In periods of high economic uncertainty, weak consumer spending, high rates, and sticky inflation, defensive—and usually pretty boring—names like Dollar General (DG) tend to shine thanks to a business model that’s more resilient to economic ups and downs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, over the last couple of years, this discount giant has encountered headwinds that have shattered its defensive reputation and blindsided shareholders. Execution missteps and a challenging macro backdrop have exacerbated the problem, sending the stock sliding from its peak. In 2025, everything has turned around, as DG’s chart turned from red to green.

After a sharp reset, Dollar General’s shares have bounced back an impressive 52% so far this year. Still, the big question is whether this turnaround can really stick—and whether there’s still upside ahead, especially with the stock trading at premium valuations again.

In my view, momentum and recent trends suggest the turnaround is gaining real traction, so I don’t think now is the time to be overly skeptical due to valuations. There’s arguably still room to ride this positive wave, with DG showing signs it can reclaim the defensive, countercyclical appeal that made it attractive in the first place. Given the upbeat sentiment, following the trend is a no-brainer, so I’m sticking with a Buy rating on DG.

Not So Recession-Proof After All

Dollar General has performed exceptionally well this year, with its stock price climbing from around $75 per share to above $114, even in a challenging macro environment—living up, in a way, to its reputation as a defensive, non-cyclical stock that tends to hold up during times of economic uncertainty.

However, if we zoom out on the price chart, we see that until August last year, DG was trading around $125. The stock then fell sharply to the levels we saw earlier this year, mainly triggered by disappointing Q2 2024 results that came in well below consensus, along with an ugly guidance cut.

Management partly blamed this on its customers being “financially constrained.” With inflation squeezing ultra-low-income shoppers—Dollar General’s core demographic—spending slowed sharply, putting pressure not just on DG but also on domestic retail peers.

It would make sense that, in a weak consumer spending environment, Dollar General should benefit from serving an ultra-low-income audience seeking affordable essentials. But execution gaps versus its bigger peers weighed heavily. For example, alongside the weaker guidance, DG admitted to inventory mismanagement, high shrinkage (theft and loss), and poor cost control—unlike Walmart (WMT) and Costco (COST), which, thanks to their larger scale and stronger supply chains, maintained better pricing power and efficiency.

Following this “reset” in DG’s valuation in the second half of last year, the primary concern heading into 2025 was that the challenging macroeconomic backdrop—combined with weak turnaround execution—would continue to weigh on the company’s ability to grow revenue and protect its margins.

Why Dollar General’s Turnaround is Different This Time

Dollar General’s improved outlook for 2025 signals that many of the issues weighing down the stock were primarily short-term in nature. The rebound has been supported by a more favorable macroeconomic environment, with consumer spending stabilizing and the company embracing a focused “back to basics” strategy.

To address margin pressures and reignite growth, Dollar General has implemented a series of restructuring initiatives, including the closure of underperforming stores and the elimination of its problematic self-checkout program, which had led to customer dissatisfaction and increased theft-related losses. Simultaneously, the company is taking a more targeted approach to expansion, prioritizing store openings in higher-return markets while maintaining leaner in-store operations.

A particularly strategic move has been the push into fuel sales. While fuel margins are inherently low, adding gas stations is designed to increase foot traffic, enhance customer loyalty, and boost the average transaction size, creating more opportunities for cross-selling once shoppers are inside the store.

