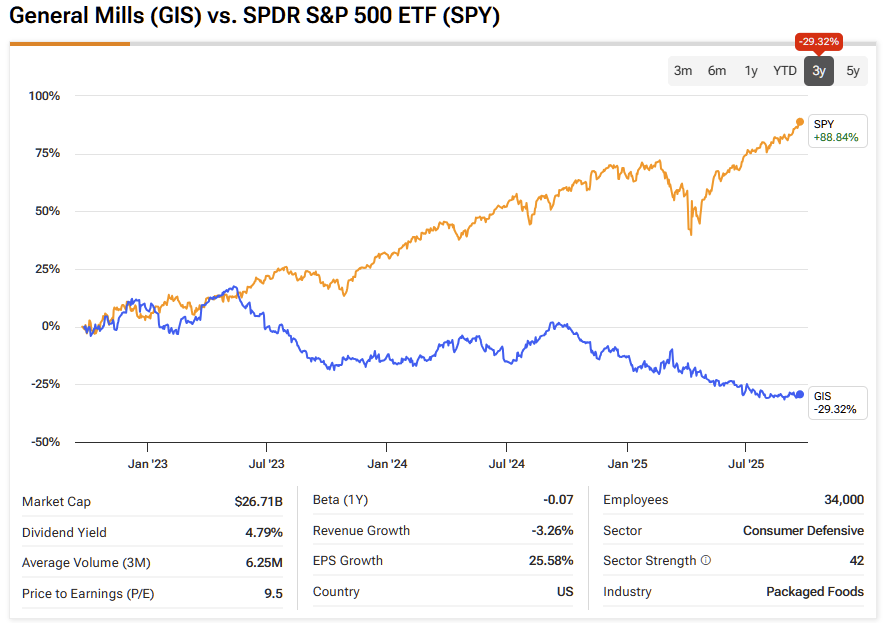

General Mills (GIS) has long been synonymous with “dead money.” In the past twelve months alone, the stock has posted negative returns of more than 29% (including dividends), extending an underperformance that already exceeds 25.3% over the last three years. For many investors, GIS has become something of a “lobster pot”—a stock that’s easy to get into, but hard to get out of, without taking losses. The term is usually reserved for penny stocks, but in GIS’s case, shareholders must be feeling blue just the same.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

The ultra-processed packaged food company faces secular structural headwinds, the most significant being changing consumer habits—recently amplified by the rise of GLP-1 weight loss drugs. Combined with price sensitivity and commodity inflation, this has created a perfect storm for negative sales growth and pressure on margins.

The latest Fiscal Q1 results brought another weak quarter—unsurprisingly—showing that the decline in net sales continues, driven by cost pressures and divestments. At this point, reversing the bearish trend would require investors to cling to the narrative that things won’t get worse than expected—based on reiterated annual sales growth guidance—and that, despite these threats, value will continue to be generated for shareholders as General Mills operates efficiently, delivering returns above its cost of capital, and supporting a dividend yield higher than the 10-year Treasury along with ~$300 million in quarterly buybacks.

However, with no visible catalysts ahead—other than a punished valuation, and for understandable reasons—I don’t see enough market strength, especially after the recent quarter, to support a consistent turnaround that would allow GIS to trade in line with the broader market. That said, I believe General Mills shares are likely to remain a lobster pot for investors, continuing to underperform in the short to medium term and warranting a Sell rating.

When Revenue Lags Inflation in General Mills

Looking specifically at General Mills’ investment thesis, there are a few key points—ranked in order of importance—that I believe determine the likely direction of the company’s share price.

The first point concerns General Mills’ overall revenue growth relative to inflation. As a seller of staple products, nominal revenue growth alone is insufficient, since price increases may simply reflect inflation. Over the past three years, General Mills has delivered a CAGR in revenue of -0.03%, while U.S. consumer prices (CPI) rose roughly 5% per year from 2022 to 2024.

In the most recent quarter, the company reported net sales of $4.5 billion, marking a 7% YoY decline, while organic sales fell 3%. Worse still, General Mills reiterated its Fiscal 2026 guidance of organic net sales growth between -1% and 1%, again expected to fall well short of inflation. This indicates that, in real terms, the company is losing ground, continuing a trend in which it is unable to fully pass on cost increases to consumers while also struggling to grow volumes.

This scenario of weak real growth connects directly to the second key point: operating margins. When revenue lags inflation and volumes remain constrained, any increase in costs—whether for commodities, transportation, or energy—puts pressure on margins, reducing real profitability.

Operating margins over the last twelve months, at 16.8%, reflect a sharp drop from 17.3% and 19% in the prior two years. This decline reflects how sensitive General Mills’ profitability is to both cost pressures and volume trends.

