Shares of Ekso Bionics Holdings (EKSO) are rising in pre-market hours after it agreed to combine with Applied Digital’s (APLD) cloud computing business to form ChronoScale, a GPU-focused AI compute platform. Following the announcement, EKSO stock gained over 30% in pre-market hours on Tuesday, while APLD is up by 1.14% as of this writing.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Applied Digital specializes in AI infrastructure and data-center solutions, providing leased computing capacity to enterprise clients. Meanwhile, Ekso Bionics designs wearable robotic exoskeletons to help people with mobility impairments.

Applied Digital to Merge Cloud Unit with Ekso

As part of the deal, Applied Digital plans to combine its cloud computing unit, Applied Digital Cloud, with EKSO. After the deal closes, the combined company will be called ChronoScale Corporation and will focus on high-performance computing designed for artificial intelligence workloads.

Once the transaction is completed, Applied Digital is expected to own about 97% of the new company. Meanwhile, EKSO plans to explore strategic options, including a potential sale of most or all of its existing business.

The deal is expected to close in the first half of 2026, pending completion of due diligence and receipt of standard regulatory and shareholder approvals.

What the Deal Means for Applied Digital

For Applied Digital, separating its high-performance computing platform from the data center business allows each unit to grow independently while gaining greater financial and strategic flexibility. The transaction is also designed to unlock value from its fast-growing AI infrastructure business.

Additionally, ChronoScale is expected to benefit from its close ties to Applied Digital’s expanding network of AI-focused data centers, giving it quicker access to infrastructure. This should help speed up deployment and reduce execution risks as demand for GPUs and AI computing continues to rise.

Is Ekso Bionics a Good Investment?

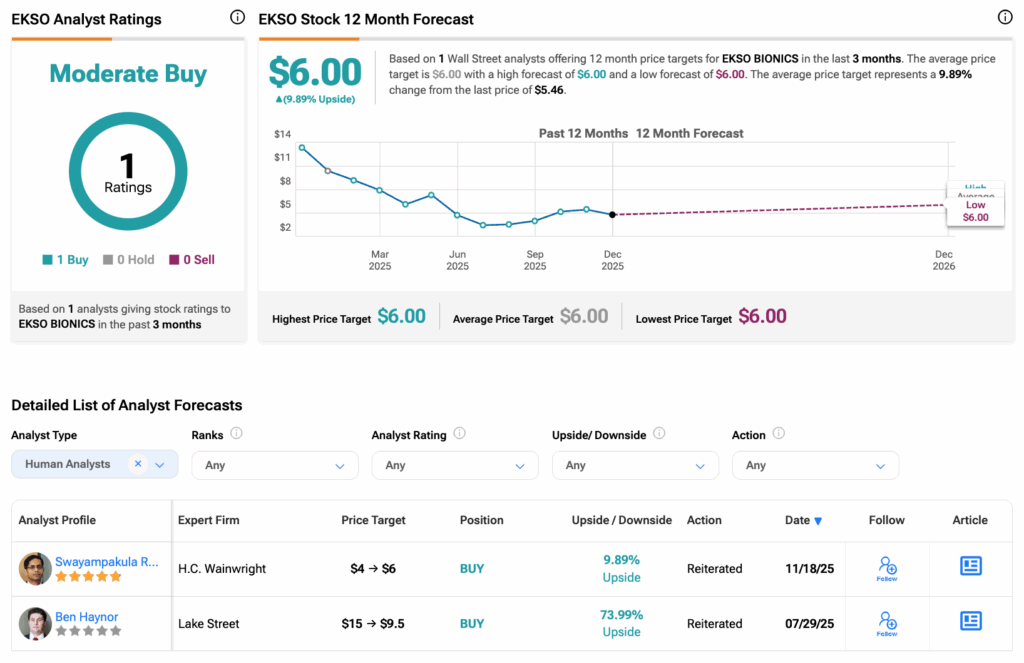

On Wall Street, analysts have a Moderate Buy consensus rating on EKSO stock based on one Buy assigned in the past three months. Furthermore, Ekso’s average share price target of $6.0 per share implies an upside of 10% from its current level.