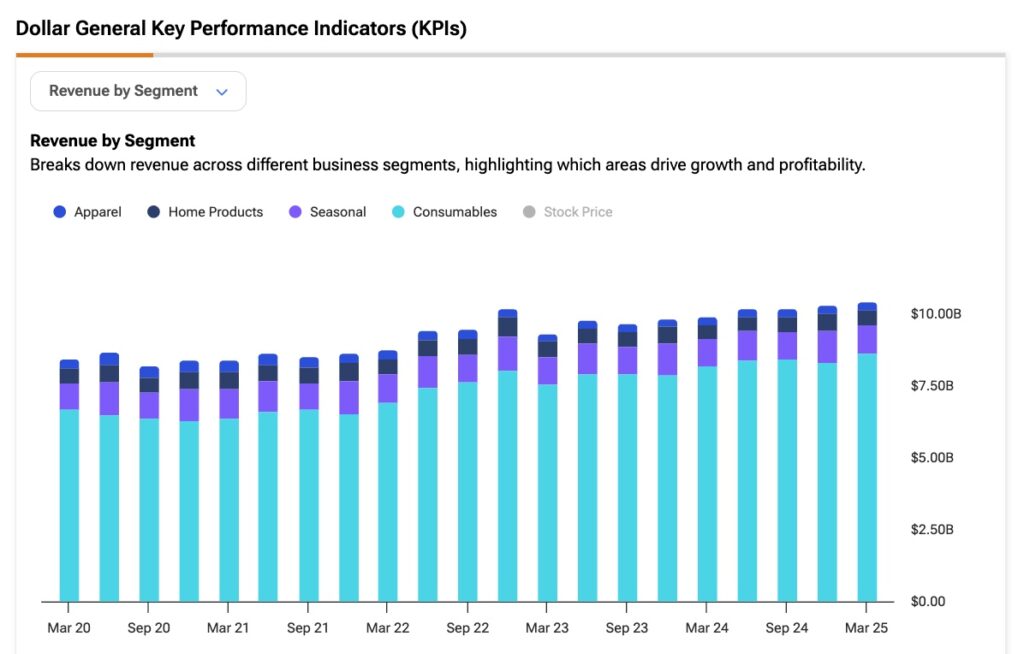

These moves have been well-received by the market so far, especially since they came alongside a guidance lift in the latest Q1 earnings report in early June. Management now expects net sales growth for 2025 of approximately 4.2% (midpoint), up from 3.9% previously, and same-store sales growth of 2%, up from 1.7%. In fact, DG has matched its best quarterly performance since May 2020 in its most recent earnings call, with revenues exceeding $10 billion per quarter, as shown by TipRanks data.

What Dollar General’s Valuations Say About Its Comeback

Since DG was trading at about 13.5x earnings back in September last year and now sits at around 22x, it’s clear that the perceived risk has shifted dramatically in just about a year. The stock now trades at a multiple roughly 14% above its five-year average and about 27% higher than the broader industry average.

Looking at forward multiples, the numbers don’t exactly scream cheap. With long-term EPS expected to grow at a CAGR of around 6.5% and an outlook for 12% EPS growth in 2025, Dollar General’s PEG ratio sits at about 3x—which is pricey for a mature retailer, but arguably justified for a business that, in theory, should carry a low risk of underperformance. Regarding profit margins, DG has finally seen a quarterly uptick while maintaining revenue growth.

With DG now on the higher side of average retail valuations, the stock’s future performance will hinge on whether the company can beat expectations and deliver real upside. If the market buys into the turnaround story — store closings, fuel sales, the loyalty push — and sees real same-store sales growth and margin expansion, then the higher multiple might be justified.

Even though the 50% gains in 2025 so far suggest the turnaround could be real (or at least that sentiment has shifted from total despair to “maybe this won’t be a disaster”), the stock is still down about 28% from its April 2024 highs and 56% below its October 2022 peak. So, historically, we’re still talking about a beaten-down stock that’s lost some of its status as a steady compounder. The real question now is whether this rally is healthy and sustainable.

Watching how price action behaves is key. If DG’s share price holds well above its 100-day moving average, it’s a good sign that the recovery thesis is intact. That appears to be the case currently, with the 100-day SMA at $91.60 and the stock trading at approximately $114.

Is Dollar General Stock a Good Buy Now?

Currently, skepticism outweighs optimism in the market’s view of Dollar General. Among the 23 analysts covering the stock, 10 rate it as a buy, while 13 maintain neutral ratings. The average price target is $116.18, indicating a modest upside of approximately 2.5% from the current share price.

Dollar General Heading Back to Normalcy

Dollar General is no longer a bargain—the market has already priced in much of this year’s rebound. While the company may have lost some of its luster as a reliable compounder in recent years, the long-term trajectory still offers reasons for optimism.

It’s evident that Dollar General’s “new normal” looks very different from a year ago, and the positive momentum is likely to continue, provided the company stays on track with execution. Given its return to behaving like the defensive, low-volatility name investors have come to expect, I remain cautiously optimistic on the stock.