Shares of Shopify (NYSE: SHOP) were down 14.91% on May 5 to close at $413.09, after the e-commerce giant reported worse-than-expected Q1 results, which significantly fell short of estimates. Shopify also announced the acquisition of Deliverr for $2.1 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors were more disappointed with the company’s updated FY2022 guidance, which reflects lower revenue growth for the first half of the year.

Q1 Miss

Adjusted earnings of $0.20 massively underperformed the analysts’ expectations of $1.00 per share. Furthermore, it was significantly lower than the adjusted earnings of $2.01 per share reported for the prior-year period.

Meanwhile, revenues jumped 22% year-over-year to $1.2 billion but fell short of consensus estimates of $1.6 billion. The increase in revenues reflected an 8% growth in Subscription Solutions revenues to $344.8 million.

In addition, gross merchandise volume (GMV) increased 16% year-over-year to $43.2 billion. Notably, this implies a two-year compound annual growth rate of 57%.

Lowered FY2022 Outlook

Based on current trends and expectations, the company updated the financial guidance for FY2022.

The company forecasts revenue growth to be lower in the first half and highest in the fourth quarter of 2022 due to the absence of government stimulus and the pandemic-triggered accelerated e-commerce growth seen in the first half of 2021.

However, Subscriptions Solutions revenue growth is expected to be at comparable levels to that in 2021, driven by merchants around the world joining the platform.

Acquisition of Deliverr

Concurrent with the earnings, Shopify announced that it had agreed to acquire the U.S.-based e-commerce fulfillment company Deliverr for $2.1 billion in a cash-cum-stock transaction (80% cash and 20% stock).

The acquisition aims to expand fast and easy fulfillment for independent brands across channels, more than doubling the size of Shopify’s fulfillment team with superior talent from the logistics industry.

Shopify’s CEO commented, “Together with Deliverr, Shopify Fulfillment Network will give millions of growing businesses access to a simple, powerful logistics platform that will allow them to make their customers happy over and over again.”

Management Commentary

Shopify’s CFO, Amy Shapero, commented, “We are confident Deliverr’s ability to simplify the process, and arm merchants with visibility and control from the display of a delivery promise across multiple channels through its completion, will be a huge benefit to our merchants.”

Wall Street’s Take

Following the dismal earnings miss, Stifel Nicolaus analyst Scott Devitt decreased the price target on Shopify to $650 (57.35% upside potential) from $800 and reiterated a Buy rating.

The lowered price target is based on expectations of slower GMV growth attributable to uncertain macro conditions and overall muted demand trends across the group.

Devitt stated that, “Shopify faces a number of near-term headwinds, including challenging compares, the absence of stimulus, ongoing inflation, and the emerging shift in consumer spending towards travel and services.”

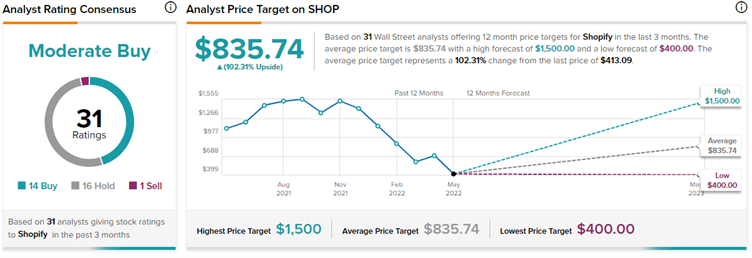

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 14 Buys, 16 Holds and 1 Sell. The average Shopify price target of $835.75 implies 102.3% upside potential to current levels.

Bottom-Line

Most e-commerce players reaped the benefits of the world moving online during the pandemic years and witnessed super-normal growth.

During the first quarter of 2021, Shopify acheived the highest revenue growth in the company’s history, driven by stimulus and COVID-19 lockdowns.

As the restrictions eased and economies are now fully opening, the growth is returning to more normalized levels. Consequentially, investors’ euphoria for the stock is slowly fading away with the company’s lowered growth outlook.

Likewise, shares of Shopify are trading near their pre-pandemic levels, down 73% over the past six months.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Block Stock Soars Despite Q1 Miss

Despite Beating Q1 Expectations, Cloudflare Crashes 10%

FuboTV Stock Drops 10% Despite 100% Revenue Growth