which are expected to drive a broader and more engaged customer base.

The guidance implies a revenue CAGR of 28.7% from fiscal year 2024 through 2030, with EBITDA growing at a 20.5% CAGR over the same period. Using a simplified reverse discounted cash flow model based on this guidance—and assuming a stable 18% tax rate, capital expenditures at 5% of revenue, depreciation and amortization at 30% of CapEx, and no major changes in working capital—along with an 8% discount rate and a 3% terminal growth rate, the implied equity value lands at roughly $10.7 billion, or about $47.80 per share.

Naturally, the discount and long-term growth rates used in this type of model are speculative, and the company’s future performance could exceed or fall short of these expectations. However, this exercise suggests that, at current levels, and with the guidance provided by Hims itself, the stock may not offer a particularly wide margin of safety under a base-case scenario.

Is Hims & Hers Health a Buy?

Wall Street analysts are currently more cautious than optimistic on HIMS. Of the 14 analysts covering the stock over the past three months, only four are bullish, while eight remain neutral and two are bearish. HIMS’ average price target is $45.50, suggesting a potential downside of almost 15% over the next twelve months.

Hims & Hers Growth Comes With Volatility

There’s a lot to like about Hims & Hers as a business. The company has made solid progress in its growth trajectory and continues to issue strong, encouraging guidance.

That said, after such a massive run-up, the stock now looks a bit overvalued based on its own projections and doesn’t offer much of a margin of safety. Given how volatile the stock has been in recent months —and with a short interest of 34.5% of the float—it might be wise for investors to stay on the sidelines for now. A pullback to below $45 per share could offer a more attractive entry point and a better cushion against risk.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue