Sea Ltd. (NYSE: SE) reported stronger-than-expected Q1 results, topping both earnings and revenue estimates driven by robust performance across all segments.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Shares of the Singapore-based internet and mobile platform company that provides online personal computer and mobile digital content, e-commerce, gaming services, and payment platforms, gained 14% on May 17 to close at $80.21.

Q1 Beat

The company reported an adjusted loss of $0.80 per share, which significantly beat the street’s estimated loss of $1.17.

Further, revenues jumped 64.4% year-over-year to $2.9 billion and exceeded consensus estimates of $2.8 billion.

The increase in revenues reflected a surge in e-commerce revenues, which increased 64.4% to $1.5 billion, as well as a 45.3% growth in Digital Entertainment revenues to $1.1 billion.

CEO’s Comments

Sea CEO, Forrest Li, commented, “The experiences, capabilities, resources and strong leadership positions we managed to accumulate and achieve during the past period position us well to navigate such uncertainties and, more importantly, capture opportunities that may also arise in our regions.”

He further added, “And as always, we will continue to focus on being humble, pragmatic, and agile while consistently driving strong execution in serving the large, underserved communities in our regions.”

Revised Outlook

Based on the “elevated macro uncertainties,” the company revised its outlook for SE.

The company now forecasts e-commerce revenues to range between $8.5 billion and $9.1 billion, compared to the prior guided range of $8.9 billion and $9.1 billion.

Wall Street’s Take

Following the Q1 results, Stifel analyst Scott Devitt decreased the price target on Sea to $115 (43.37% upside potential) from $160 and reiterated a Buy rating.

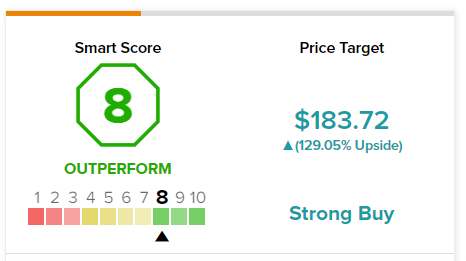

Overall, the stock has a Strong Buy consensus rating based on 15 Buys and two Holds. The average Sea price target of $183.39 implies 128.64% upside potential from current levels.

TipRanks’ Smart Score

SE scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Bottom-Line

While Southeast Asia’s e-commerce and gaming firm reported an impressive Q1 beat, it did widen its revenue guidance at the lower end, hinting at a possible slowdown in revenues.

This could mean that the pandemic-driven sales growth seen in the last two years has reached its zenith and may start to flatten out.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Tapestry Posts Q3 Beat Despite Chinese Slump; Shares Up 15.5%

Why Did MoneyLion Shares Gain almost 50%?

Blue Bird Corporation Posts Mixed Q2 Results