Why General Mills Still Creates Value

Ultimately, when deciding to allocate capital to a company in search of alpha, investors expect the company to generate returns exceeding those of risk-free instruments. That’s why looking at the return on invested capital (ROIC) makes so much sense in the context of the General Mills thesis. Over the past ten years, the Minneapolis-based company has delivered an average ROIC of 10.85%, which is quite consistent, and over the past twelve months, it has been 9.6%.

Since GIS is a low-beta stock with a debt/equity ratio of 0.5, assuming a WACC of roughly 6%—given a long-term bond rate of around 4%—this implies a spread of 3.6% between ROIC and WACC. In other words, even with the structural headwinds the company faces, General Mills remains efficient in its capital allocation, supporting a dividend yield of ~4.8% and has executed $1.65 billion in buybacks over the past twelve months (a ~6.2% buyback yield), making it attractive for investors seeking risk-adjusted returns.

Furthermore, trading at 12.5x earnings, or a 16% discount to the packaged foods sector, makes the thesis relatively de-risked. At the same time, it highlights the market’s skepticism in assigning a richer multiple to a company that, while delivering decent shareholder returns, is growing below inflation, facing margin pressure, and shows little prospect of returning to its pre-GLP-1 growth trajectory.

Is GIS a Good Long-Term Investment?

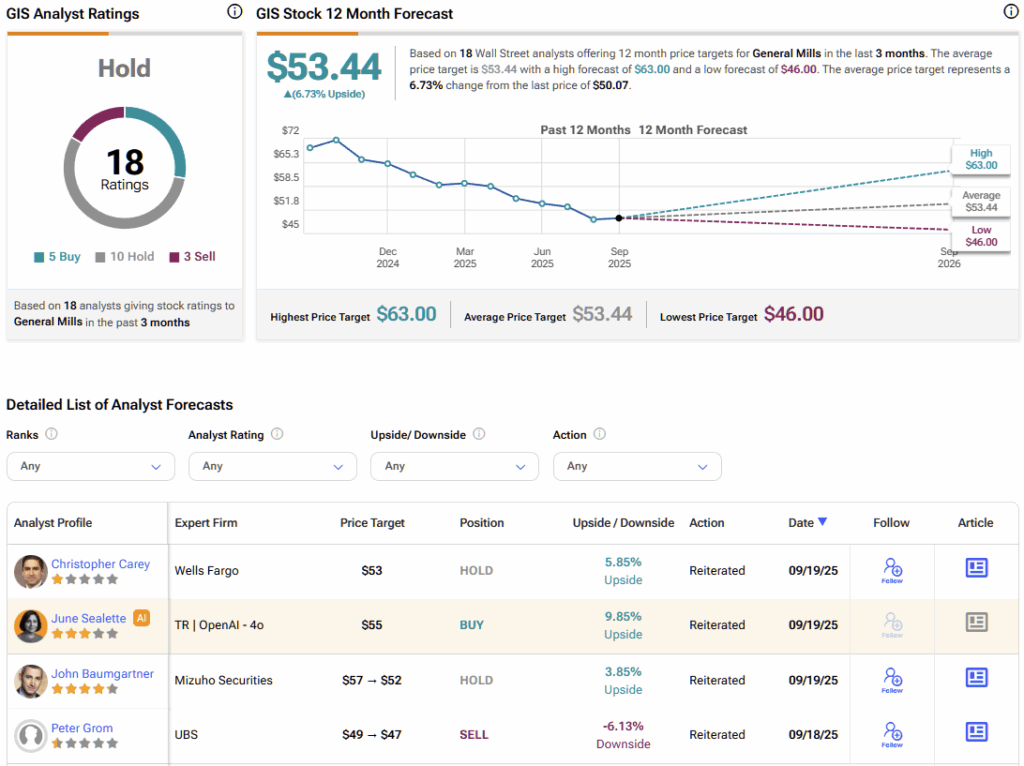

The Wall Street consensus on General Mills carries a healthy dose of skepticism. Of the 18 analysts who’ve covered the stock over the past three months, ten rate it a Hold, five a Buy, and three a Sell. The current average price target sits at $53.44, implying a modest 6.7% upside from the latest share price over the coming year.

A Value Trap Disguised as Shareholder Yield

Quarter after quarter, General Mills seems to rely on the same thesis: that it will deliver numbers that are simply less bad than expected, with the bar constantly being lowered. What concerns me is that the company’s underperformance—mirroring much of the ultra-processed food sector—has structural roots. Shifting consumer habits toward healthier options, combined with a new environment of persistently high inflation in the U.S., only make the already slim prospects for real sales growth even more remote. For many shareholders, GIS is becoming a “lobster pot”—easy to get into for the yield, but increasingly challenging to exit without incurring losses.

Yes, the stock trades at a discounted multiple, and its rich shareholder yield (dividends plus buybacks) may look tempting to some value investors. But without evident progress on driving real top-line growth, I don’t see any path toward true alpha here. For now, I maintain a Sell rating on GIS until the company can demonstrate at least minimal evidence that it can offset its ongoing sales decline, and until the lobster pot finally offers a way out.