U.S solar-tech pioneer First Solar (FSLR) has materially benefited from the Trump administration’s solar tariffs on Southeast Asian imports, as evidenced by a 74% increase in its market value since July. This stock market rally seems to have more legs, as the company is well-positioned to grow, aided by several favorable developments, including a surge in demand for renewable energy, regulatory protection from cheap imports, and its strong domestic manufacturing footprint, at a time when the Trump administration is promoting the onshoring of manufacturing jobs.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am bullish on First Solar’s prospects, as I believe strong earnings growth will lead to further expansion in its valuation multiples over the next couple of years.

Tariffs on Rivals Boost First Solar’s Growth Potential

One of the core drivers of my bullish outlook on First Solar is its strong positioning to benefit from the Trump administration’s tariffs on solar imports from Southeast Asia. Reciprocal tariffs—50% on India, 20% on Vietnam (plus a 40% penalty on transshipped goods), and 19% on Malaysia—are designed to curb Chinese manufacturers’ long-standing practice of routing solar components through third-party countries to bypass U.S. trade restrictions. Earlier tariffs on low-cost Chinese imports failed to fully achieve their objective for this very reason. By closing this loophole, the new measures significantly improve First Solar’s competitive standing against Chinese imports.

In addition, First Solar stands to gain directly from the Antidumping and Countervailing Duties that took effect on June 9, targeting solar products from Southeast Asian nations. Under these rules, PV products from Cambodia, Malaysia, Thailand, and Vietnam face tariff rates of 3,403%, 799%, 542%, and 168%, respectively. These duties further restrict low-cost foreign supply and reinforce the company’s domestic advantage.

Beyond improving competitiveness, the tariffs also create meaningful pricing power for First Solar over the long term, with potential margin expansion. On the Q3 earnings call, management noted that the current backlog is priced at approximately 30.5 cents per watt, while future contracts could be priced as high as 36.5 cents per watt under the new tariff regime. This represents roughly a 20% increase in average selling prices. With manufacturing costs largely fixed, this ASP expansion should translate into substantial incremental revenue—and materially higher profitability—over the coming years.

Energy Demand is Likely to Get a Major Boost From AI

My bullish view on First Solar is further reinforced by the accelerating demand for renewable energy, which coincides with a period when the company is already benefiting from favorable tariff dynamics. In 2024, global data centers consumed approximately 415 TWh of electricity.

According to the International Energy Agency, that figure is expected to more than double to 1,050 TWh by 2030—roughly equivalent to Japan’s total annual electricity consumption. Nearly half of global data center electricity usage in 2024 came from the U.S. — a share that is likely to persist through 2030 given the country’s concentration of large technology firms and hyperscale data centers.

Against this backdrop, First Solar’s booking figures underscore the magnitude of the opportunity ahead. As of Q3, the company reported total booking opportunities of 79.2 GW, compared with manufacturing capacity of just 23.5 GW. With prospective demand exceeding current supply capacity by more than threefold, First Solar is well-positioned to deliver robust revenue growth through the end of the decade. Moreover, ongoing tightness in electricity supply should further enhance the company’s pricing power, providing an additional tailwind to margins over time.

First Solar’s Balance Sheet Strength Paves The Way For Continued Investments

First Solar’s robust liquidity position further strengthens my confidence in its long-term growth outlook, particularly as the company ramps up capital investments to meet rising electricity demand. A key initiative is the construction of a 3.7 GW manufacturing facility, which is expected to cost approximately $330 million, with production beginning as early as Q4 2026. While capital-intensive spending is likely to remain elevated over the next several years, First Solar is uniquely positioned to fund most of these investments internally.

A major contributor to the company’s strong liquidity is its ability to collect customer deposits well in advance of module delivery. As of Q3, customer downpayments totaled nearly $3 billion, including $2.2 billion in deferred revenue and $660 million in long-term deferred revenue. These upfront payments provide a powerful source of working capital, allowing First Solar to efficiently bridge funding gaps without relying heavily on external financing.

Liquidity is further enhanced by the company’s monetization of tax credits under Section 45X. In June and July alone, First Solar transferred tax credits totaling approximately $670 million. As a leading domestic renewable energy manufacturer, the company is well-positioned to continue leveraging these credits as a meaningful source of growth capital.

