Zip Co Ltd. (ZIP) shares were down around 5% to AU$0.83 at market close on September 5. The company provides point-of-sale credit in a category known as buy now, pay later or BNPL.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ZIP stock is exiting the ASX 200 index

Zip shares have fallen following the announcement that the BNPL provider will soon lose its place on the ASX 200 index. The S&P Dow Jones Indices, which maintains the index, will remove Zip from the index on September 19.

The ASX 200 index tracks the top 200 listed companies in Australia. The index is rebalanced on a quarterly basis so it accurately reflects the 200 largest companies on the market. As such, some companies are added, while others are removed, in line with their changing market capitalisation.

Having lost almost 90% of its value over the past year, Zip is no longer one of the largest 200 companies.

BNPL companies face difficult times

Inflation and rising interest rates have created a difficult business environment for BNPL companies. For example, high product prices threaten to slow down consumer spending, which negatively impacts BNPL credit demand. Meanwhile, rising interest rates make paying back established loans more difficult, and increase the risk of loan defaults.

Zip is among a number or BNPL stocks hurting amid the changed global economic conditions. Shares of U.S.-listed BNPL provider Affirm (AFRM) have also taken a significant hit in 2022.

Is Zip a Buy Now?

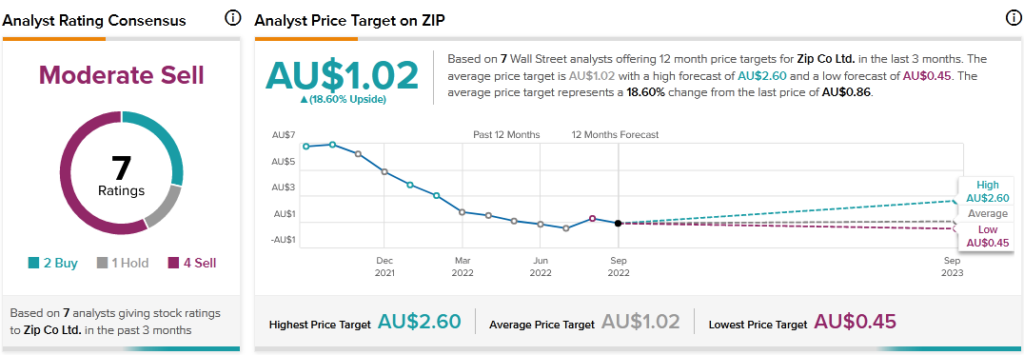

According to TipRanks’ analyst rating consensus, ZIP stock is a Moderate Sell, based on two Buys, one Hold, and four Sells. The average ZIP price target of $1.02 implies nearly 19% upside potential.

Final Thoughts

Zip’s removal from the ASX 200 index threatens to diminish demand for the stock. Firstly, fund managers tracking the ASX 200 index are required to sell ZIP shares.

Moreover, its removal reduces media and general exposure for Zip, and thus potential attention from retail investors. Only time will tell if Zip can bounce back and reclaim its position on the ASX 200.