Bank of America (BAC) now believes that global chip sales could reach around $1 trillion by 2027, thanks to the booming demand for artificial intelligence. That’s a big jump from its earlier forecast of $860 billion. Notably, the bank’s analysts highlighted stronger-than-expected growth in memory chips like HBM, DRAM, and NAND, along with parts used in AI and data centers. However, this is slightly offset by slower growth in consumer products and cars.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking ahead, the firm expects the chip industry to make $745 billion in 2025, $870 billion in 2026, and $971 billion in 2027. These numbers are all about 3% to 6% higher than earlier predictions. Interestingly, if you remove memory chips from the total, sales are still anticipated to be strong at $538B in 2025, $621B in 2026, and $706B in 2027. And since analysts believe that this AI boom will last longer than past cycles, they remain confident that companies will spend more to build out AI systems.

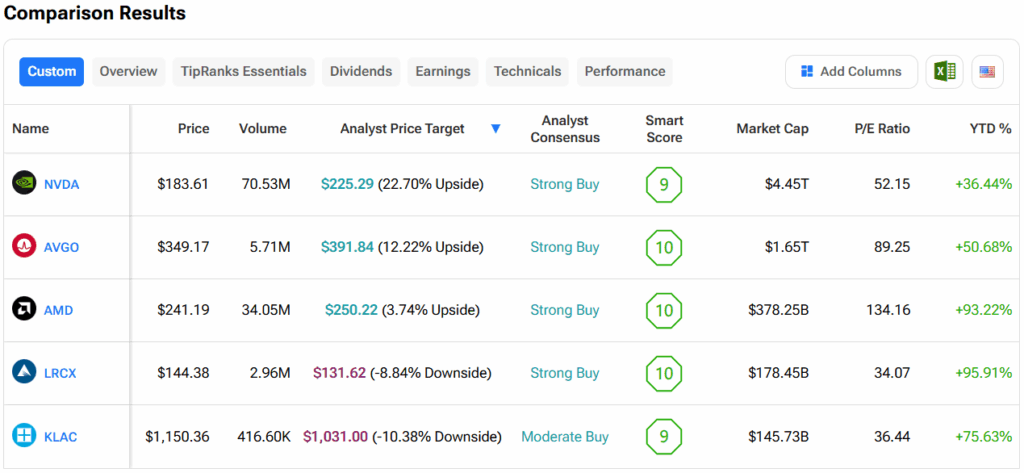

On top of that, Bank of America also raised its forecast for how much will be spent on chip-making equipment, as it now expects $118 billion in 2025, $128 billion in 2026, and $138 billion in 2027. While 2026 and 2027 might see a slightly lower growth rate, the overall trend still points up. In fact, it estimates that long-term spending will remain higher than usual due to the growing complexity of making chips. As a result, the firm’s top stock picks—Nvidia (NVDA), Broadcom (AVGO), AMD (AMD), Lam Research (LRCX), and KLA Corp. (KLAC)—are all expected to benefit from stronger demand.

Which Chip Stock Is the Better Buy?

Turning to Wall Street, out of the five chip stocks mentioned above, analysts think that NVDA stock has the most room to run. In fact, NVDA’s average price target of $225.29 per share implies more than 22% upside potential. On the other hand, analysts expect the least from KLAC stock, as its average price target of $1,031 equates to a loss of 10.4%.