By the end of Q3, First Solar held nearly $2 billion in cash and equivalents and had access to an additional $1 billion through a revolving credit facility. With annual capital expenditures expected to remain below $1 billion and operating cash flow reaching $815 million in the first nine months of 2025, the company appears well equipped to fund its expansion plans while minimizing the need for dilutive capital raises.

Is First Solar a Buy?

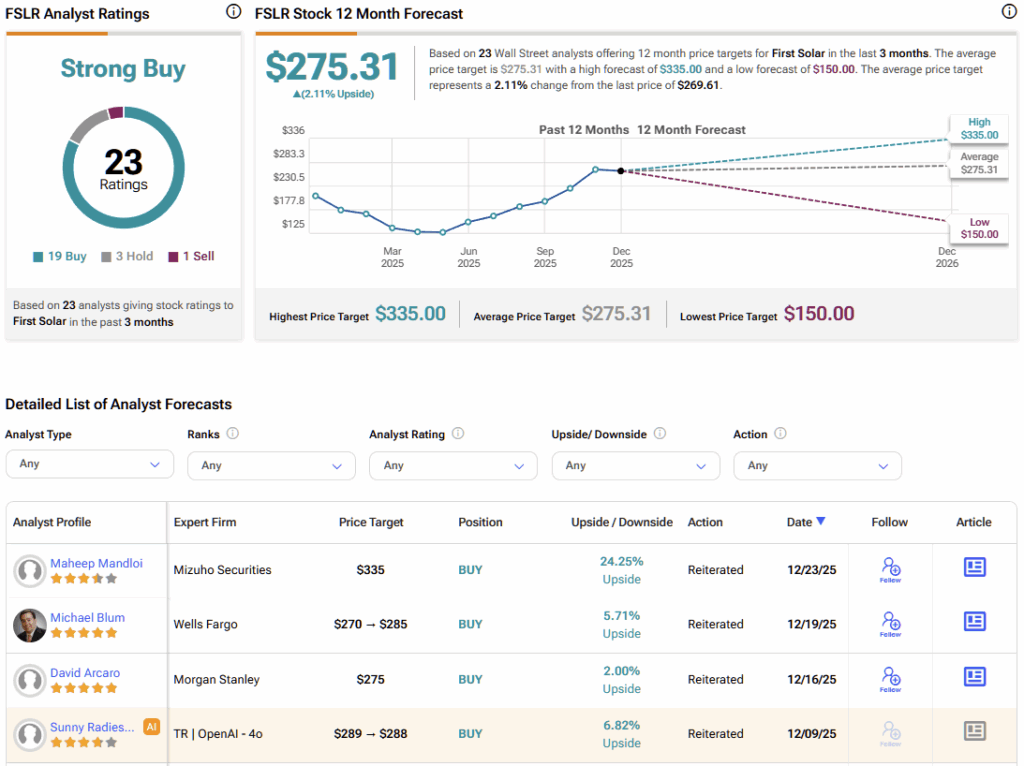

Based on ratings from 23 Wall Street analysts, the average First Solar price target is $275.31, implying just 2% upside from the current market price.

Although analyst ratings point to limited upside from here (primarily due to the strong stock market performance of First Solar since June), I believe positive analyst revisions are likely in the future when tariff benefits become quantifiable (in the next couple of quarters). At a forward P/E multiple of 18.6x, the company’s valuation remains reasonable, leaving sufficient room for stock price growth without pushing the company into deeply overvalued territory.

First Solar’s Policy Tailwinds and Competitive Advantage

First Solar has clearly landed on the favorable side of U.S. policy momentum. Import tariffs on solar components from China and Southeast Asia are reshaping the competitive landscape in a way that materially benefits domestic producers, positioning First Solar to sit at the low end of the renewable energy cost curve. Over time, these trade measures should not only strengthen the company’s market share but also enhance its pricing power.

Combined with a strong liquidity profile, First Solar is exceptionally well-positioned to capitalize on the powerful structural tailwinds driving the U.S. renewable energy sector. As policy support, demand growth, and capital availability converge, the company appears poised to translate these advantages into sustained long-term growth.