Gold (GLD) and silver (SLV) prices dropped sharply on Monday after the Chicago Mercantile Exchange (CME) stepped in to cool the market. More specifically, the CME raised margin requirements, which means that traders now have to put up more cash to keep their positions in precious metals. This move came after a strong rally saw gold futures jump about 65% this year and silver prices more than double. As a result, some traders likely reduced their exposure, which pushed prices lower.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to a notice posted on Friday, the CME increased margin requirements for gold, silver, and other metals as part of its normal review of market volatility. In simple terms, higher margins are meant to protect the exchange in case traders can’t meet their obligations when contracts are settled. These kinds of changes often happen after big price moves. Following the announcement, silver futures fell roughly 8% early Monday, while gold prices slid about 5% at the time of writing.

Interestingly, at the start of 2025, silver was trading at nearly $30 an ounce before briefly spiking to almost $80 ahead of the CME’s decision. That rally was driven by falling supplies, slower production at major mines, and rising industrial demand from areas such as solar panels and data centers. At the same time, gold has been supported by geopolitical uncertainty and fears of a stock market bubble.

Is CME Stock a Good Buy?

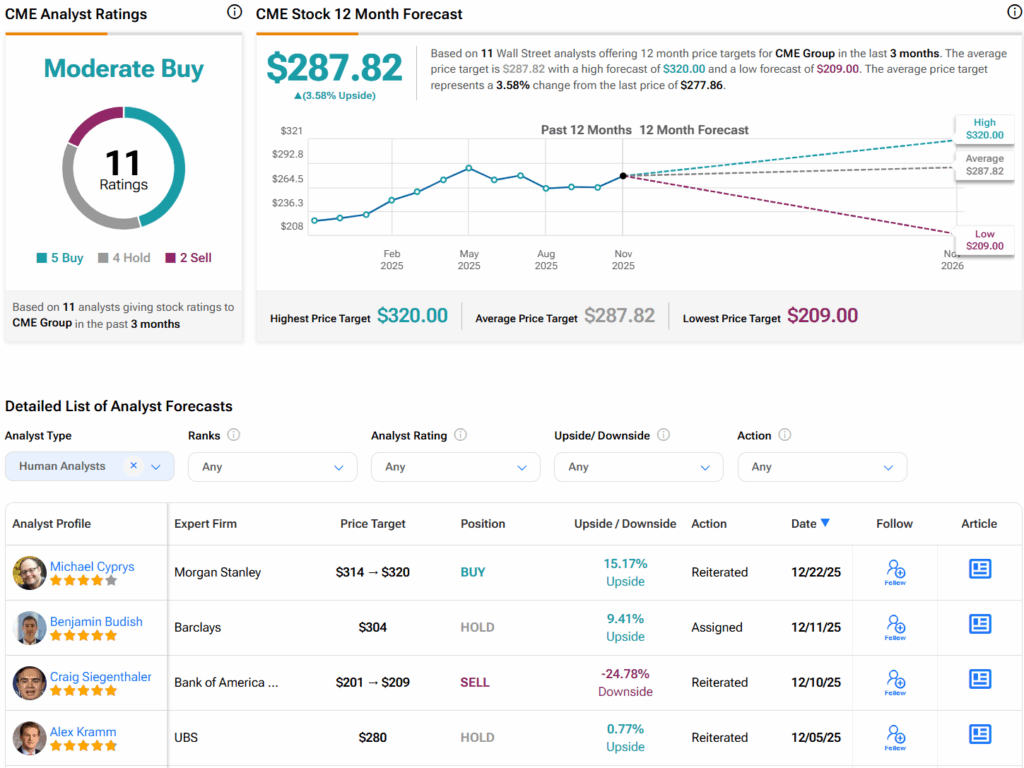

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CME stock based on five Buys, four Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CME price target of $287.82 per share implies 3.6% upside potential.